Category: RS Composite

Jan 26, 2026

in RS Composite

We have upgraded the Core-Satellite, Regime RS, Core-Regime RS and Advanced RS Pro and the Relative Strength backtests.

Last month we added a Majority Pick option to the Relative Strength Composite backtest. Now, Pro Subscribers wishing to reduce trade activity, can employ the Majority Pick option when testing a composite model on any of the aforementioned RS backtests.

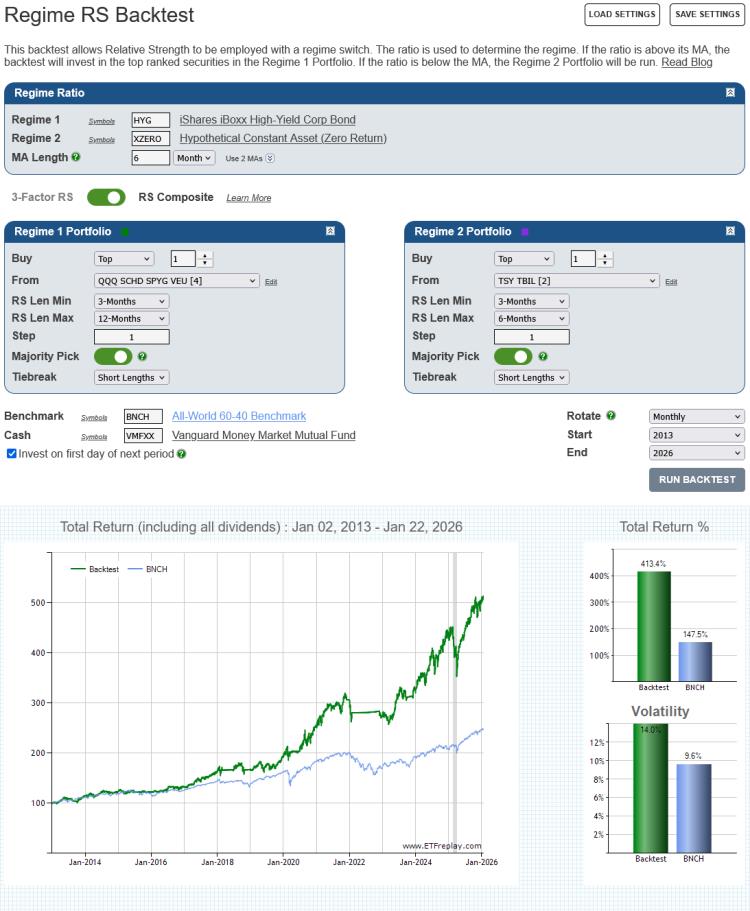

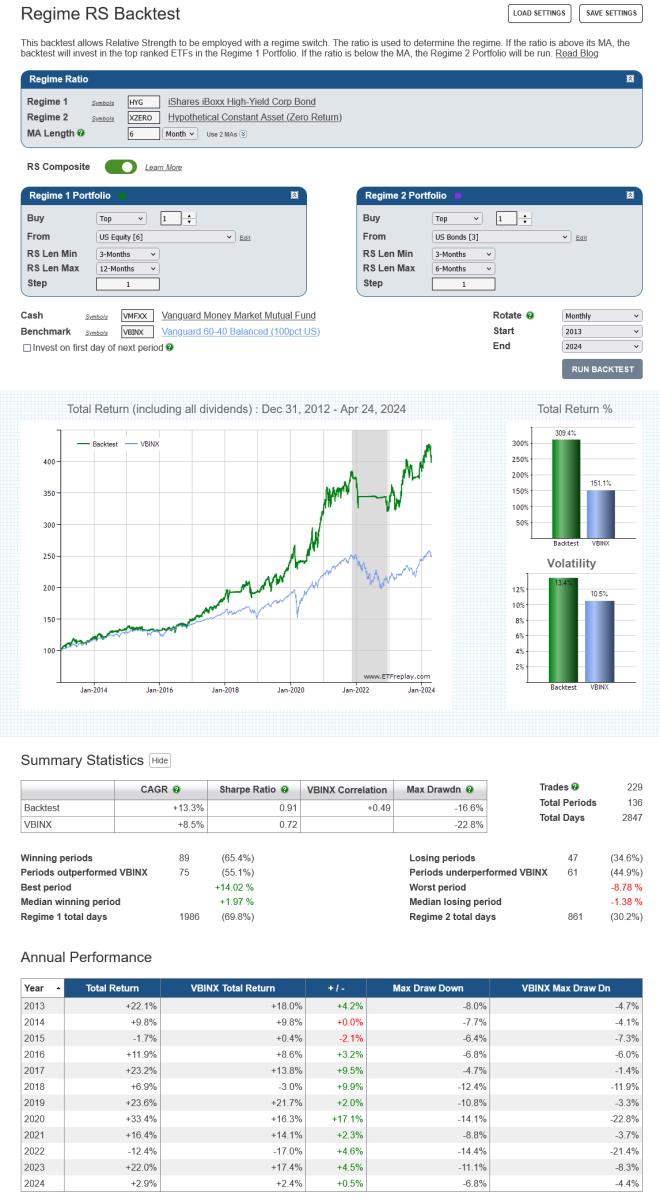

The example below uses HYG versus its 6-month moving average as a regime indicator to switch between stock and bond RS strategies.1 When HYG is above its 6-month MA, the backtest will run the equity strategy and with Majority Pick turned on, rather than investing in the ETF picked by each of the chosen RS lengths (3 through 12-months), the backtest will instead invest only in the ETF that’s been picked by the majority of RS lengths.

