Using Different Weightings Based On Rank In an ETF Relative Strength Backtest

Dec 11, 2014

in Relative Strength

User Question:

I run a portfolio relative strength backtest with 5 ETF but all are assigned an equal weight of 20%. How can I assign different weights to the ranked ETFs? Example: Top 5 Weighted as 30%, 30%, 20%, 10%, 10% respectively."

Answer:

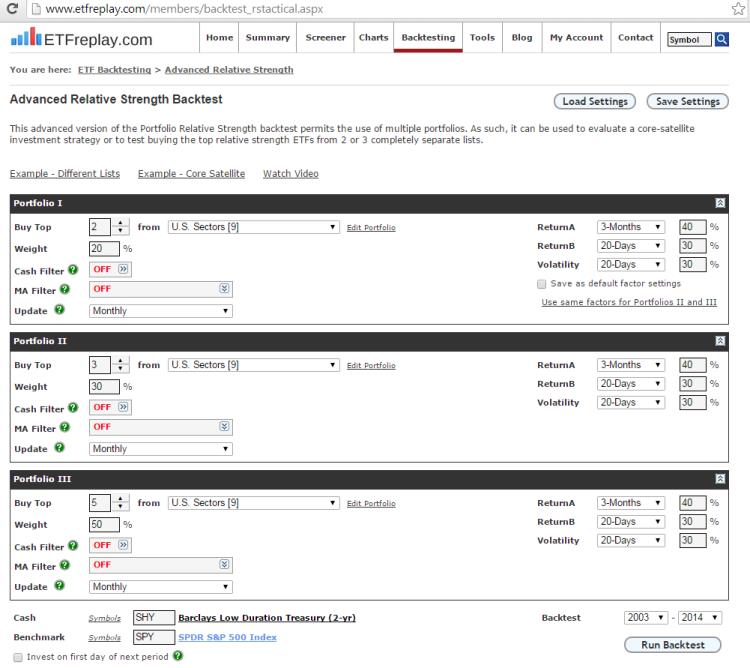

For this you would use the Advanced Relative Strength Backtest (subscriber link).

By layering the strategies using different numbers of selections while at the same time using the same ETF list, you can create weightings based on Rank.

Note that the top two ranked securities in this portfolio list would each receive 10% from portfolio I, 10% from portfolio II and 10% from portfolio III. The backtest report combines weights and it becomes simply 30% for each of the two top ranked ETFs. Similarly, the 3rd ranked ETF received 10% from Portfolio II and 10% from portfolio III; making 20% in total. The 4th and 5th ranked ETFs are allocated 10% each by portfolio III.

Dive into the backtest report to see all the breakdown of sub-periods and the weightings of each ETF and its contribution to return for that period.

Follow ETFreplay on