Understanding ETF Volatility

Dec 02, 2010

in Drawdown, Volatility

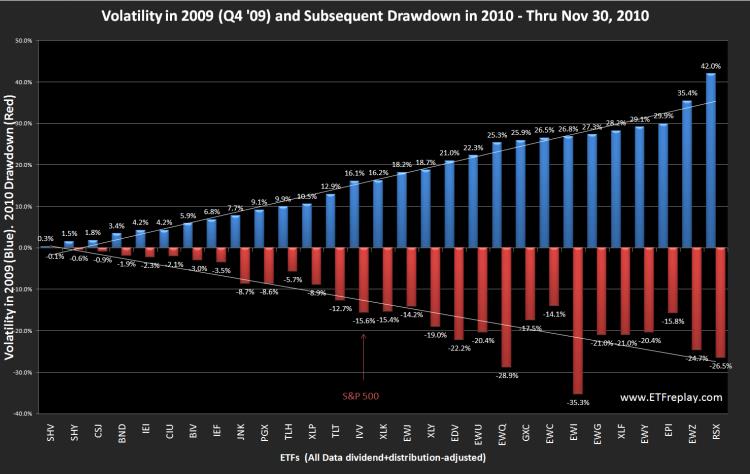

Volatility is a tough topic to get your hands around. But one key idea is to think in terms of drawdowns -- in general, the higher the volatility the higher the drawdown. What does this mean? It doesn't mean that volatility is just bad --- it means that with funds like the Russia Fund (RSX) or Brazil (EWZ) or Financial stocks (XLF), your TIMING is more important than with something like a consumer staples ETF (XLP) or an investment grade bond fund (CIU). Since we've posted this many times this year, it's time to take a look at some actual hard data through the first 11 months of 2010.

The chart below compares the known volatility exiting 2009 with the subsequent drawdown in 2010. We think this shows the basic idea pretty well. Its certainly not going to be exact --- but in general, it makes sense. So we can think about this from a higher level to help us. If our portfolio were 100% long Brazil (EWZ) all year, then the portfolio value would have moved down -24.7% off its high at one point. You didn't 'lose' -24.7% vs your starting cost --- but you did lose a big % off the high. A goal in portfolio management is to smooth out the ride a bit.

Note here that this is just one 11-month period of data. The concept is solid -- but the future will be different. The S&P 500 had a -15.6% drawdown during this particular period. Less volatile ETFs all had lower drawdowns. A few on this list that had significantly higher volatilities had lower drawdowns --- but not by much. This is for concept and its relative. If the S&P 500 has a larger drawdown next year, then expect these numbers to all be bigger when we do this again next year.

Follow ETFreplay on