Apr 05, 2019

in Channel

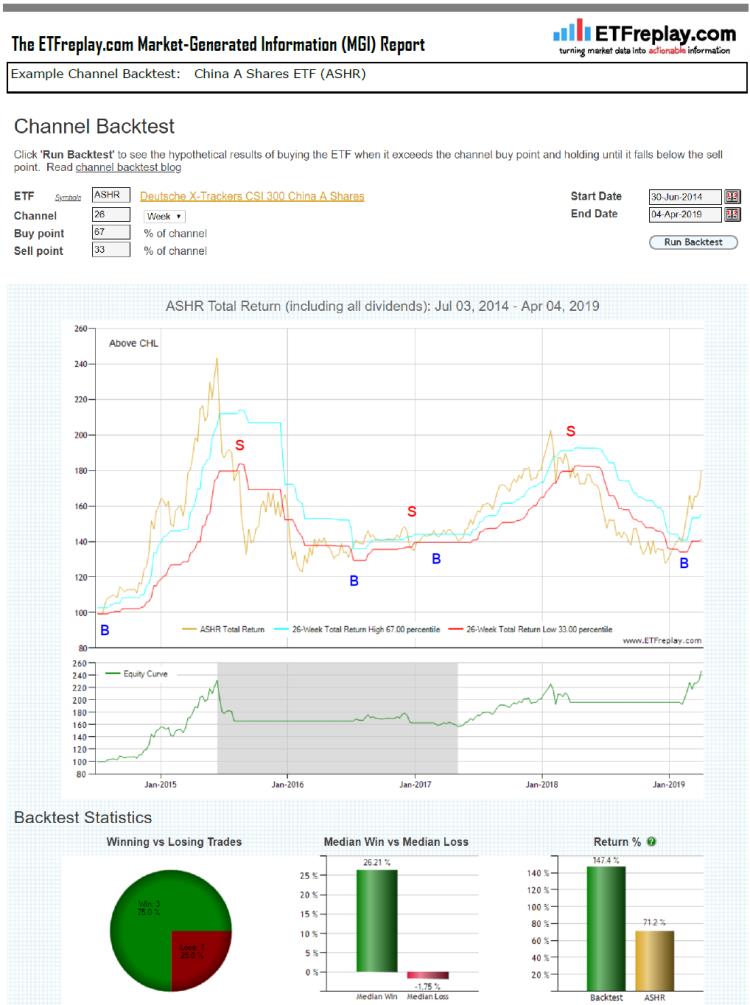

Channels are a good, simple supplement that offer an ABSOLUTE look and can be used in conjunction with other RELATIVE studies. Wider channels give your trade room to work. Tighter channels will cause some whipsaw losses. If you are bullish on an ETF based on a range of factors, then running a skewed channel might be a good idea --- ie, run the exit (Sell channel) at 0% but a buy at just 60%... This allows you to get in quickly while still offering room for the investment to work. This study uses a simple 67% / 33% buy/sell trigger with a ~6 month lookback (26-weeks means you will trade usually on a Friday -- if holiday then Thursday). Entries and exits only occur on the close of the last day of the week (Fridays) allowing for easy monitoring. Note that this look has trades that have lasted a while. This is because the sell rules will allow a fair bit of movement before exiting.

Finally, because a channel uses a percentage, it may be easier to see the trend in the ETF than othewise. An uptrend is defined by higher lows and higher highs. A downtrend is defined by lower highs and lower lows. The channel is a another tool to have to see and understand what is happening in the market.

Mar 05, 2019

in Video, Dashboards

We have added Dashboards as a new feature to the website so that subscribers can easily view multiple models and/or markets in one place.

Dashboards can be used in numerous different ways, including:

- to view market activity from various angles with a mixture of several different models

- to look at one model applied to several different ETFs / markets

- to monitor different variations of a single model

etc etc.

Most importantly, you have the choice of how to set up your own personal dashboard(s).

To create a dashboard:

- From 'My Account' in the top menu, choose 'My Dashboards'

- Click 'Add Dashboard' button in the top right corner, enter a name and click save

- A dashboard with 6 empty windows will now appear

- Click the 'Add Item' button in top right corner of one of the empty windows

- Choose between:

- 'Screener'

- 'Ranks'

- 'Ratio Chart'

- 'MA Chart'

- 'MA List'

- 'Channel Chart'

- Enter the rest of the required details, click 'Save' and the desired chart or table will appear in the window.

