Does an ETF track its underlying index by its price?

Sep 11, 2017

in Total Return

Does the ETF market price track the ETF's underlying index?

No. You must calculate the Total Return and use that resulting data series for accurate backtesting signals.

ETFs as you may be aware are designed to track an index. In order to have the ETF track the index in terms of a backtest, you need to re-vinvest the dividends and distributions paid. An 'index' of course doesn't make distributions since it is not an actual investment product. So the 'index price' actively builds the dividends back into the calculation of the index value (price). But ETFs don't do this, they must pay out distributions by SEC law.

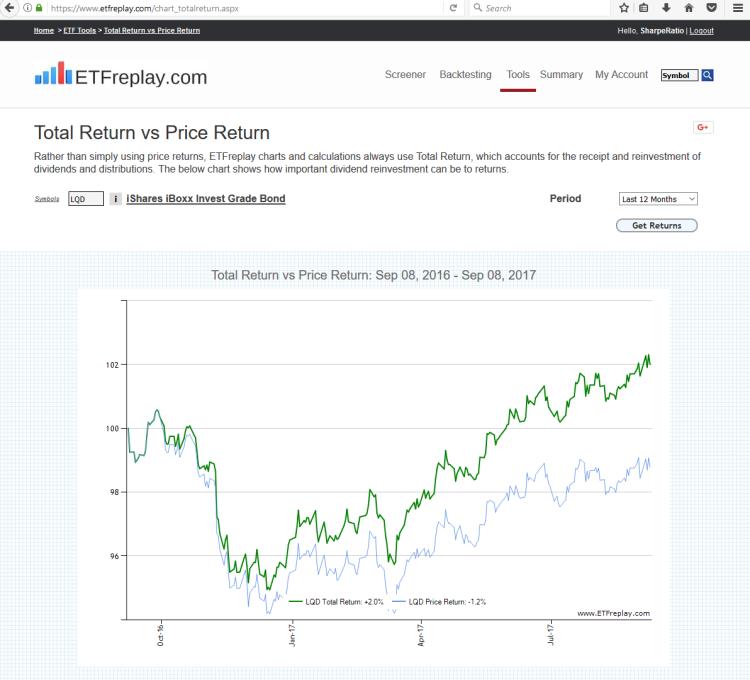

Thus, only the CALCULATED total return data series can represent the INDEX PRICE (the ETF PRICE does not). If you just used the ETF price, you will get inaccurate signals. You can observe the difference between the price return and total return with our Total Return vs Price Return tool.

Follow ETFreplay on