Classic Example of ETF Market Generated Information: Junk Bond Investors

Oct 17, 2016

in Ratio

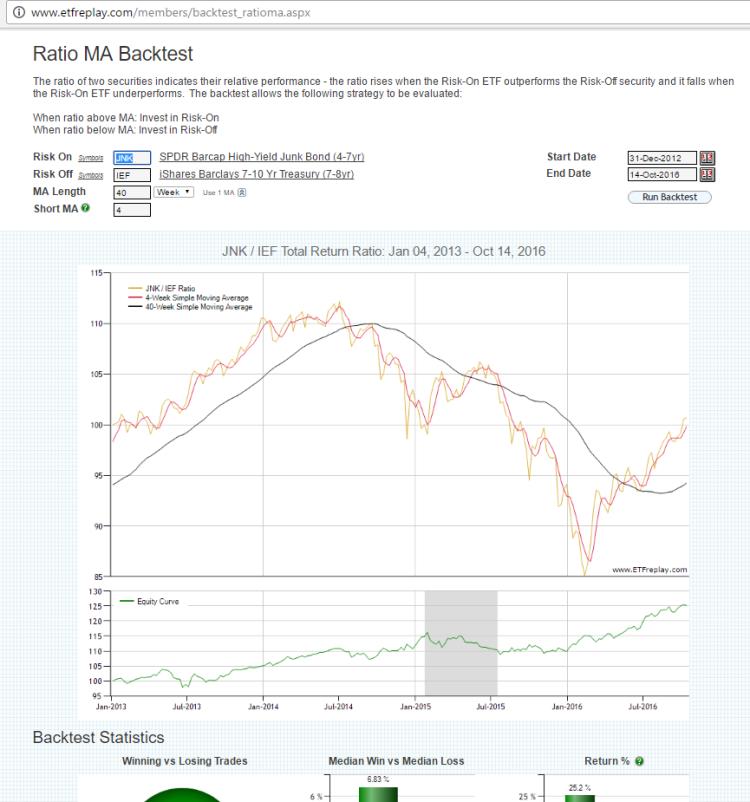

Every recession has something in common: investors flee junk bonds. You do NOT have to predict this, you only need to monitor it.

Junk bond investors got worried in late 2014 and much of 2015 -- and the stock market went effectively nowhere during that time (while High-Quality and Low Volatility segments outperformed strongly).

Most of 2016 has seen a decent bull market in junk bonds. Since fixed-income investors are very sensitive to their income actually being fixed --- and not variable, this group of investors is a very useful group to track.

Follow ETFreplay on