Strategy Diversification: Combine a core allocation with regime based portfolio switching

May 07, 2019

in Regime Change

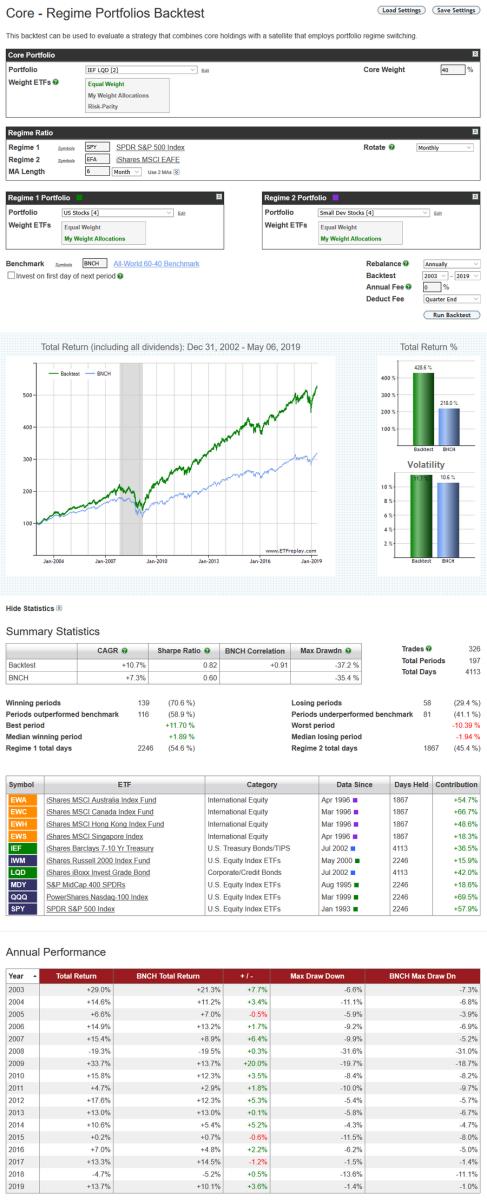

Back in 2010 we created our first multiple strategy module, the Advanced Relative Strength backtest, allowing subscribers to combine together different models into an overall portfolio. To illustrate the backtest, we produced a simple example that employed two sub-strategies; a basic US equity model (MDY, IWM, SPY and QQQ) and an international model using smaller developed country funds (EWA, EWC, EWH and EWS).

The example below uses the same ETFs as that original illustration, but this time, rather than running each model concurrently, we have employed the SPY / EFA ratio moving average as a regime switch to dynamically alternate between the two portfolios. When the SPY / EFA ratio is trending upwards (i.e. above its MA), the backtest invests in the US equity portfolio. When the opposite is true, it switches to the International stock portfolio. This regime approach is then mixed with a solid fixed income core portfolio (IEF and LQD) to form an annually rebalanced 60-40 strategy.

The Core-Regime Portfolios backtest is available to pro subscription members.

Follow ETFreplay on