Introduction to Regime Change ETF Backtesting

Mar 10, 2015

in Regime Change

Q. What is regime change?

Regime change in financial markets terms means that there is a shift in a basic financial relationship that has governed a backtest periods results. Some examples might be an inflationary regime changing to a disinflationary era, reflected in how long-term treasury bonds behave. Or it might be a period of sustained high equity market volatility changing to a more narrow range market. Or a rising US Dollar vs a US dollar bear market. Rising price of oil vs declining etc....

Q. Why is understanding what regime you are in important?

Models and backtests are good at identifying relationships and how to profit from those relationships. But standard backtesting is only good if that financial relationship you are backtesting actually stays in-tact. Relationships develop, exist for a period of time --- often lengthy -- and then they can change.

Recall that the rules of financial markets are not like the rules of other areas of observation like in science. The temperature at which water freezes is the same across time. However, the financial markets are different and need to be thought about differently. You cannot be sure that a given financial law will continue into the future. Water doesn't learn from its freezing in the past and adapt -- but investors do.

Thus, regime change is one of the main problems with many articles you see written that study only very long periods of time. You get caught thinking something is true over the long-run and so -- since you are a long-term investor after all -- you don't care about a 3-7 year period of poor performance.

But there is a key problem with that, what if the underlying regime assumption has been mined and through that long-term analysis papers were written about this financial 'law' that exists. But we know that the thing you are counting on is NOT a law of nature, it is just a financial relationship. If you are wrong in your belief system, how much drawdown (or lost performance) will it take you before you figure out your previous thinking was simply flawed in terms of a reasonable time frame of performance analysis (3-7 years) ?

Q. How do you identify regime change?

This takes ongoing research. This takes ongoing thinking. This takes work. You can and should think about very long-term backtests too -- we are not advising taking only a short-term approach --- but then you should also put time and effort into intermediate-term backtesting to help determine whether the model you are relying upon is acting correctly. Balance the long-term backtests with shorter/intermediate term backtests. There is no way to know exactly how relationships will hold/change in the future --- but you can monitor them in ongoing fashion. You don't have to ride a relationship down into oblivion.

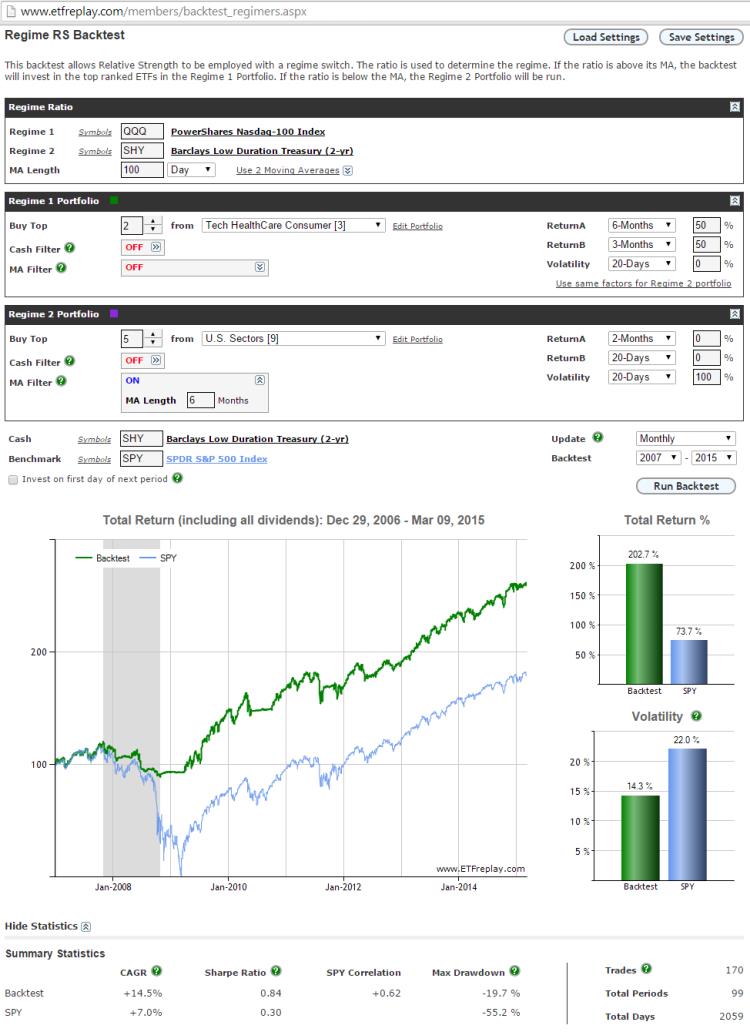

New ETFreplay Backtesting Module: "Regime Relative Strength"

This new module uses some existing methods that have been on ETFreplay.com for years --- but it now combines them into a single process. Before, you had to build this using component modules and then assemble and enter the information as an imported backtest. Now we have automated portions to take more of the monotonous sludgework out and give you more time to do what you should be doing with your time, doing research and thinking about the relationships to test -- not the mechanics of how to make a backtest work and the associated de-bugging.

Think of this as a multi-step process rolled into a single backtest. First, you come up with a rule of how to define Regime 1 vs Regime 2. Once the regime is determined, you line up a backtest strategy for that regime. When the regime switches, you associate a 2nd strategy for that regime. You are always in one regime or the other, there is no grey area -- (backtests need to be specific in the details).

We have defined the 'rule' in this case based on the concept of the Ratio Moving Average. Recall that if you are judging many ETFs (more than 2) against each other, you should use a multi-factor model. But if you are just looking at 2 ETFs, one vs the other, then you may want to just use the total return ratio of the 2 and define rules that way.

Once you have defined what constitutes Regime 1 or Regime 2, you can then set up a strategy for each regime.

Example:

Regime 1 Rule: When QQQ / SHY is trending up (above its 100-day MA because QQQ is stronger)

Regime 1 Portfolio: Own the top 2 performing basic NASDAQ Sectors

Regime 2 Rule: All Other Times (i.e. QQQ / SHY is trending down because QQQ is weaker)

Regime 2 Portfolio: Reduce drawdown risk but maintain equity exposure by owning lower vol ETFs.

This is a very simple example. You can of course add filters such as cash or moving average filters just like the regular backtesting applications elsewhere on ETFreplay.

Update: If you want to run a backtest that switches Relative Strength strategy based on whether or not QQQ alone is above / below its x-period MA, then you can use the ratio of QQQ / XZERO. ZERO is a constant (i.e. zero return), so an MA of the ratio QQQ / XZERO is the same as a moving average of QQQ itself. See 'Using SPY as a regime switch'

Follow ETFreplay on