When HYG is below its 6-month MA, the backtest will switch to running the bond relative strength strategy. As Majority Pick is turned on, the backtest will invest in the bond ETF that ranks first by the majority of the four RS lengths (3, 4, 5 and 6-months).

click image to view full size version

Regular subscribers can upgrade to a Pro Subscription at My Account > Subscription Settings > Upgrade to Pro.

note:

-

XZERO is simply a zero return index (i.e. it's a constant), consequently an MA of the ratio HYG / XZERO is the same as a moving average of HYG itself. See Using SPY as a regime switch.

Dec 09, 2025

in RS Composite

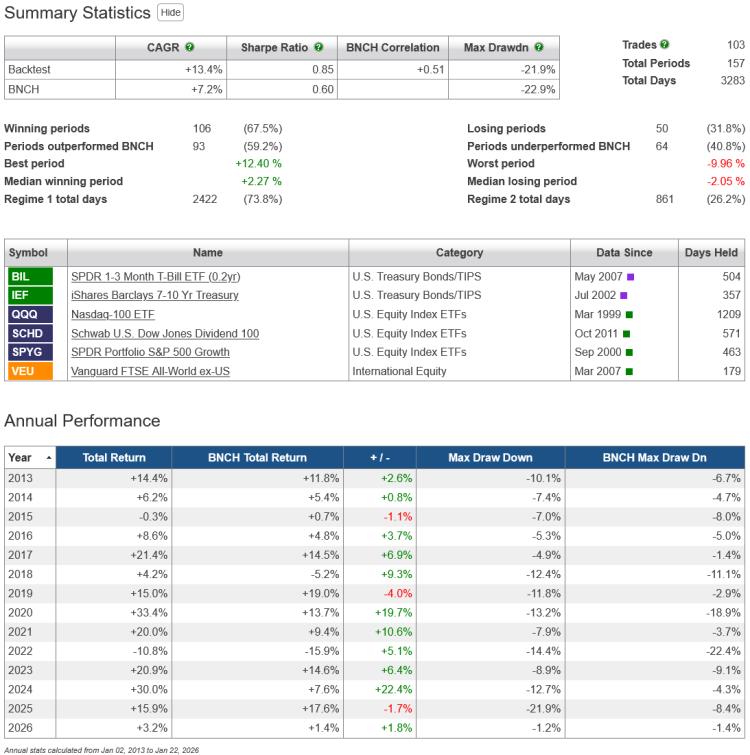

We have added a new option to the Relative Strength Composite backtest for Pro Subscribers; Majority Pick.

