Dec 16, 2019

in Relative Strength, Mean Reversion, Video

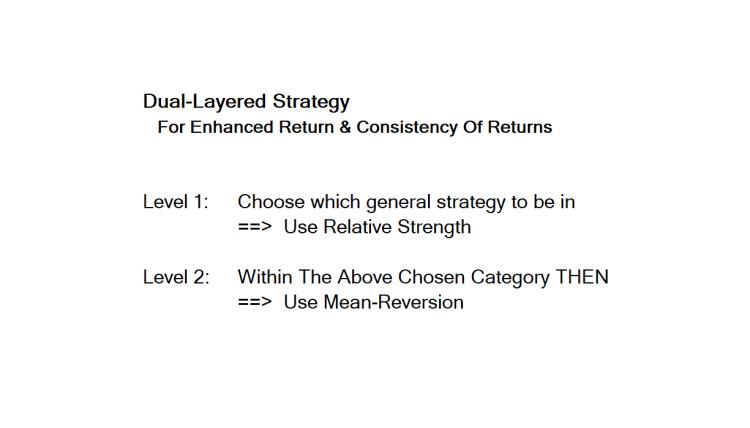

Layering 2 strategies on top of each other for better return -- and importantly this can improve the consistency on a year-to-year basis. The mean reversion strategies tend to add more return when things are volatile -- but less relative to the benchmark when the market is rising on low volatility. That said, low volatility uptrends are often an excellent environment for absolute gains anyway and you will naturally participate in such a market because mean-reversion has zero market timing associated with it. That is, sometimes you will just track rather than outperform a low-volatility uptrend.... and that is a good thing.

to expand video on screen, click the '4 expanding arrows' icon in the bottom right corner of the video screen

Nov 04, 2019

in Mean Reversion

A video to demonstrate mean-regression on ETFreplay.com and some concepts on trading -- for example, many small gains cumulatively add up over time when you buy at wholesale and sell at retail prices.

to expand video on screen, click the '4 expanding arrows' icon in the bottom right corner of the video screen

Aug 27, 2019

in Mean Reversion, Video

A video to demonstrate mean-regression on ETFreplay.com and some concepts related specifically to ETF mean-regression.

to expand video on screen, click the '4 expanding arrows' icon in the bottom right corner of the video screen