Diversification comes in various forms

Jul 09, 2019

in Backtest

Maintaining a well diversified portfolio is a time-tested way to protect against going all-in on what turns out to be a terrible investment. Diversification can also be employed at the strategy level for the same reason. An example of this is the core-satellite framework, where a rebalanced core portfolio is mixed with different strategies that focus on Relative Strength and Moving Average trend following etc.

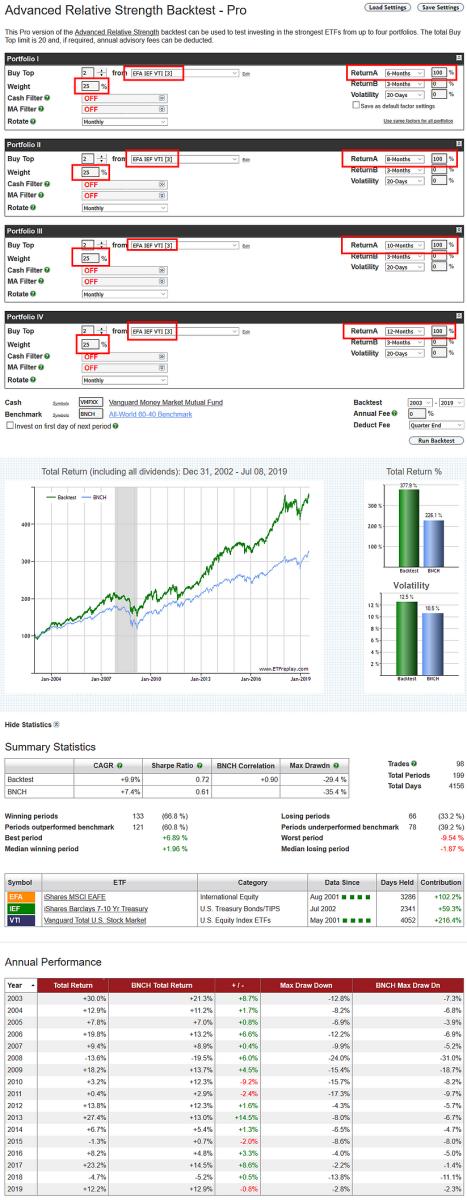

It is also possible to diversify across different versions of a single strategy, to reduce the risk of parameter choice misfortune. For example, rather than relying solely on 12-month returns, for instance, the backtest below equal weights 4 variants of the same model: a 6-month version, 8-month, 10-month and one using 12-month returns all on the same ETFs: EFA, IEF and VTI (the constituents of BNCH).

click image for full size version

Just as a well diversified portfolio means that at least some part of it will always be a drag, a composite made up of different model variants will always underperform the best version of the strategy....but it also avoids being exclusively in the worst.

Follow ETFreplay on