If Majority Pick is turned on, rather than investing in the security picked by each RS length, the backtest will instead invest only in the top / bottom X securities that have been picked by the majority of RS lengths.

Though it sacrifices some of the diversification benefit of the full / regular composite, the Majority Pick reduces trade activity, often significantly, while still retaining the spirit of the composite approach.

click image to view full size version

Tiebreak

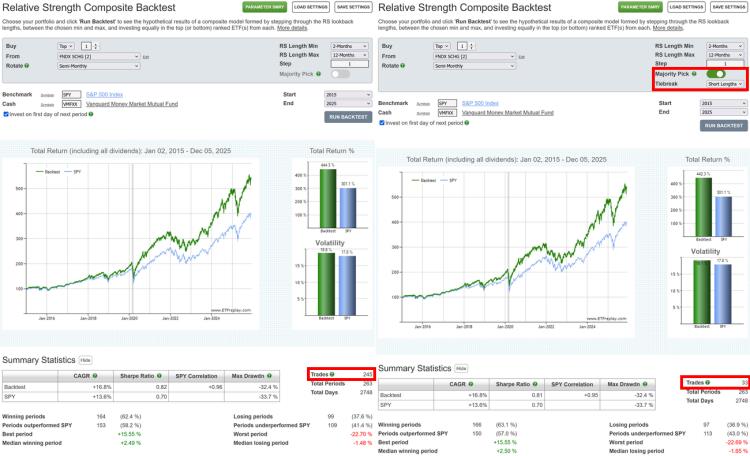

In the event of a tie, where two or more securities have been picked by an equal number of RS lengths, then each of the chosen RS lengths will be assigned a weight and the security with the greatest total assigned weight will be picked.

By default the assigned weights decline exponentially from the shortest RS length (i.e. shorter lengths have greater weight). However,if preferred, you can opt for the weights to decline exponentially from the longest RS length, so that longer lengths have greater weight.

In the example below ABC and XYZ are tied, each the pick of 3 RS Lengths. On a tiebreak, the majority pick is XYZ, as the weights assigned to the RS lengths that picked XYZ total 50.039% versus 44.825% for the RS lengths that picked ABC.

Regular subscribers can upgrade to a Pro Subscription at My Account > Subscription Settings > Upgrade to Pro.

Go to the Relative Strength Composite backtest.

