Jan 26, 2026

in RS Composite

We have upgraded the Core-Satellite, Regime RS, Core-Regime RS and Advanced RS Pro and the Relative Strength backtests.

Last month we added a Majority Pick option to the Relative Strength Composite backtest. Now, Pro Subscribers wishing to reduce trade activity, can employ the Majority Pick option when testing a composite model on any of the aforementioned RS backtests.

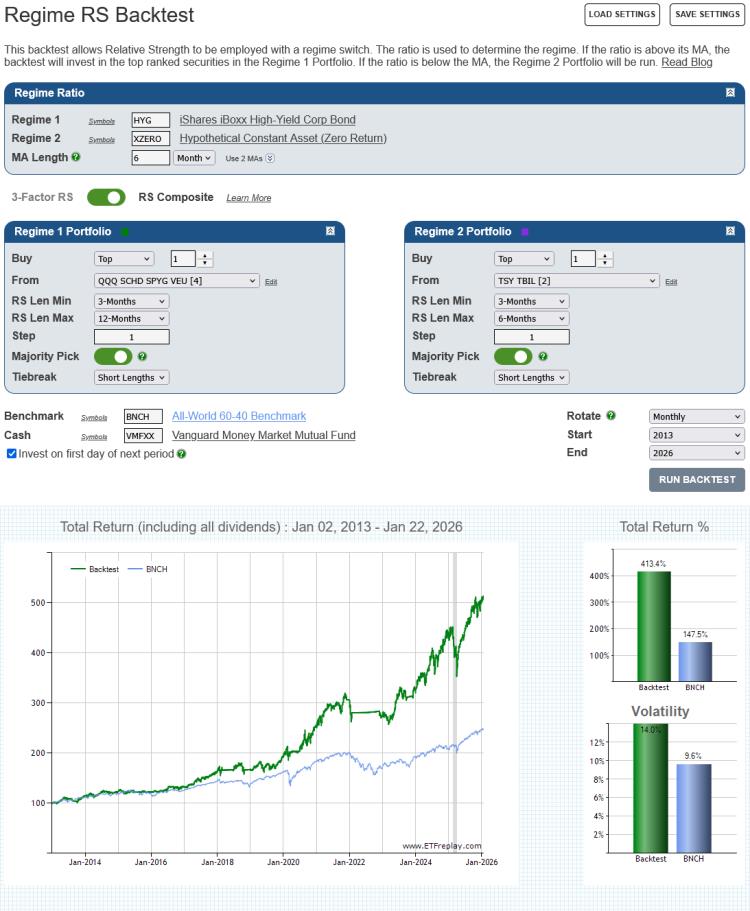

The example below uses HYG versus its 6-month moving average as a regime indicator to switch between stock and bond RS strategies.1 When HYG is above its 6-month MA, the backtest will run the equity strategy and with Majority Pick turned on, rather than investing in the ETF picked by each of the chosen RS lengths (3 through 12-months), the backtest will instead invest only in the ETF that’s been picked by the majority of RS lengths.

When HYG is below its 6-month MA, the backtest will switch to running the bond relative strength strategy. As Majority Pick is turned on, the backtest will invest in the bond ETF that ranks first by the majority of the four RS lengths (3, 4, 5 and 6-months).

click image to view full size version

Regular subscribers can upgrade to a Pro Subscription at My Account > Subscription Settings > Upgrade to Pro.

note:

-

XZERO is simply a zero return index (i.e. it's a constant), consequently an MA of the ratio HYG / XZERO is the same as a moving average of HYG itself. See Using SPY as a regime switch.

