Aug 28, 2020

Q. "I have seen a few examples using ETFreplay to backtest stocks. This is something I would like to do but I don't see where this can be done on the website. Can you help?"

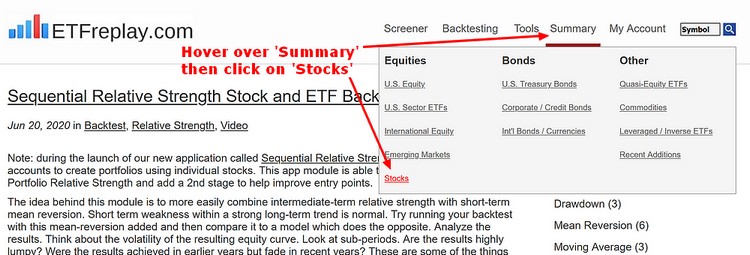

A. To see the list of available stocks hover over 'Summary' in the main menu, under 'U.S. Equity', click on 'Stocks'. The list is prmarily made up of the main holdings of the large ETFs, which are obviously our focus. There are also a few other interesting names and a small number of ADRs. These stocks can be added to portfolios, just like ETFs and mutual funds, and can be used with all backtesting modules and tools.

Jun 20, 2020

in Backtest, Video, Sequential RS

Note: during the launch of our new application called Sequential Relative Strength, we are allowing all accounts to create portfolios using individual stocks. This app module is able to expand on the core Portfolio Relative Strength and add a 2nd stage to help improve entry points.

The idea behind this module is to more easily combine intermediate-term relative strength with short-term mean reversion. Short term weakness within a strong long-term trend is normal. Try running your backtest with this mean-reversion added and then compare it to a model which does the opposite. Analyze the results. Think about the volatility of the resulting equity curve. Look at sub-periods. Are the results highly lumpy? Were the results achieved in earlier years but fade in recent years? These are some of the things ETFreplay was created to do -- not just look at the return of a strategy -- but to decompose it and analyze it to try to find something that is more robust. #STUDY

to expand video on screen, click the '4 expanding arrows' icon in the bottom right corner of the video screen. Use the settings icon to change to 1080 quality if it seems at all blurry

Jun 10, 2020

in Mean Reversion, Regime Change

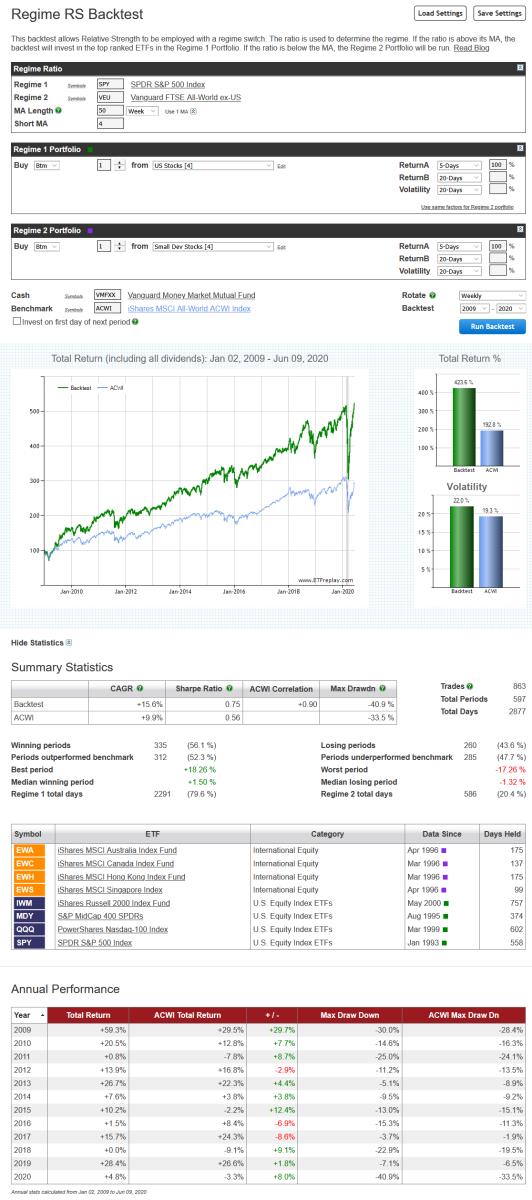

Late last year we produced a video that showed how two different strategies, relative strength and mean reversion, could be layered on top of each other. That example went through each of the constituent backtests separately, in order to explain the mechanics of the process.

The example below shows how such a dual-layered strategy can be run in a single backtest. The first layer employs the SPY / VEU ratio moving average as a regime switch to dynamically alternate between whichever is stronger; U.S. or International stocks. Then, the second layer picks the weakest short-term performer within that chosen asset class.

To keep it simple, we have used the same basic U.S. (MDY, IWM, SPY and QQQ) and international (EWA, EWC, EWH and EWS) ETFs that we have used in previous examples.