Jan 02, 2025

in RS Composite

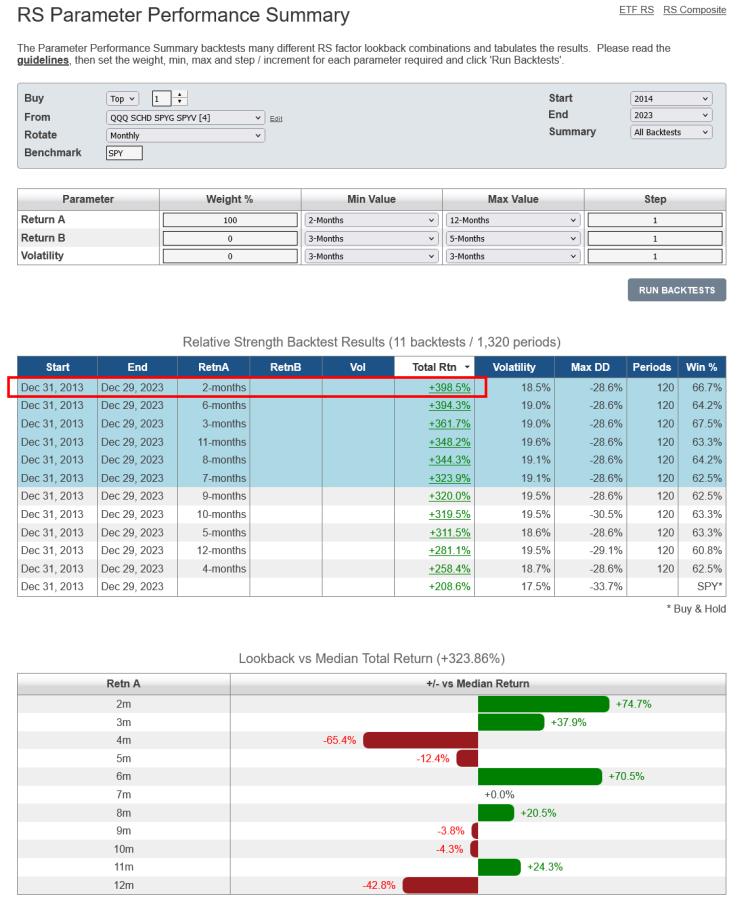

With any parameter based model the risk always exists that a single particular value will underperform in the future, even though it performed well in backtests.

Below is the Parameter Summary of a Relative Strength model that invests in the strongest (i.e. top 1) security from a list of 4 U.S. equity ETFs (QQQ, SCHD, SPYG and SPYV). For the 10-years through 2023, the highest Total Return was produced by the 2-month lookback length.

click image to view full size version

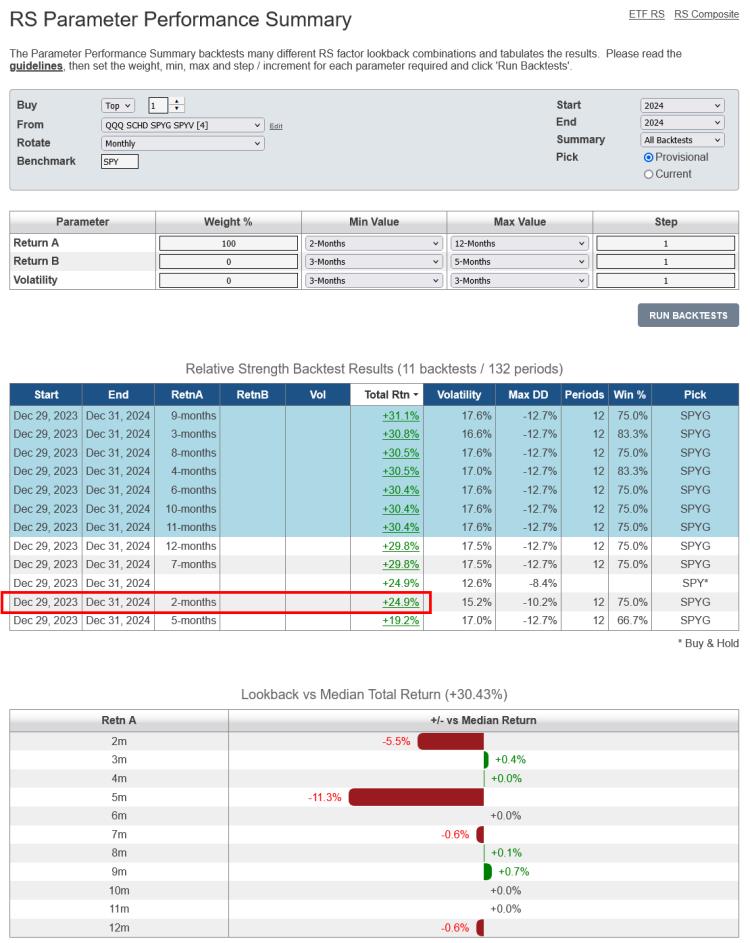

During 2024, however, the 2-month lookback was the second worst performer.

