Allocation ETF Overweight Example

Dec 01, 2012

in Ratio

Quick mini-analysis of an ETF we are long in our Allocations Board models (EPP).

Here is a summary of the rationale:

We went long EPP on an Allocations Board portfolio during a small pullback in late August. (members can see allocation board for details). Why EPP and why then?

First, EPP is a regional ETF covering developed markets in the Pacific ex-Japan region. This means companies based in Australia, Hong Kong & to a lesser extent Singapore and New Zealand. Note that none of these are considered emerging markets --- though all are clearly closely tied to the growth of Eastern Asia, which in turn are all emerging Markets (ex-Japan).

EPP began by performing well on a relative strength basis during the summer of 2012 vs various lists we keep on constant monitor.

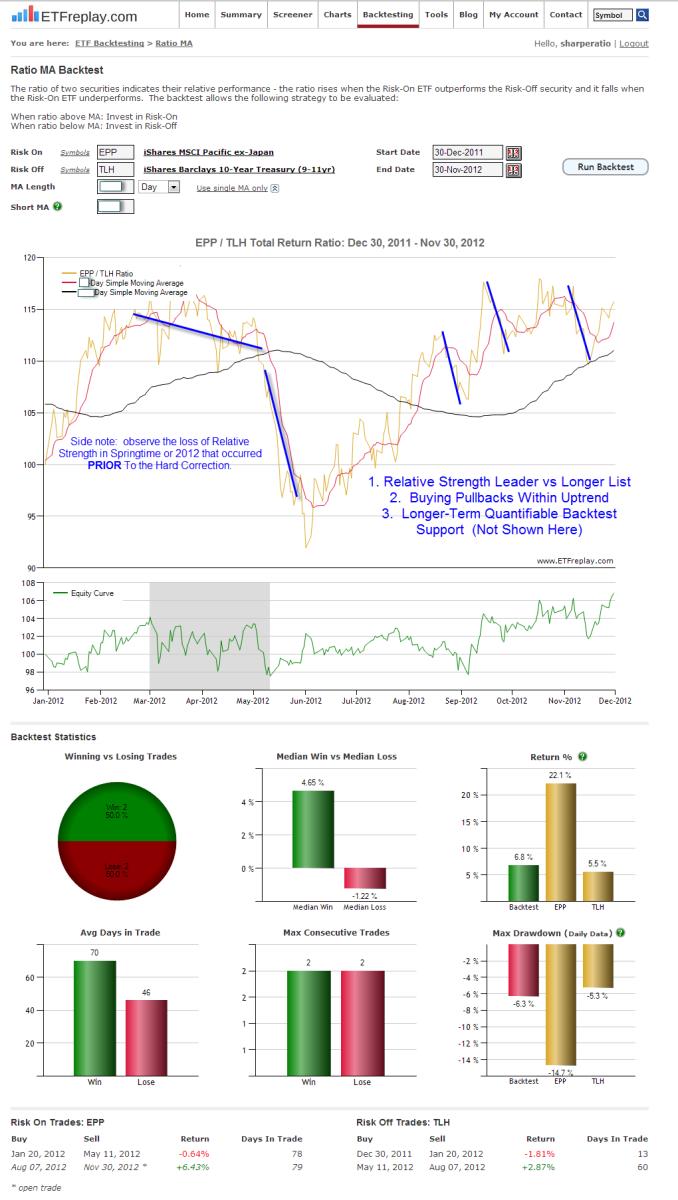

EPP is very volatile -- so we wanted to expose the model to strong relative strength -- but also be sure to plan ahead in case things went adversely against us. This can be a tricky situation because you absolutely must give yourself a chance to participate in the uptrend by giving it some room in the short-run ---- but we wanted also to have a plan in place to avoid large portfolio drawdowns. Below is a snapshot using the Ratio MA module to manage the individual position. Also included are some pullbacks which are normal for a volatile security like this. These would be buying opportunities within a perceived uptrend. This is not meant to be how anyone else should choose to manage a position. This is just a snapshot of how we were thinking about it.

The exact parameter settings should not be the focus here. Investing is not a pure science, in our view. It is much more like a game of poker, partly mathematical and partly behavioral/psychological. Good poker players don't take wild risks with no plan in place if things go adversely. They start out with a plan for each part of the hand and then make adjustments and often have to make some tough decisions as more information is revealed that is adverse to their position. Sometimes they make a mistake and fold the best hand (like a trading whipsaw) --- but over time, good long-term decision-making is what makes a good investor (and a good poker player). PLAN YOUR HAND.

Note that the ETF in discussion here (EPP) was not chosen in the first place because of this ratio MA analysis -- that is just a second more detailed view of how we planned to manage the position. EPP was instead originally chosen because we like what the ETF represents on a fundamental basis (companies based in Australia, Hong Kong & Singapore) AND it also was showing strong signs of a new uptrend beginning (this is what good relative strength analysis does -- it locates particular strength in the market that over time suggests continuation rather than reversal).

Follow ETFreplay on