Category: Backtest

Sep 02, 2025

in Backtest

We have enhanced the ETF Portfolio Backtest with a couple of upgrades.

First, there is now the option to mark rebalance events on the main chart. If the backtest is primarily rebalancing into risk-on assets (typically buying equities) because they are under weight compared to their starting / target weight, the 'R' icon is blue. If the backrest is predominantly rebalancing away from risk-on assets and towards risk-off / lower volatility assets, the 'R' icon is red.1

click image to view full size version

Second, we have added the functionality to save and load all the backtest settings; portfolio, benchmark, rebalance option, start / end dates etc.2

Go to the ETF Portfolio Backtest.

Note:

- To prevent the chart from becoming a cluttered mess, no ‘R’ icons will be displayed on the chart if there are more than 25 rebalance events.

- Regular subscribers can save up to 5 different sets of settings. Pro subscribers can save up to 20.

Sep 12, 2024

in Backtest

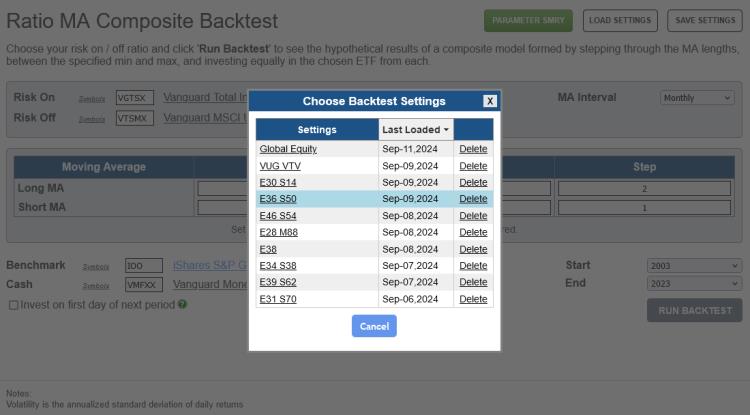

The load and save settings function on all relevant backtests now displays the date that each of the settings were last loaded.

click image to view full size version

The last loaded dates will initially be empty / blank, but will update, from now on, as and when you load the backtests.

The Load Settings function is straightforward to use. Simply click the ‘Load Settings’ button in the top right corner of the backtest and then:

- to load a backtest, click on its name

- to delete the settings, click 'Delete'

- to cancel / close the window, click the X in the top right corner or click the ‘Cancel’ button underneath the table

- to sort the table, click the column heading

To save your backtest settings:

- Click the ‘Save Settings’ button in the top right corner of the backtest

- Enter a new name for your settings, or, select a name from the table to overwrite existing settings

- Click ‘Save’

Regular subscribers can save up to 5 sets of settings per backtest. Pro subscribers can save up to 20 per backtest.

