Category: Relative Strength

Apr 22, 2021

in Relative Strength, Sequential RS

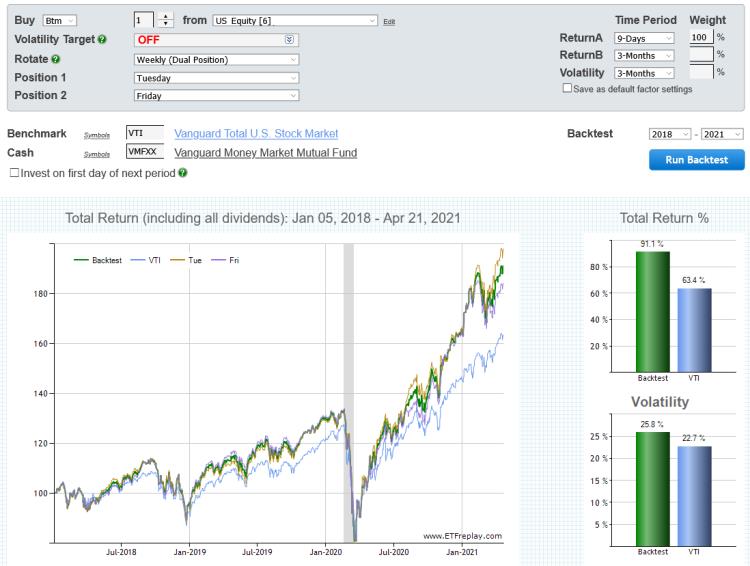

We have added two new rotation options to the Portfolio Relative Strength and Sequential Relative Strength Backtests:

- Monthly (Dual Position)

- Weekly (Dual Position)

Choosing one of these options allows you to diversify across two rotation days. For example, select Weekly (Dual Position) and set Position 1 to Tuesday and Position 2 to Friday. In the chart below the yellow line shows the performance from rotating every Tuesday, the purple line is the Friday rotation, and the green line shows the combined equity curve.

click image to view full size version

Diversifying across two rotation days hedges against going all-in on what could turn out to be the worst performing rotation day in future. Similarly, though a particular day may have historically performed best, it is not guaranteed to always outperform. Employing two different rotation days guards against that risk and in doing so, can provide a more realistic assessment of a strategy’s performance.

Dec 16, 2019

in Relative Strength, Mean Reversion, Video

Layering 2 strategies on top of each other for better return -- and importantly this can improve the consistency on a year-to-year basis. The mean reversion strategies tend to add more return when things are volatile -- but less relative to the benchmark when the market is rising on low volatility. That said, low volatility uptrends are often an excellent environment for absolute gains anyway and you will naturally participate in such a market because mean-reversion has zero market timing associated with it. That is, sometimes you will just track rather than outperform a low-volatility uptrend.... and that is a good thing.

to expand video on screen, click the '4 expanding arrows' icon in the bottom right corner of the video screen

Oct 17, 2018

in Relative Strength, Video

An updated video for the Advanced Relative Strength Backtest (and we simultaneously provide a brief overview of ETFreplay as well in the beginning of this video). The public video below uses the following subscriber-only backtest Advanced Relative Strength Backtest

to expand video on screen, click the '4 expanding arrows' icon in the bottom right corner of the video screen

Sep 04, 2018

in Relative Strength, Video

In this video we demonstrate how to build 2 individual strategies and then easily combine them using the Core-Satellite backtest module. The public video below uses the following subscriber-only backtest ETFreplay Core - Satellite Backtest

to expand video on screen, click the '4& expanding arrows' icon in the bottom right corner of the video screen

Jul 26, 2018

in Relative Strength, Regime Change, Video

A video with a demonstration of the new Core-Regime RS Backtest module. The public video below uses the following subscriber-only backtest ETFreplay Core - Regime Relative Strength Backtest

to expand video on screen, click the ' 4 expanding arrows' icon in the bottom right corner of the video screen