New Ratio MA Composite Backtest

Mar 13, 2023

in Ratio

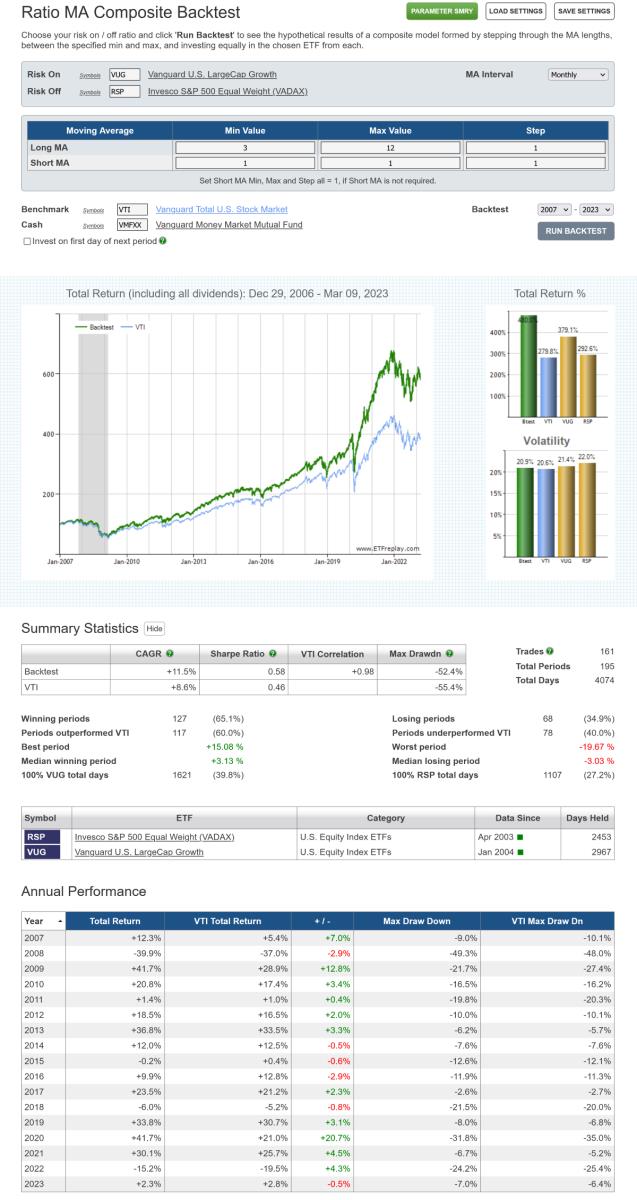

We have added a new composite version of the Ratio Moving Average backtest, which makes it possible to diversify across a range of MA lengths.

The Ratio MA backtest creates a ratio of the Total return value (not just price) of two securities; Risk On / Risk Off. The ratio will rise when the Risk On security outperforms the Risk Off security and fall when Risk-On underperforms.

The regular Ratio MA backtest invests in the Risk On security when the ratio is above its x-period moving average (i.e. the ratio is trending up) and switches to Risk Off when the ratio is below its MA.

The new Ratio MA Composite backtest reduces the risk of choosing a single MA length that, though it backtested well, turns out to perform poorly. For instance, rather than relying solely on a 6-month moving average, with the possibility that it underperforms in the future, the example below employs a range of moving average lengths from 3-month through 12-month with a step value of 1. This means that, each month, the backtest will compare the VUG / RSP ratio to its 3-month moving average, 4-month MA, 5-month, 6…11 and 12-month MA and invest 10% in the chosen security from each.

click image to view full size version

The step value can be changed to strike the desired balance between MA length diversification and real-world practicality. For instance, if the step value was increased to 2 in the above example, then the backtest would compare the VUG / RSP ratio to its 3-month, 5-month, 7, 9 and 11-month moving averages and invest 20% in the ETF resulting from each of those.

The composite can also be employed as a blended regime indicator using the weights displayed in the Backtest Trade History table.

The new Ratio MA Composite and the RS Composite backtest, which we introduced at the end of January, are available to all (regular and pro) annual subscribers.

notes:

- To see how each of the MA lengths performed individually, rather than as a composite, use the Ratio MA Parameter Performance Summary. The Parameter Performance Summary results can then be used to narrow the range between the min and max MA lengths.

-

If, rather than using a ratio, you want a backtest employing a range of moving average lengths on a single ETF, then you can use XZERO as the Risk Off security. XZERO is simply a zero return index (i.e. it's a constant), so an MA of the ratio ABC / XZERO is the same as a moving average of ABC itself. See Using SPY as a regime switch.

Follow ETFreplay on