Feb 16, 2024

in Backtest, Relative Strength, RS Composite

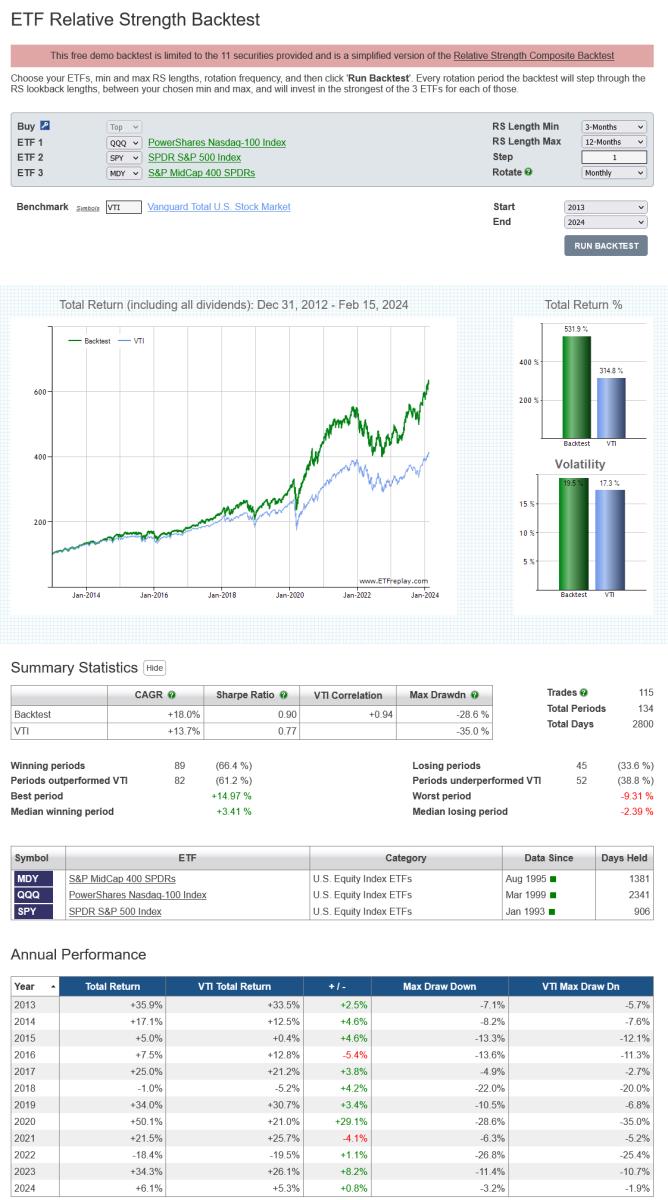

The ETF Relative Strength backtest, which is free to use, now offers the option to backtest either regular 3-Factor RS models or Relative Strength Composite models.

With Relative Strength Composite, rather than relying on a single lookback period for relative strength, you can diversify across a range of RS lengths and thereby protect against parameter choice misfortune.

i.e. though a particular lookback may have historically outperformed other lookback lengths, there's always the possibility that it may underperform in the future.

The RS composite model reduces that risk by stepping through the lookback periods, from your chosen minimum to maximum, and invests in the top (strongest) of the 3 securities from each of those.

In the example below the minimum RS length is 3-months, the maximum is 12-months and the step value is 1. This means that, each month, the backtest will invest 10% in each of the:

- Top ETF from QQQ, MDY and SPY ranked by 3-month total return

- Top ETF from QQQ, MDY and SPY ranked by 4-month total return

- …5-month total return

- …6-month total return

- …7-month total return

- …8-month total return

- …9-month total return

- …10-month total return

- …11-month total return

- Top ranked ETF from QQQ, MDY and SPY ranked by 12-month total return

click image to view full size version

If QQQ ranks top for all 10 of those specified RS lookback periods, then 100% will be invested in QQQ. If SPY ranks top for 11 and 12-month returns and QQQ for the others, then 80% will be invested in QQQ and 20% in SPY. etc etc.

The step value can be increased to determine whether it is possible to obtain sufficient diversification without needing to employ every RS length. For instance, raising the step value to 3 in the above example will mean the backtest ranks QQQ, MDY and SPY by 3, 6, 9 and 12-month returns each month and invests 25% in the top ranked security from each of those.

To backtest just 6 and 12-month RS lengths, set RS Length Min to 6-months, Max to 12-months and Step to 6. The backtest will then, each month, rank QQQ, MDY and SPY by 6 and 12-month returns and invests 50% in the top ranked security from each.

Go to the ETF Relative Strength backtest

Not a subscriber? Subscribe

Note:

- All returns on ETFreplay are Total Return, which accounts for price appreciation and the receipt and reinvestment of dividends (and any other distributions, such as capital gains distributions). See Total Return vs Price Return

-

Subscribers, when logged in, have the option to switch from backtesting relative strength to mean-reversion and are not restricted to the 11 symbols provided for ETF 1, 2 and 3. Annual subscribers (regular and pro) also obviously have access to the fully fledged portfolio RS Composite backtest.

