New Module: Allocations

Sep 19, 2011

We have added a new module to ETFreplay.com that expands the functionality in a logical way. It is located on the My Account tab:

ETFreplay.com has advanced methods for screening and backtesting various relative strength and moving average strategies. The ETFreplay.com community runs thousands of backtests and it makes sense to see how members may be able to help each other with shared research ideas.

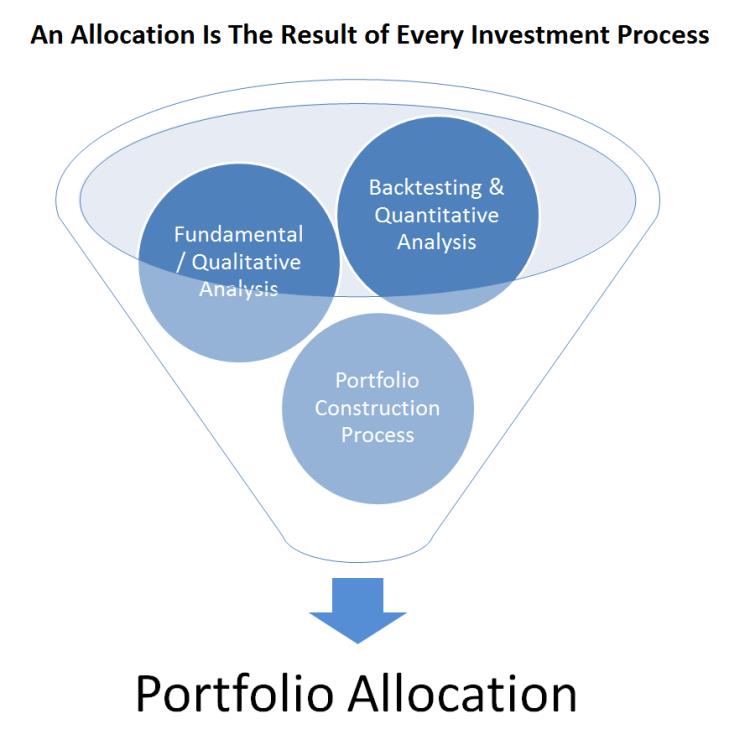

If you think about portfolio management, it doesn't matter what your process is --- in the end, when each day closes --- you have a portfolio filled with securities. Even if your portfolio is mostly cash, that is still an allocation. So our new Allocations module allows you to go to the final step in a process -- that is, take everything you know --- from fundamental to quantitative etc... and create an allocation. Once set-up, we will automate the tracking of the total return -- as well as calculate some of the most important items --- such as your portfolio volatility and portfolio drawdowns and sharpe ratio etc...

Importantly, you can do this privately if you would like --- or you can place the allocation you create on the public Allocations Board. You create your own customized fund symbol (ie, ETFRS) to identify the allocation. You can comment on each others allocations or choose to have comments turned off. You can keep watch lists of various strategies (from those which have chosen to be public). You can delete or create new allocations. We have tried to design it in a way that simply helps you to make better portfolio decisions. And as we've done with all of our applications, we will make the module significantly better over time.

ETFreplay.com has provided research applications that aid in the investent process --- but we simply can't model every possible variation of your requests into a few clicks. After you have researched and tested some ideas and have weighed all the variables and then have decided what to do, what we can do is capture the final allocation that you enter.

Note that we have installed some rules that may seem a bit rigid at first --- but these rules are necessary as we do not want to have this become a short-term trading competition. This is about portfolio management, not the latest earnings speculation or the macro news-of-the-day. The graphic below is one way to visualize the process as we see it.

Note that you can set an allocation to begin and it will use that days closing values. You can update on any day and it will then save the result of the historical fund return and subsequently combine that with the return of the new allocation. We will capture the total return of all securities (adjusting for dividends & cap gains distributions) so that your income securities are properly tracked. We know that relative to a real account, sometimes you will get a price that is different than the closing price -- but this is an allocation app and its purpose is to show various types of portfolio strategies --- not to perfectly mimic intraday trades.

Over the long-run, allocation moves are the overwhelmingly dominant factor in portfolio performance. Sometimes you may get into an ETF at a price $0.25 better than the closing price --- but this will be partially offset by the times your entry is worse. In the long-run, this is a lot less important than other factors.

We have been in beta testing on this the past few months and have worked out many of the details. We plan to add various features to this module over time. We are calling this a BETA product for now as we may have some plumbing adjustments necessary depending on how many people find use in this module and will surely have to allow for the scaling of data should many people like this feature. So please give it a try and tell us how you like it -- it is included in your existing subscription so there is no additional cost. We are excited about the potential this new application has should the ETFreplay.com community begin to share ideas and learn from each other not just through talk --- but through portfolio allocation actions.

Follow ETFreplay on