Using a Regime Ratio to switch between Mean Reversion and Relative Strength strategies

Dec 09, 2021

in Mean Reversion, Regime Change, Relative Strength

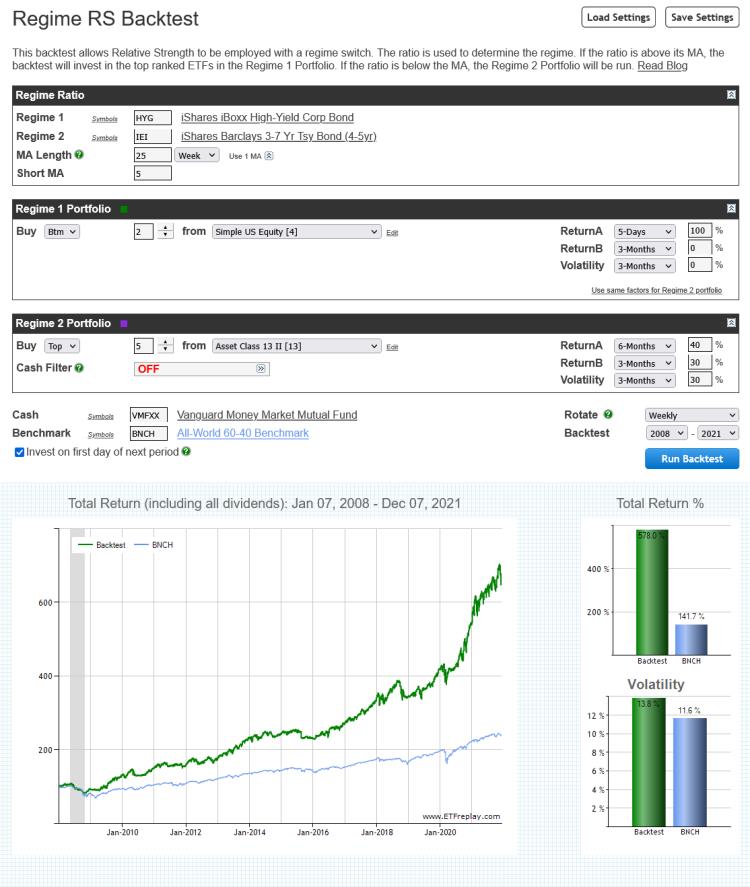

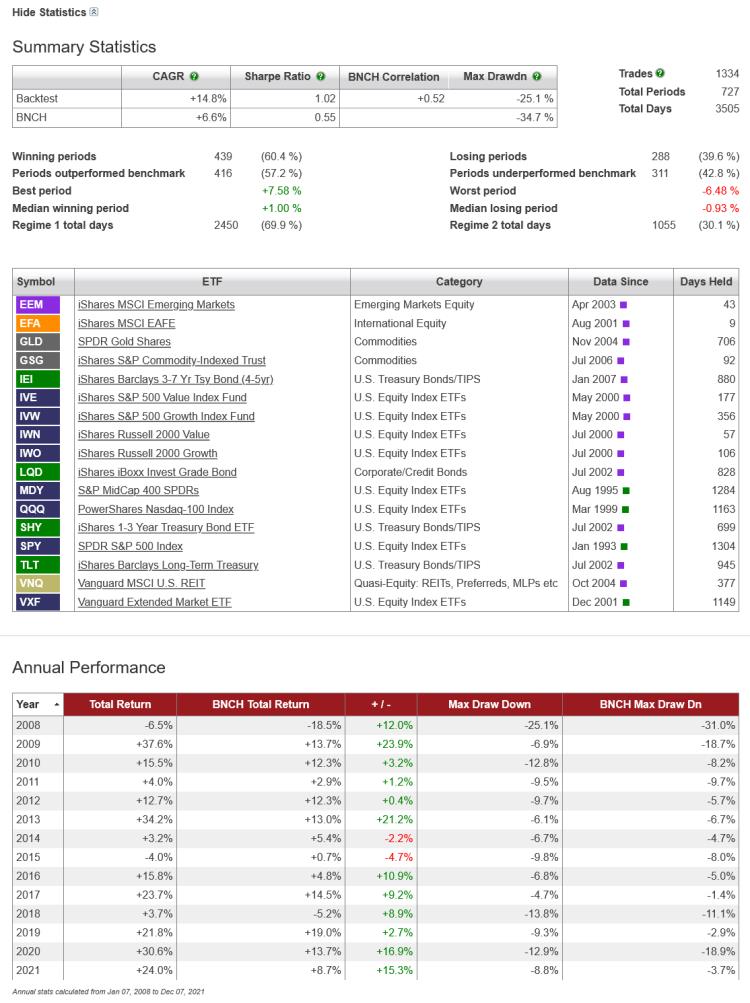

This example employs a simple credit spread style ratio to define the prevailing risk on / off regime and uses that to switch between different strategies.

When the High Yield / Treasury ratio is trending upwards (i.e. short MA above long MA) the backtest pursues a mean-reversion strategy, investing in the weakest short-term performers (buying wholesale) in a list of broad U.S. equity ETFs.

Conversely, when the HYG / IEI ratio trends down (short MA below long MA), the backtest switches to a Relative Strength strategy; buying the top five from a list of mixed asset class ETFs. Selecting the strongest five securities from the list provides some diversification while also giving the backtest the opportunity, in bear markets, to allocate 80% to fixed income and, in the most severe periods, to avoid equities entirely.

Specific parameters and ETFs are not the focus of this example, rather, it is intended to highlight the backtest functioanlity and to provide a starting point for subscribers to further research and develop.

Follow ETFreplay on