Regime Driven Mean Reversion

Jun 10, 2020

in Mean Reversion, Regime Change

Late last year we produced a video that showed how two different strategies, relative strength and mean reversion, could be layered on top of each other. That example went through each of the constituent backtests separately, in order to explain the mechanics of the process.

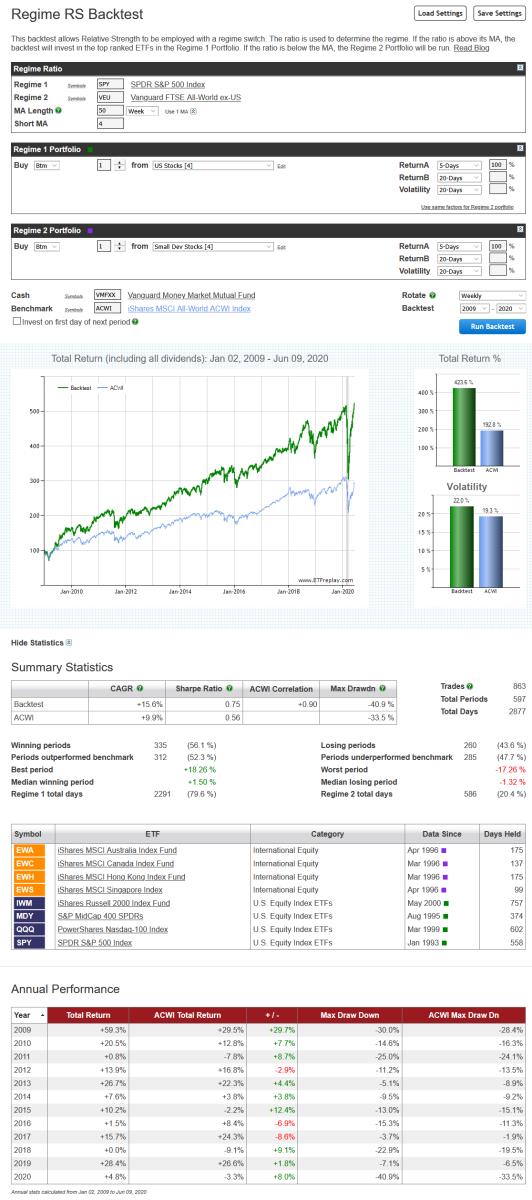

The example below shows how such a dual-layered strategy can be run in a single backtest. The first layer employs the SPY / VEU ratio moving average as a regime switch to dynamically alternate between whichever is stronger; U.S. or International stocks. Then, the second layer picks the weakest short-term performer within that chosen asset class.

To keep it simple, we have used the same basic U.S. (MDY, IWM, SPY and QQQ) and international (EWA, EWC, EWH and EWS) ETFs that we have used in previous examples.

Follow ETFreplay on