Dec 09, 2025

in RS Composite

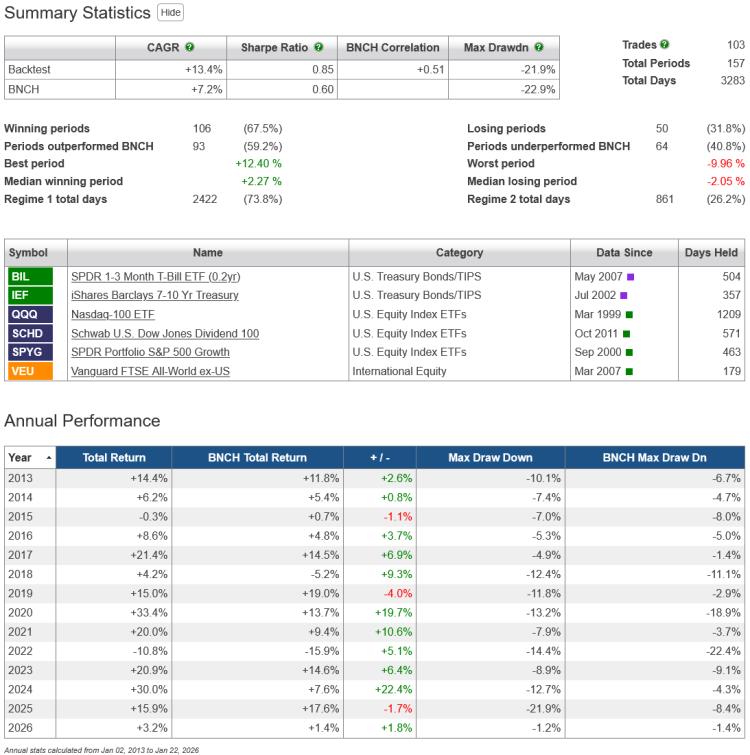

We have added a new option to the Relative Strength Composite backtest for Pro Subscribers; Majority Pick.

If Majority Pick is turned on, rather than investing in the security picked by each RS length, the backtest will instead invest only in the top / bottom X securities that have been picked by the majority of RS lengths.

Though it sacrifices some of the diversification benefit of the full / regular composite, the Majority Pick reduces trade activity, often significantly, while still retaining the spirit of the composite approach.

click image to view full size version

Tiebreak

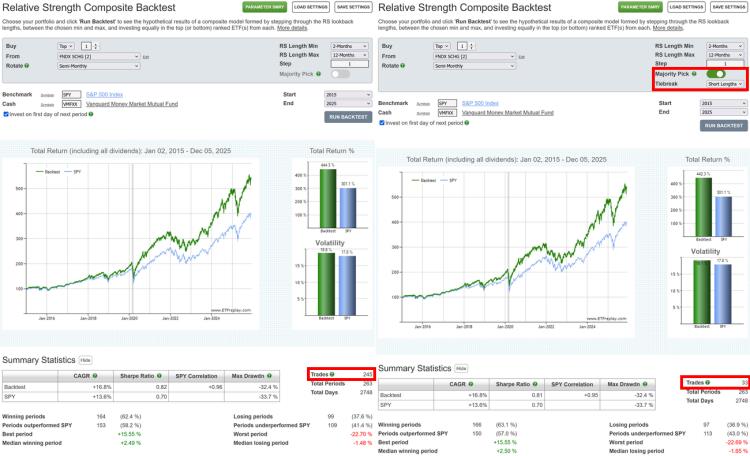

In the event of a tie, where two or more securities have been picked by an equal number of RS lengths, then each of the chosen RS lengths will be assigned a weight and the security with the greatest total assigned weight will be picked.

By default the assigned weights decline exponentially from the shortest RS length (i.e. shorter lengths have greater weight). However,if preferred, you can opt for the weights to decline exponentially from the longest RS length, so that longer lengths have greater weight.

In the example below ABC and XYZ are tied, each the pick of 3 RS Lengths. On a tiebreak, the majority pick is XYZ, as the weights assigned to the RS lengths that picked XYZ total 50.039% versus 44.825% for the RS lengths that picked ABC.

Regular subscribers can upgrade to a Pro Subscription at My Account > Subscription Settings > Upgrade to Pro.

Go to the Relative Strength Composite backtest.

