Apr 10, 2022

in TRD Total Return Diff, Video, Tracking Error

Instructional video on how to use Tracking Error to improve consistency in ETF backtesting. #STUDY

to expand video on screen, click the '4 expanding arrows' icon in the bottom right corner of the video screen. Use the settings icon to change to 1080 quality if it seems at all blurry

Oct 17, 2021

in Backtest, Relative Strength, TRD Total Return Diff, Video, Ratio, Parameter Summary

Instructional video on how to use the Parameter Performance Summary functionality. #STUDY

to expand video on screen, click the '4 expanding arrows' icon in the bottom right corner of the video screen. Use the settings icon to change to 1080 quality if it seems at all blurry

Mar 27, 2020

in Mean Reversion, TRD Total Return Diff

Related But Different ETFs:

Mar 03, 2020

in Backtest, Mean Reversion, TRD Total Return Diff

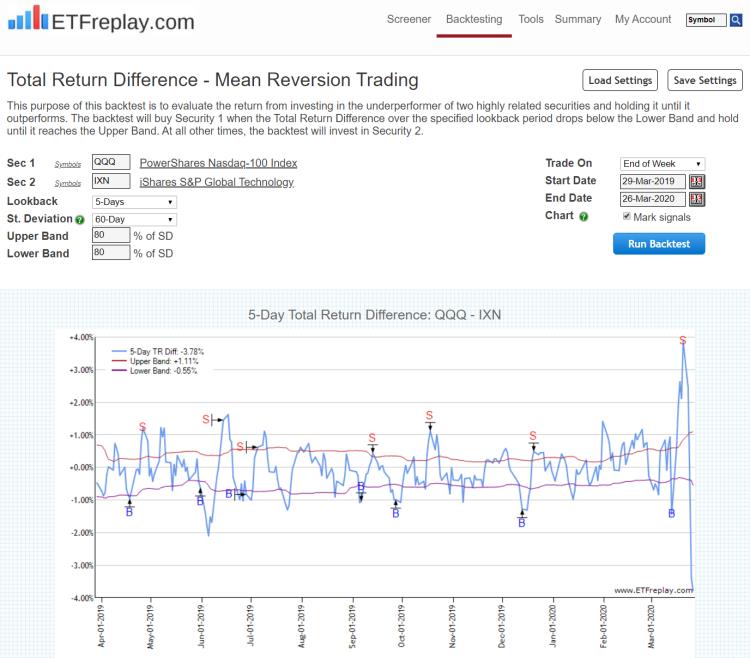

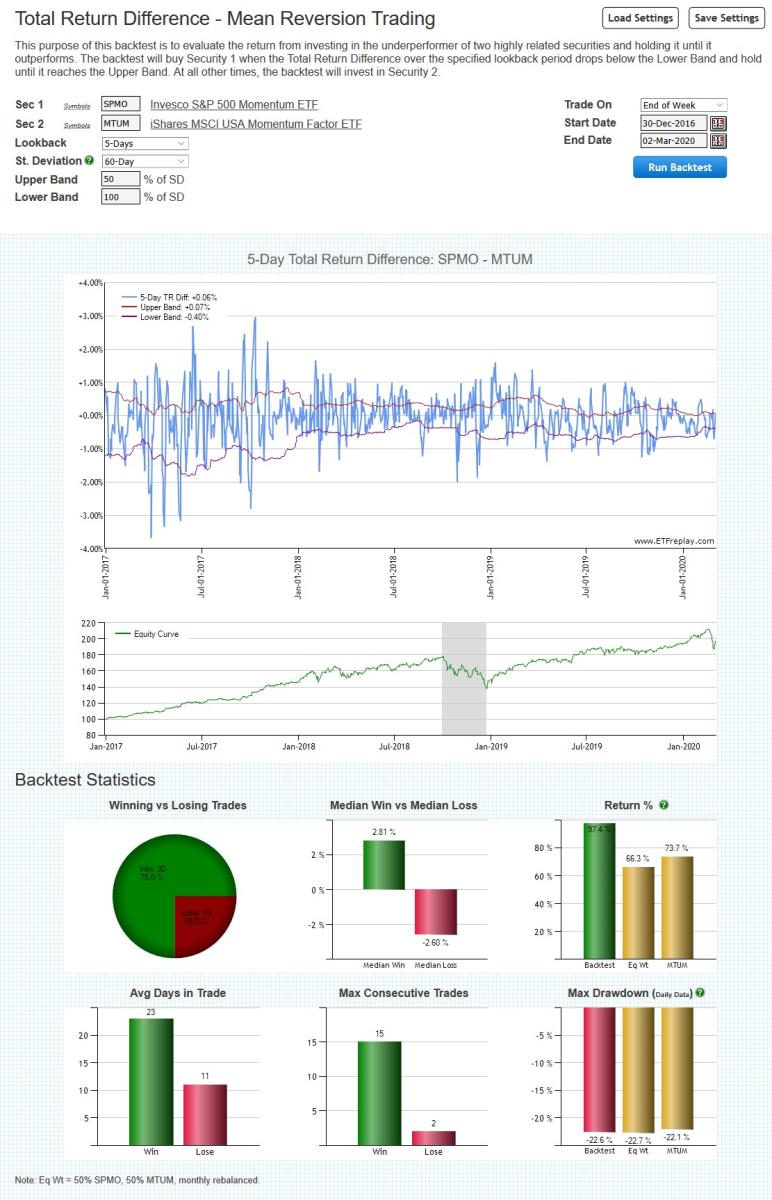

We have introduced a new backtest for subscribers that is focused on short term mean reversion. It is intended to be used with highly related securities, which are unlikely to drift apart for very long before coming back together. Consequently, when one of the securities underperforms by a non-insignificant margin, an opportunity occurs.

The backtest works by comparing the difference in the x-day Total Return between the securities / ETFs. When that x-day return difference is more than y standard deviations below the mean, the backtest will buy Security 1. It will then hold that security until it reaches z standard deviations above the mean, when it will be sold in favor of Security 2.

Suitable primarily for non-taxable accounts only, the idea is that these short-term trades among correlated assets can be used to materially enhance the returns through compounding without a material difference in the underlying beta exposure. More return not for less risk -- but for very similar risk. Said another way, taking a modicum of extra risk can be quite profitable.

Go to Total Return Difference (TRD) - Mean Reversion Backtest