- Repeat steps 4, 5 and 6 for the other empty windows, up to a total of 6 per dashboard

- Items can be edited / removed by clicking 'Edit Item' in the top right corner of the required window

- The 'through' date can be changed via the calendar control in the top left corner

The video below demonstrates one way to use ETFreplay Dashboards:

to expand video on screen, click the 'expanding arrows' icon in the bottom right corner of the video screen

Jan 15, 2019

in Backtest

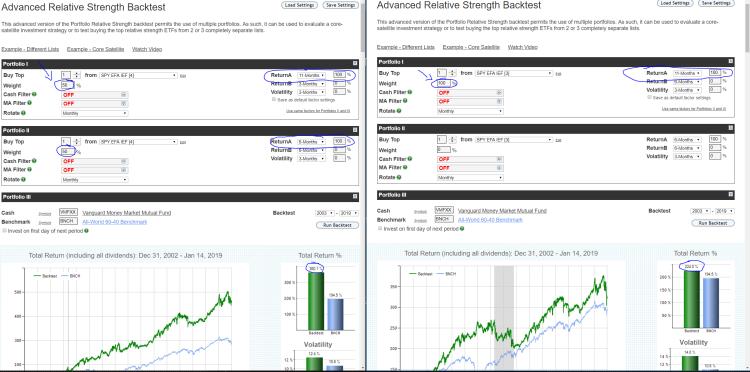

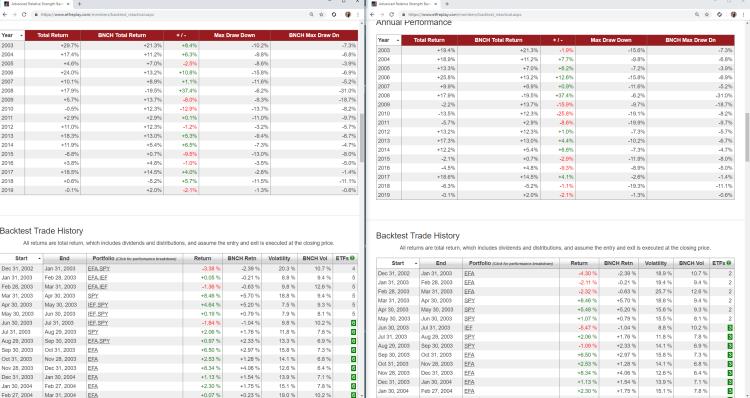

The example below is pretty self-explanatory but in a nutshell it compares 2 strategies set side by side in detached browser windows.

Strategy A on left uses 2 pieces: 1. 50% choose 1 of 3 ETFs using 11-month total return 2. other 50% using 6-month returns on the same portfolio of ETFs, also choose 1...

Strategy B on right using 1 strategy: using ONLY 11-month returns.

Rather than only highlight just the overall total return of each, of high importance is looking at the year by year (Calendar) returns vs a benchmark. The 100% 11-month strategy has seen years of large outperformance and underperformance. The blended strategy would have been much easier to stick by and actually achieve the end result - in addition it added return over the period. We know from many research papers that 3 - 12 month relative strength all have some level of validity long-term. No matter what the very long-term backtest looks like for these 2 strategies, we cannot know for sure which one is going to do better over the next 10 years. But we can glean information by studying different types of backtests and help make a judgment about what is happening now. Indeed, backtests primary function is to help guide you to understand what is happening in the most recent (current) period.

Oct 17, 2018

in Relative Strength, Video

An updated video for the Advanced Relative Strength Backtest (and we simultaneously provide a brief overview of ETFreplay as well in the beginning of this video). The public video below uses the following subscriber-only backtest Advanced Relative Strength Backtest

to expand video on screen, click the '4 expanding arrows' icon in the bottom right corner of the video screen

Sep 04, 2018

in Relative Strength, Video

In this video we demonstrate how to build 2 individual strategies and then easily combine them using the Core-Satellite backtest module. The public video below uses the following subscriber-only backtest ETFreplay Core - Satellite Backtest

to expand video on screen, click the '4& expanding arrows' icon in the bottom right corner of the video screen