Foreigners Buying US Bond Indexes

Jan 26, 2010

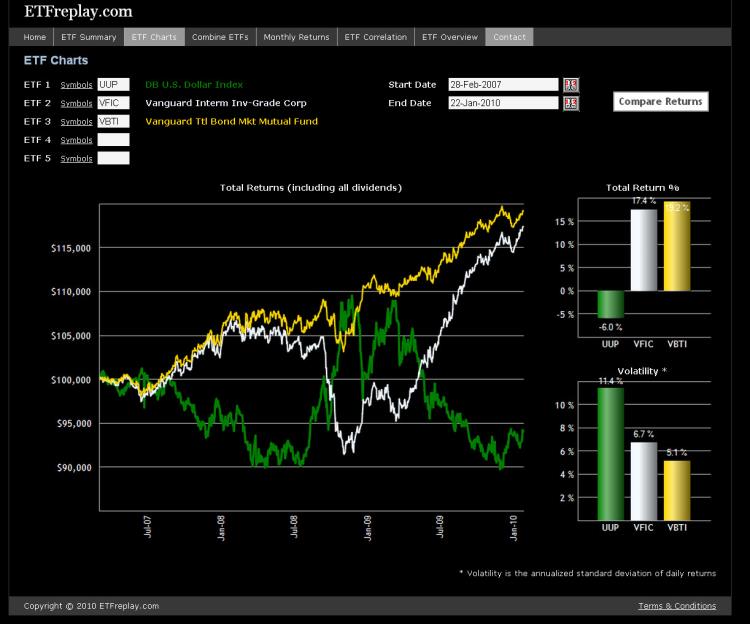

What has currency done to US bond market returns for foreign investors? While various currencies have performed notably differently, the overall Deutsche Bank Dollar Index ETF is a good proxy to make a weighted judgment of overall effect. Since February 2007, when the UUP was launched, there has been a depreciation of the dollar of about -6%. With domestic currency bond market index returns in the +17 to +19% over this period and understanding that some currencies fared much better or worse than the underlying DB dollar index, you can see that currency can be quite a meaningful contribution to overall return.

To update this chart to today or visualize similar relationships using other ETF combinations, go here: http://www.etfreplay.com/charts.aspx

Follow ETFreplay on