Nov 07, 2023

in Backtest

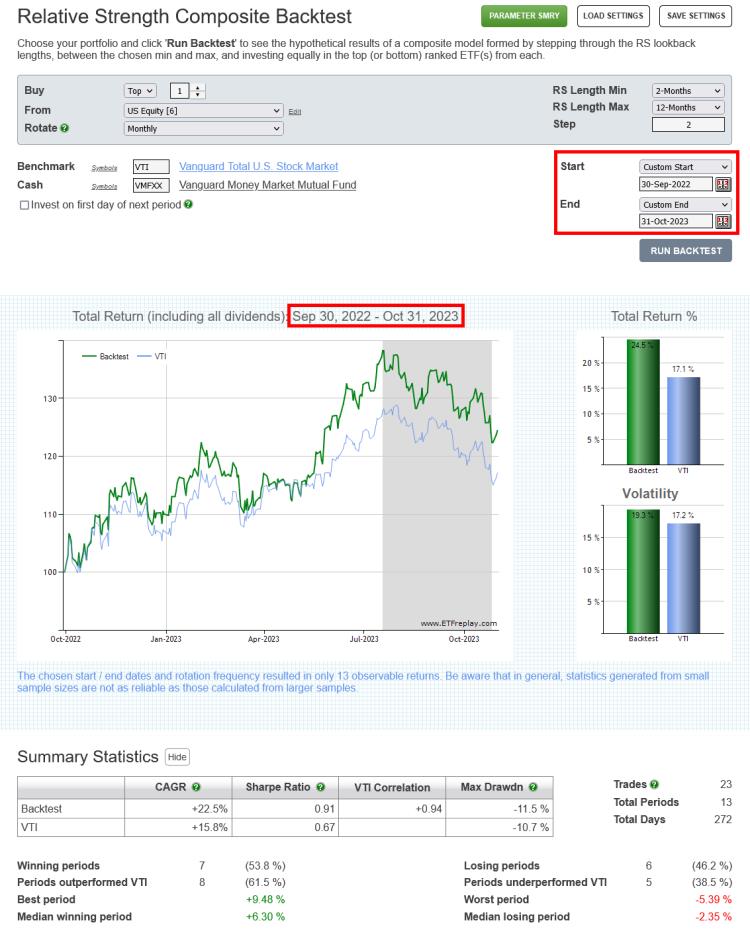

Subscribers can now set specific start and end dates on all portfolio Relative Strength, Regime, Ratio MA, Moving Average and Channel backtests.

All the backtests still allow you to simply set the start and end year, if so desired. But, it is now also possible to choose a custom start and / or end date, as per the example below:

Note: if the specified start date is not a valid rotation day, the backtest will start on the chosen day and will invest in the picked securities as of the rotation date that immediately preceded the specified start date.

For example:

If a monthly rotating Portfolio Relative Strength backtest has a chosen start date is Jan 10, 2023, the backtest will begin on Jan 10, 2023 and will invest in the top x ranked ETF(s) through Dec 31, 2022.

If a quarterly rotating Portfolio Moving Average backtest has a chosen start date is Nov 29, 2019, the backtest will begin on Nov 29, 2019 and will invest in ther ETF(s) that were above their MA through Sep 30, 2019 (and will invest in cash for those that were below).

etc. etc.

Jul 05, 2022

in Backtest, Dashboards, Tracking Error

We have added some new functionality to the Core-Satellite backtest, Tracking Error tool and Dashboard.

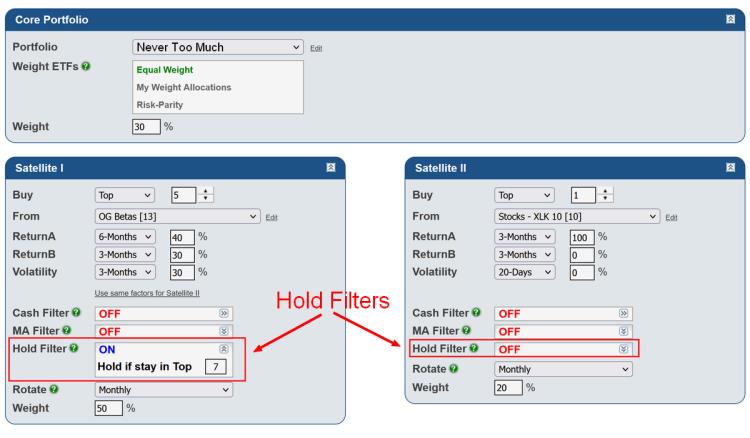

Core-Satellite

The Core-Satellite backtest has an updated look and the Hold Filter, which we recently added to the Portfolio RS and RS - Combine Portfolios, can now be applied to either (or both) of the satellites.

click image to view full size version

The appearance of the other parallel relative strength backtests, the sequential RS and various regime backtests has been similarly updated.

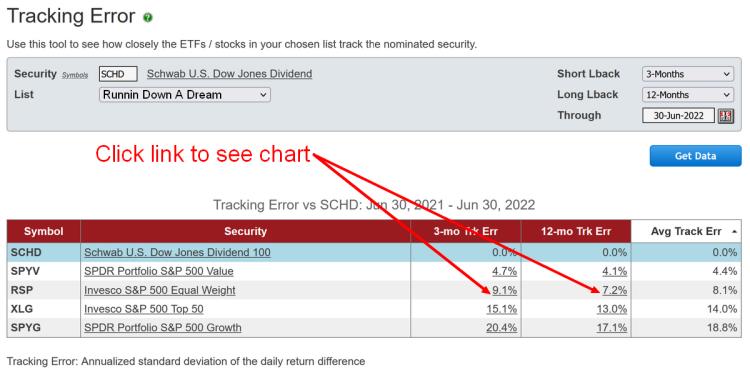

Tracking Error tool

The tracking error values now link through to the ETF charts page, which will automatically load the two securities over the specified duration and display their performance.

click image to view full size version

Dashboard

We recently added a new Summary window option that displays the 1-Day, Year-To-Date, 2021 and 2020 Total Return of each security in your chosen list.

click image to view full size version