Category: Backtest

Jun 20, 2020

in Backtest, Video, Sequential RS

Note: during the launch of our new application called Sequential Relative Strength, we are allowing all accounts to create portfolios using individual stocks. This app module is able to expand on the core Portfolio Relative Strength and add a 2nd stage to help improve entry points.

The idea behind this module is to more easily combine intermediate-term relative strength with short-term mean reversion. Short term weakness within a strong long-term trend is normal. Try running your backtest with this mean-reversion added and then compare it to a model which does the opposite. Analyze the results. Think about the volatility of the resulting equity curve. Look at sub-periods. Are the results highly lumpy? Were the results achieved in earlier years but fade in recent years? These are some of the things ETFreplay was created to do -- not just look at the return of a strategy -- but to decompose it and analyze it to try to find something that is more robust. #STUDY

to expand video on screen, click the '4 expanding arrows' icon in the bottom right corner of the video screen. Use the settings icon to change to 1080 quality if it seems at all blurry

Mar 03, 2020

in Backtest, Mean Reversion, TRD Total Return Diff

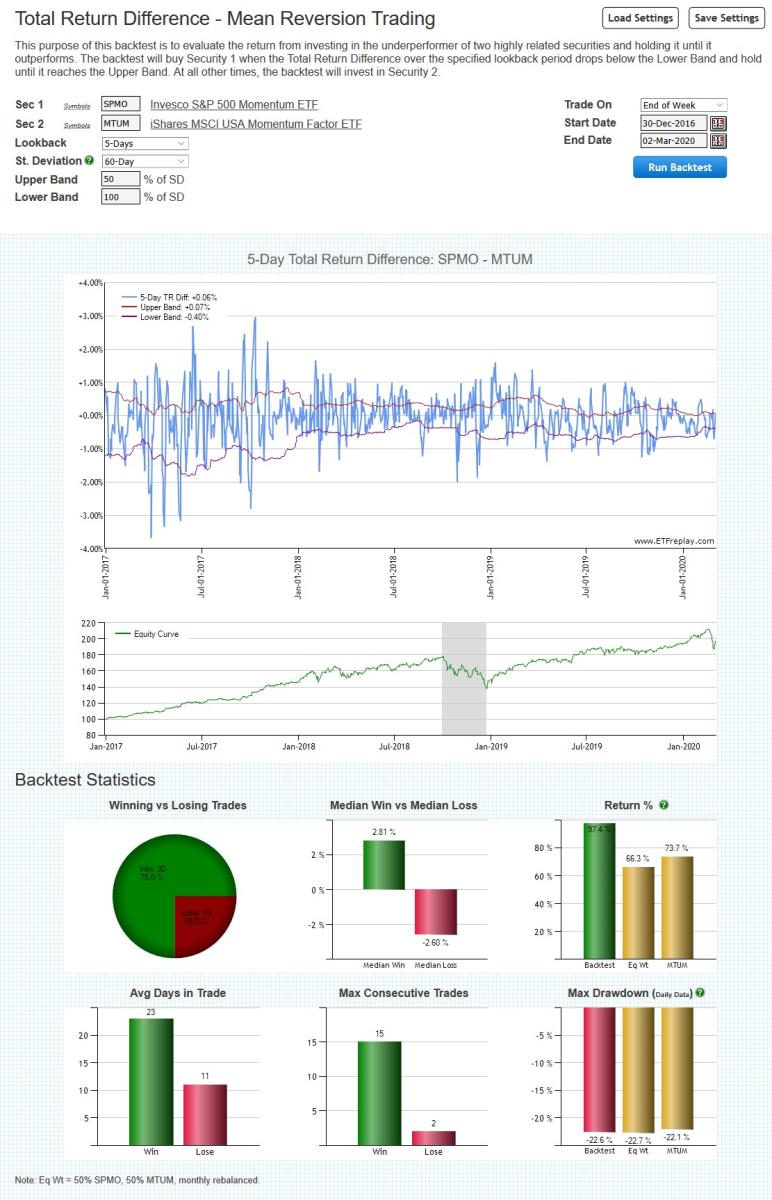

We have introduced a new backtest for subscribers that is focused on short term mean reversion. It is intended to be used with highly related securities, which are unlikely to drift apart for very long before coming back together. Consequently, when one of the securities underperforms by a non-insignificant margin, an opportunity occurs.

The backtest works by comparing the difference in the x-day Total Return between the securities / ETFs. When that x-day return difference is more than y standard deviations below the mean, the backtest will buy Security 1. It will then hold that security until it reaches z standard deviations above the mean, when it will be sold in favor of Security 2.

Suitable primarily for non-taxable accounts only, the idea is that these short-term trades among correlated assets can be used to materially enhance the returns through compounding without a material difference in the underlying beta exposure. More return not for less risk -- but for very similar risk. Said another way, taking a modicum of extra risk can be quite profitable.

Go to Total Return Difference (TRD) - Mean Reversion Backtest

Jul 09, 2019

in Backtest

Maintaining a well diversified portfolio is a time-tested way to protect against going all-in on what turns out to be a terrible investment. Diversification can also be employed at the strategy level for the same reason. An example of this is the core-satellite framework, where a rebalanced core portfolio is mixed with different strategies that focus on Relative Strength and Moving Average trend following etc.

