Correlations During Crisis

Feb 24, 2010

in Correlation

I know that this may be implied by others --- but its not enough that something simply be non-correlated to be included in a portfolio. It also needs to have positive expected return.

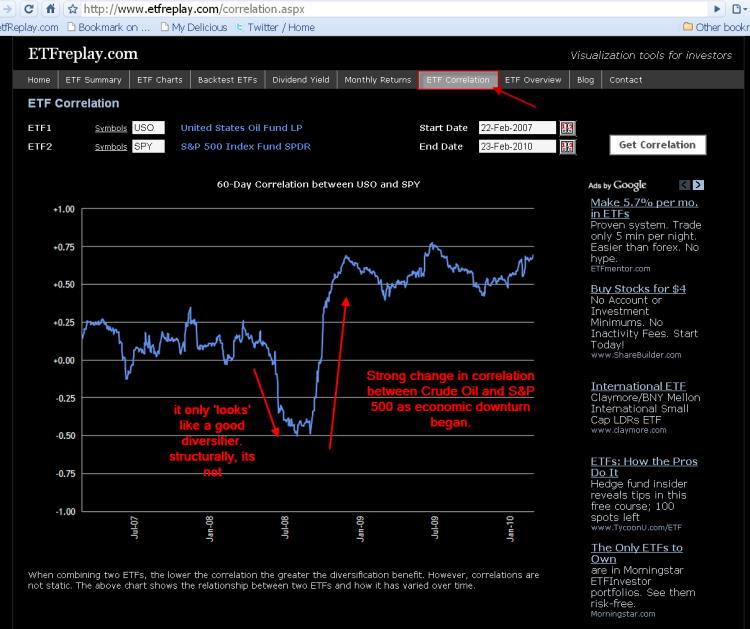

Structurally speaking, commodities markets are both 1) quite volatile and 2) generally quite sensitive to the overall economy -- which is what the stock market is sensitive to. In times of crisis, its been shown over and over again that correlations generally rise, so that you thought you were getting non-correlation, but instead you just get a more volatile asset that delivers an even larger drawdown for your portfolio. An excellent example is what just happened with crude oil in 2008, see images:

Follow ETFreplay on