Nov 03, 2025

in Total Return

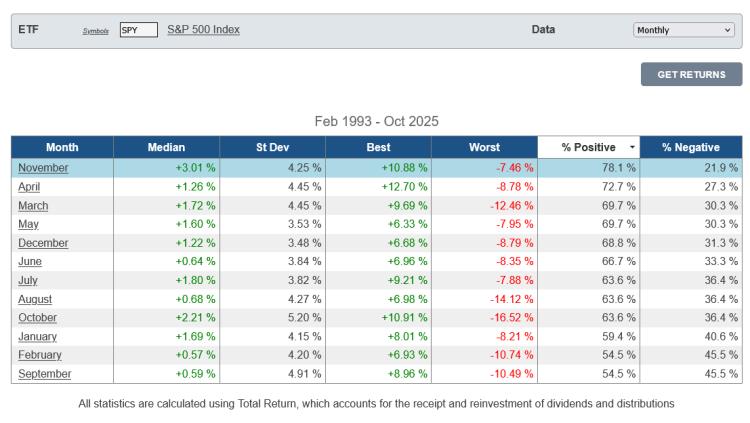

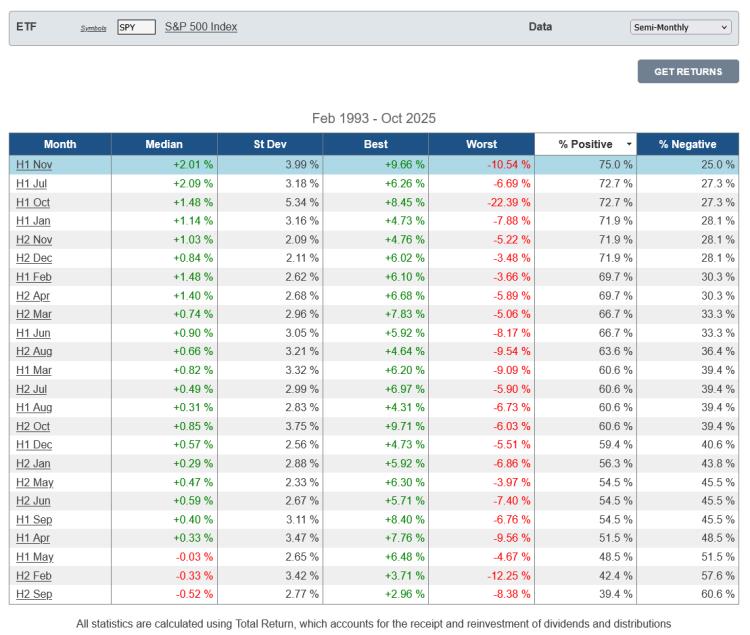

SPY returns have been positive more frequently in November than any other month of the year. Since its inception, SPY has produced a median return of 3% in November and been positive 78% of the time.

click image to view full size version

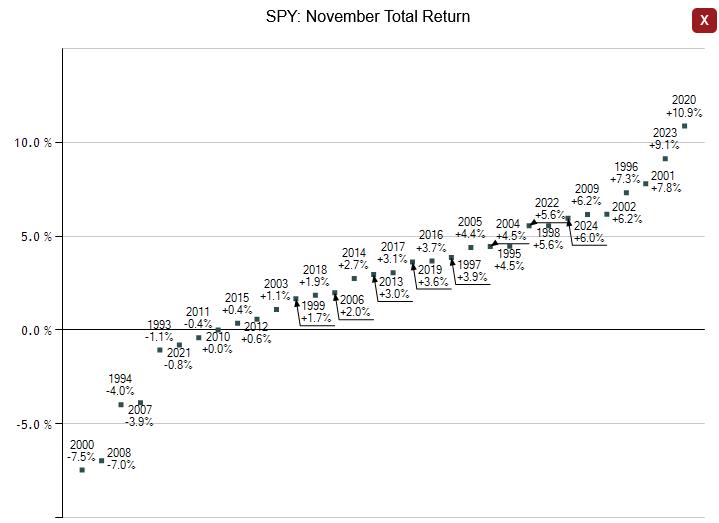

Its best November return so far has been +10.9% in 2020 and its worst -7.5% in 2000. 2021 was the last time it posted a negative return in November (-0.8%).

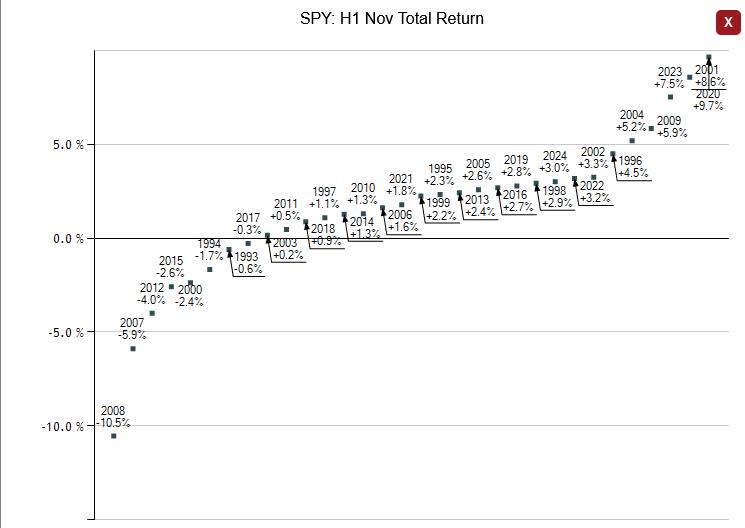

The first half of November has historically been stronger than the second half of the month for SPY; its median return for the first half of November is +2% and it’s been positive 75% of the time versus a median return of +1% with 71.9% positive for the second half.

SPY’s worst first-half November return so far has been -10.5% in 2008. It last produced a negative return for the first half of November in 2015 (-2.6%). In 2015 the second half of November reversed the first half decline and SPY finished the month positive.

