ETF Regime Change Backtesting: an update of a 2011 example

Dec 02, 2016

in Regime Change

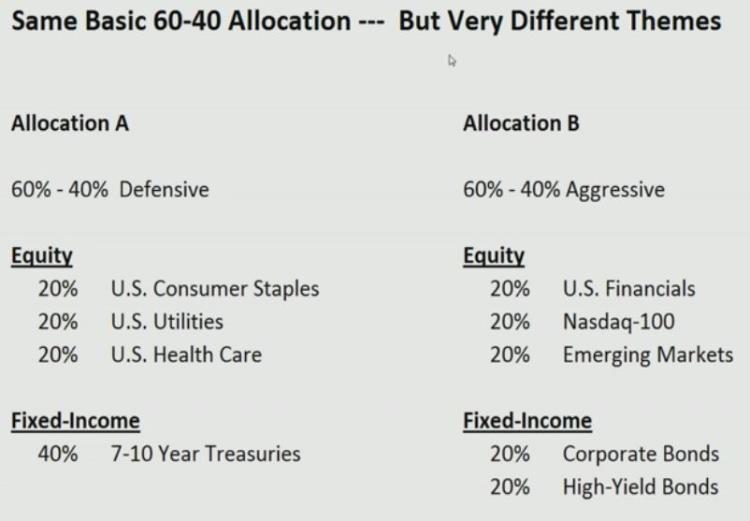

Back in 2011 we produced a little video that compared the performance of two very different 60-40 allocations: an aggressive portfolio invested in Emerging Markets, Financials and High Yield; and a defensive strategy based around Treasury Bonds, Utilities and Healthcare.

The purpose of that video, was not to show which allocation was best but rather to illustrate that 'that different sectors perform differently during the course of the business cycle'. It therefore makes sense that when there is a change in the overall regime, allocations should be materially adjusted.

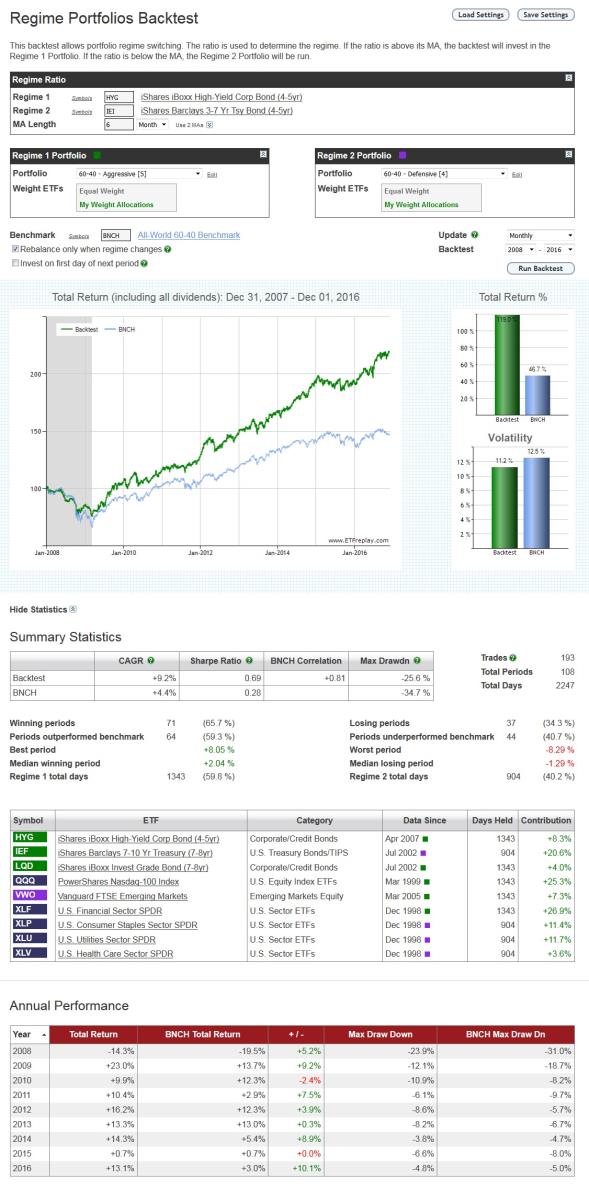

Below is an update to that original example. The same two aggressive and defensive allocations are used, but this time we have employed the Regime Portfolios Backtest to dynamically switch between them depending on the prevailing regime. For this example with have used a simple credit spread style ratio to define the regime. When high yield bonds are outperforming treasuries, the backtest invests in the aggressive allocation. When the opposite is true, it switches to the defensive portfolio.

This is not meant to be a comprehensive strategy by any means, it's just a simple example to illustrate the concept of adapting to change. Hopefully though it provides a solid starting point for subscribers to conduct their own regime based research.

Follow ETFreplay on