ETF Basics: ETFs are No More Of A 'Derivative' Than Mutual Funds

Dec 28, 2010

We have noticed that there still seems to be a fair bit of misunderstanding among those new to ETFs. While the structure of ETF's is different than you may be used to -- it is really not that complex.

Ignoring leveraged and inverse ETFs --- the vast majority of ETF assets are plain vanilla index funds --- they are not derivatives.

Some people think that since ETFs are only representing shares -- and that they aren't actually the underlying securities--- this therefore makes an ETF a derivative. But this is simply not true. The ETF holds the actual shares it represents just as when you buy a mutual fund, you don't get the shares delievered to you --- you get mutual fund shares that represent the underlying securities. Clearly everyone should understand that mutual funds are not derivatives. They are classified by the S.E.C. as investment funds --- which is how the S.E.C. categorizes ETF's as well.

In fact, you could argue ETFs are less of a derivative than a mutual fund as in the ETF process, actual shares are passed for any creation/redemption. This is not true when buying a mutual fund. If you send $2,000,000 to a mutual fund, they create shares for your purchase -- but they do not necessarily buy anything with that money --- it could just sit in cash, it depends on the decision of the portfolio managers. During this process, no exchange is necessarily involved. You can send your money directly to a mutual fund company and no exchange would ever know the difference. There were some scandals on this topic in the early 2000's that you may remember regarding late-trading and manipulation --- this was only possible because there was little transparency of this off-exchange activity.

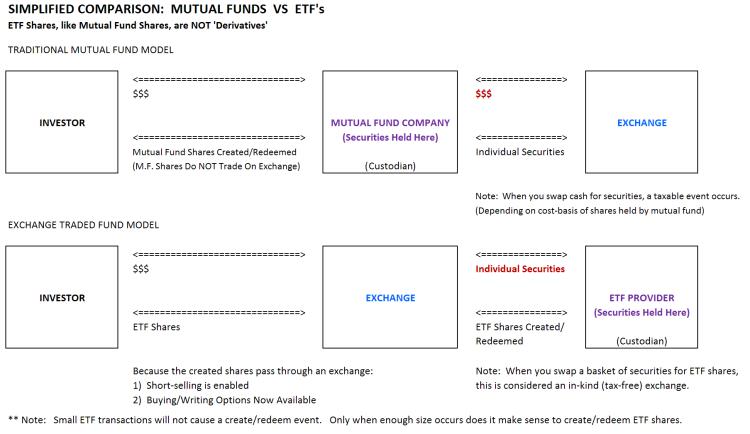

To better understand how simple this really is, below is an image of the basic mechanics. Note that in reality there are actually custodians, index information providers, authorized participants and market makers involved ---- but those are all peripheral considerations.

Note also that because the shares are created behind the scenes and the shares traded are on an exchange, this opens up a few new markets. Now you can sell ETFs short and/or you can trade options on these exchange products. Neither of these are possible when the creation occurs directly to the investor. Even if you never sell short or trade options, this activity is actually good for you --- as all this incremental trading volume created by options participants allows the ETF provider to cycle out lower-cost shares in the tax-free exchange between the exchange and the ETF provider. You can see in the diagram above how this is only possible because the exchange sits BETWEEN you and the fund provider.

Follow ETFreplay on