Mar 27, 2020

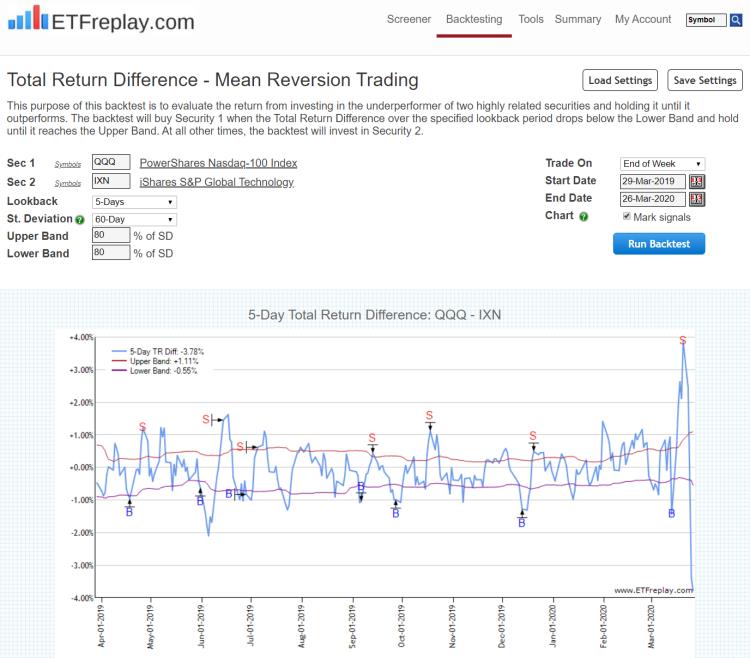

in Mean Reversion, TRD Total Return Diff

Related But Different ETFs:

Mar 03, 2020

in Backtest, Mean Reversion, TRD Total Return Diff

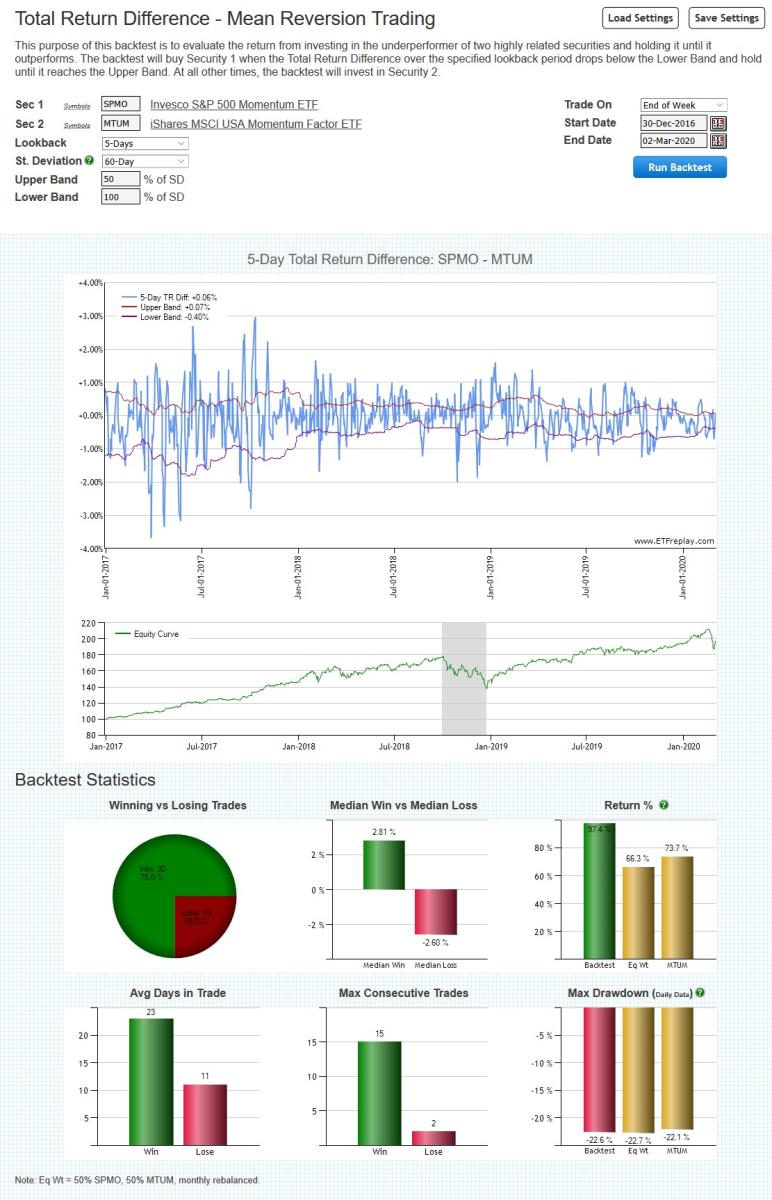

We have introduced a new backtest for subscribers that is focused on short term mean reversion. It is intended to be used with highly related securities, which are unlikely to drift apart for very long before coming back together. Consequently, when one of the securities underperforms by a non-insignificant margin, an opportunity occurs.

The backtest works by comparing the difference in the x-day Total Return between the securities / ETFs. When that x-day return difference is more than y standard deviations below the mean, the backtest will buy Security 1. It will then hold that security until it reaches z standard deviations above the mean, when it will be sold in favor of Security 2.

Suitable primarily for non-taxable accounts only, the idea is that these short-term trades among correlated assets can be used to materially enhance the returns through compounding without a material difference in the underlying beta exposure. More return not for less risk -- but for very similar risk. Said another way, taking a modicum of extra risk can be quite profitable.

Go to Total Return Difference (TRD) - Mean Reversion Backtest