click image to view full size version

The RS Composite method, which we introduced in early 2023, hedges against this uncertainty by diversifying across a range of parameter values. For example, below is an RS Composite backtest where the minimum lookback length is 2-months, the maximum lookback is 12-months and the step value is 2. This means that, each month, rather than investing is just the top ETF ranked by 2-month returns, the composite backtest will invest 16.67% in each of the:

- top ETF from QQQ, SCHD, SPYG and SPYV ranked by 2-month returns

- top ETF ranked by 4-month returns

- …6-month returns

- …8-month returns

- …10-month returns

- top ETF ranked by 12-month returns

click image to view full size version

As can be seen, whereas the 2-month single lookback strategy was comparatively underwhelming in 2024, the RS Composite model performed rather well.

For more, watch this video: Using Parameter Summaries and Composite Relative Strength

Notes:

- a composite model will always underperform the single best parameter value, but, as demonstrated, it avoids being exclusively in the worst performer.

- Studying the Parameter Performance Summary guidelines is always highly recommended

Oct 08, 2024

in RS Composite

We have upgraded the Core-Satellite, Core-Regime RS and Advanced RS Pro backtests.

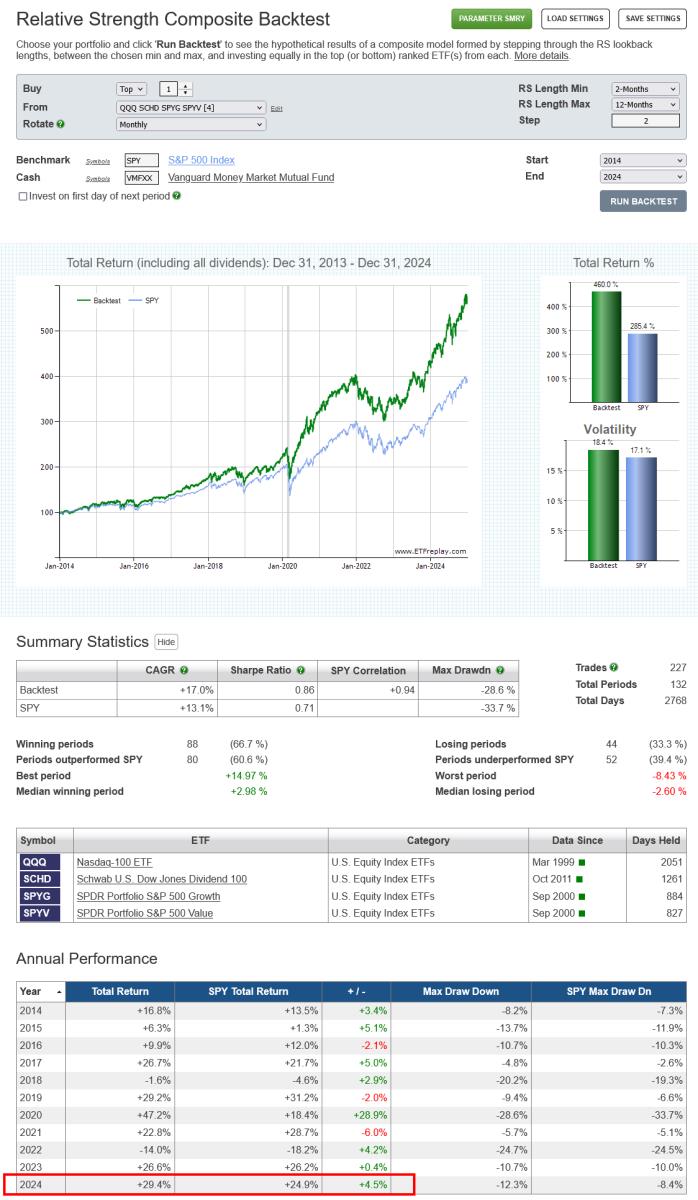

Core-Satellite backtest

Annual subscribers, both pro and regular, now have the option to switch between employing 3-factor Relative Strength or RS Composite on the Core-Satellite backtest.