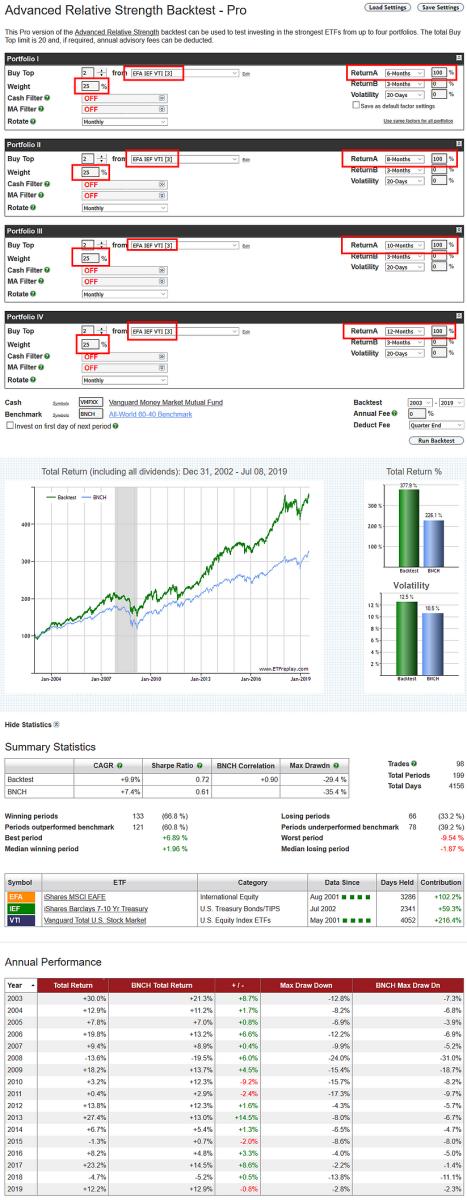

It is also possible to diversify across different versions of a single strategy, to reduce the risk of parameter choice misfortune. For example, rather than relying solely on 12-month returns, for instance, the backtest below equal weights 4 variants of the same model: a 6-month version, 8-month, 10-month and one using 12-month returns all on the same ETFs: EFA, IEF and VTI (the constituents of BNCH).

click image for full size version

Just as a well diversified portfolio means that at least some part of it will always be a drag, a composite made up of different model variants will always underperform the best version of the strategy....but it also avoids being exclusively in the worst.

Jan 15, 2019

in Backtest

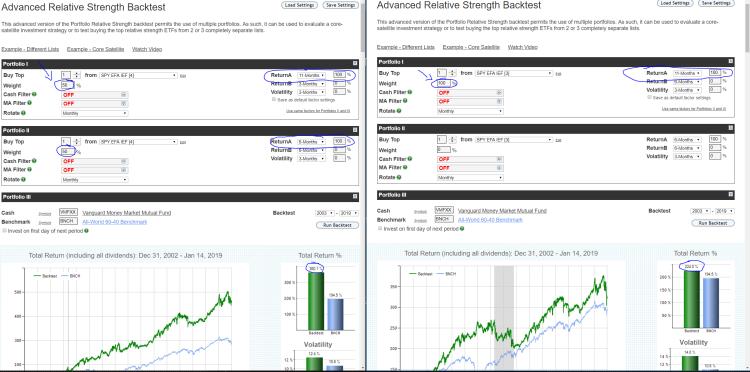

The example below is pretty self-explanatory but in a nutshell it compares 2 strategies set side by side in detached browser windows.

Strategy A on left uses 2 pieces: 1. 50% choose 1 of 3 ETFs using 11-month total return 2. other 50% using 6-month returns on the same portfolio of ETFs, also choose 1...

Strategy B on right using 1 strategy: using ONLY 11-month returns.

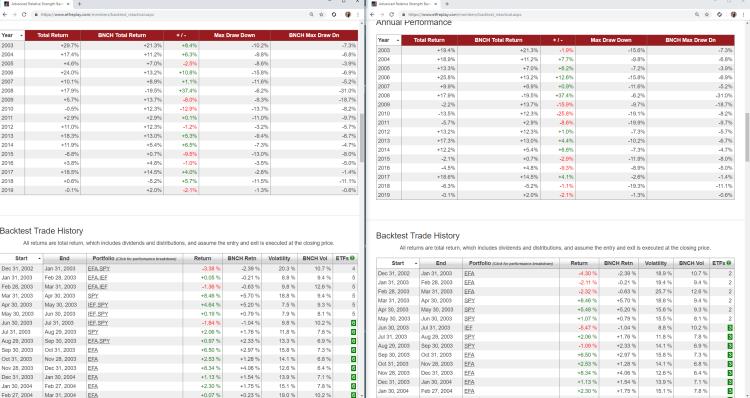

Rather than only highlight just the overall total return of each, of high importance is looking at the year by year (Calendar) returns vs a benchmark. The 100% 11-month strategy has seen years of large outperformance and underperformance. The blended strategy would have been much easier to stick by and actually achieve the end result - in addition it added return over the period. We know from many research papers that 3 - 12 month relative strength all have some level of validity long-term. No matter what the very long-term backtest looks like for these 2 strategies, we cannot know for sure which one is going to do better over the next 10 years. But we can glean information by studying different types of backtests and help make a judgment about what is happening now. Indeed, backtests primary function is to help guide you to understand what is happening in the most recent (current) period.

Feb 15, 2018

in Backtest, Video

A ~5 minute video using the Regime Relative Strength Backtest to look at some parts of an Absolute Return strategy and ways to improve upon it.

to expand, click the '4 expanding arrows' icon in the bottom right corner of the video screen