Using a Regime ETF Backtest To Address Market Cap Weighting Skewing Benchmark Returns

Oct 14, 2020

in Regime Change

This model is simple yet addresses an important issue for those that want to compete against a benchmark.

In order to compete against a specific benchmark, it makes sense to understand that benchmark. If you totally ignore it, you can do great but at times you will probably get frustrated because your strategy is totally out of sync.

So take the example of a logical model of S&P Equal Weight vs NASDAQ Equal Weight. This is a pretty good indicator but at the same time, the S&P Equal Weight is wildly different portfolio than the weighted S&P because of the fact that market weight S&P is strongly skewed to the big, very profitable money-making S&P names (AAPL, AMZN, MSFT etc).

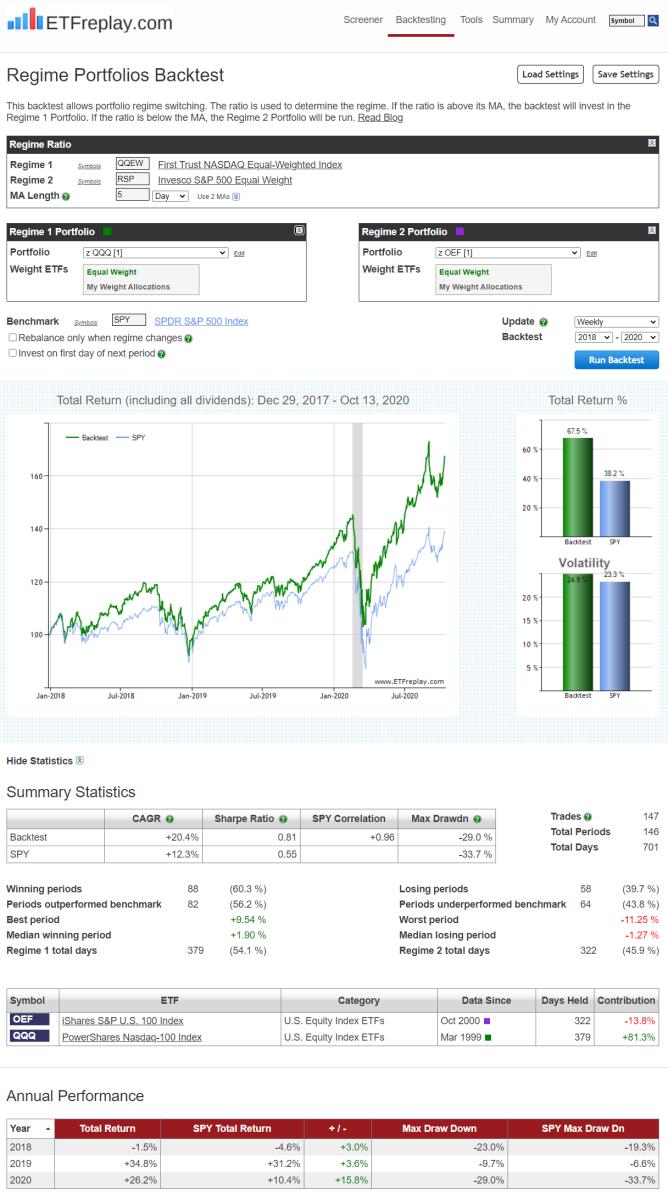

This backtest addresses that by using our Regime model. It still uses S&P EW vs NASDAQ EW as its indicator -- but then when it comes to actually buying and selling, it uses market cap weighted QQQ and market cap weighted OEF (S&P 100).

Take a look;

Follow ETFreplay on