click image to view full size version

For more detail on the difference between the 3-factor Relative Strength model and RS Composite, see Relative Strength: 3 Factor vs Composite

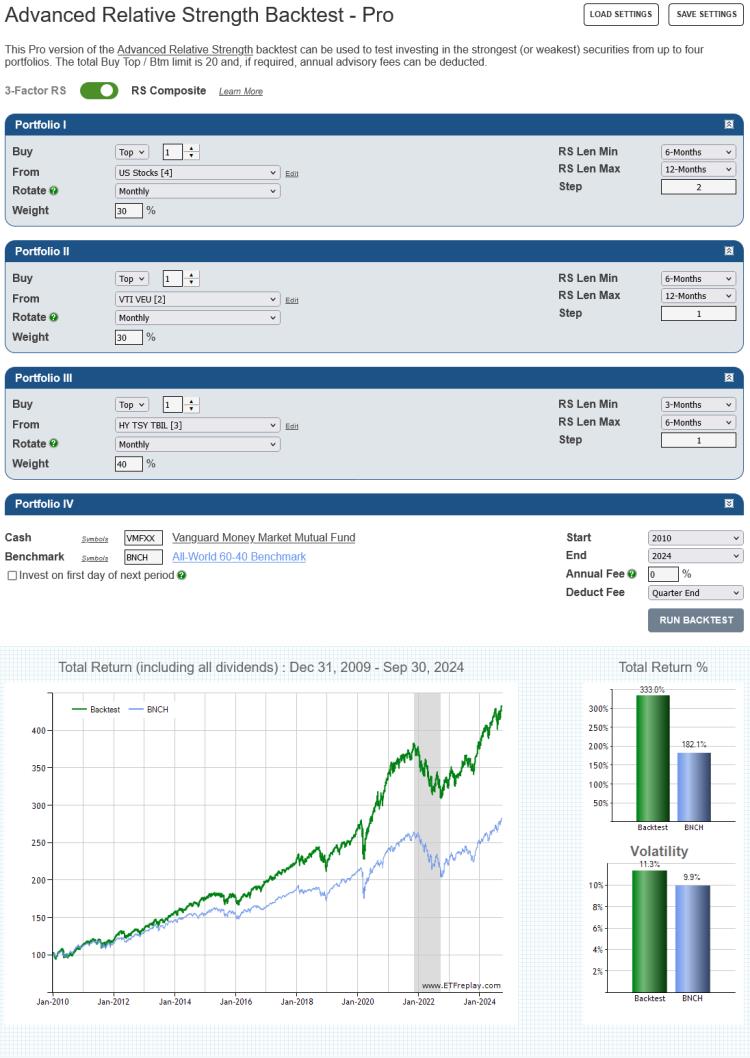

Core-Regime RS and Advanced RS Pro

For Pro subscribers, the option to switch between 3-factor RS and RS Composite is now also available on both the Core-Regime RS and Advanced RS Pro backtests.

click image to view full size version

Apr 26, 2024

in Regime Change, RS Composite

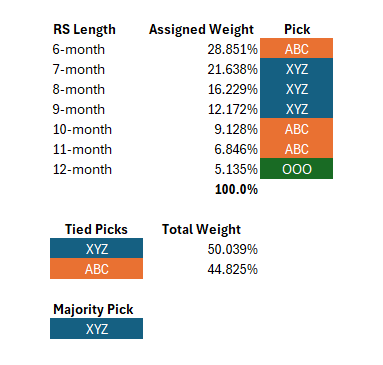

We have added an RS Composite option to the Regime Relative Strength backtest.

Annual subscribers (both pro and regular) can now switch from using regular 3-factor RS models to RS Composite models by turning on the RS Composite option.

click image to view full size version

For more detail on the difference between the 3-factor Relative Strength model and RS Composite, see Relative Strength: 3 Factor vs Composite

Go to the Regime Relative Strength backtest