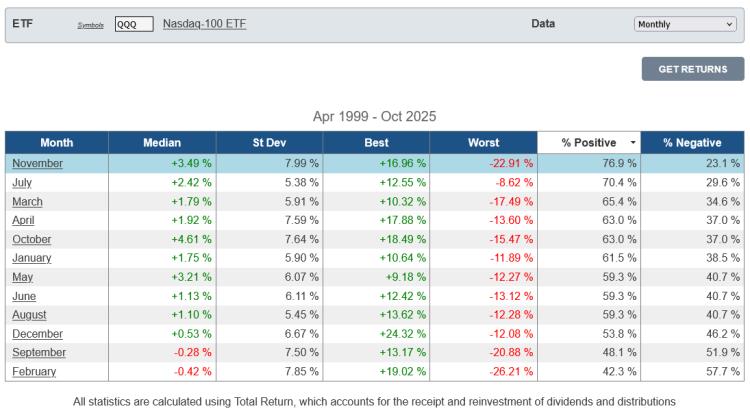

QQQ has also been positive more frequently in November than any other month, though it is also the month with the highest standard deviation.

click image to view full size version

Sep 02, 2025

in Backtest

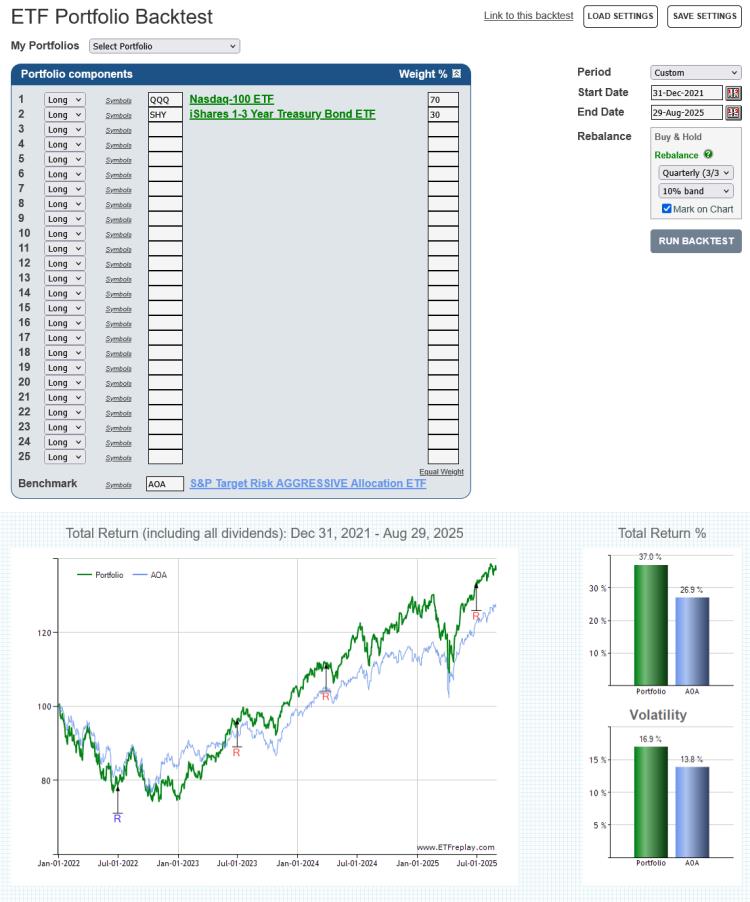

We have enhanced the ETF Portfolio Backtest with a couple of upgrades.

First, there is now the option to mark rebalance events on the main chart. If the backtest is primarily rebalancing into risk-on assets (typically buying equities) because they are under weight compared to their starting / target weight, the 'R' icon is blue. If the backrest is predominantly rebalancing away from risk-on assets and towards risk-off / lower volatility assets, the 'R' icon is red.1

click image to view full size version

Second, we have added the functionality to save and load all the backtest settings; portfolio, benchmark, rebalance option, start / end dates etc.2

Go to the ETF Portfolio Backtest.

Note:

- To prevent the chart from becoming a cluttered mess, no ‘R’ icons will be displayed on the chart if there are more than 25 rebalance events.

- Regular subscribers can save up to 5 different sets of settings. Pro subscribers can save up to 20.

Jul 08, 2025

Pro Subscribers now have the option to edit, or add, imported data directly, rather than importing an Excel spreadsheet each time.

To use this new functionality, click the ‘Edit Data’ button above the Imported Data Series table.

The edit page will then automatically load with the last date from your imported data series. Change the date to go back and edit older data, or forward to add new data.

When wanting to insert, or overwrite, large amounts of data, Importing an Excel spreadsheet remains preferable.

Pro Subscribers can create up to 25 Imported Data series and they can then be used with any backtest. Regular subscribers can upgrade to a Pro Subscription at My Account > Subscription Settings > Upgrade to Pro.