Moving Average ETF Backtest For Portfolios

Sep 20, 2010

in Moving Average

If you have created a portfolio list on ETFreplay, we are building new applications to leverage your ETF lists.

We have two new modules out that we have been working on for the past few months. These applications offer simplified views to help us try to understand larger forces at work in the global marketplace.

Building upon academic research regarding the use of moving averages, these apps save investors time by allowing many calculations and quantitative analyses to be simplified into a few clicks. We think that creating specific entry/exit rules and creating a detailed strategy report adds value to better understanding a concept. That is, we create apps that convert concepts into tangible, specific techniques. The accountability of these techniques is built into the very architecture of the website. On any day, you are just a click away from an updated view of the profit and loss history of a particular strategy.

Importantly, this type of research should be used as a complement to other forms of research. We suggest you think about which types of ETFs you want to be involved with over the long-run and then use techniques such as relative strength and moving average backtesting to help you research methods that reduce risk of a large drawdown, while potentially offering to enhance your return as well.

ETFreplay.com/backtest.aspx

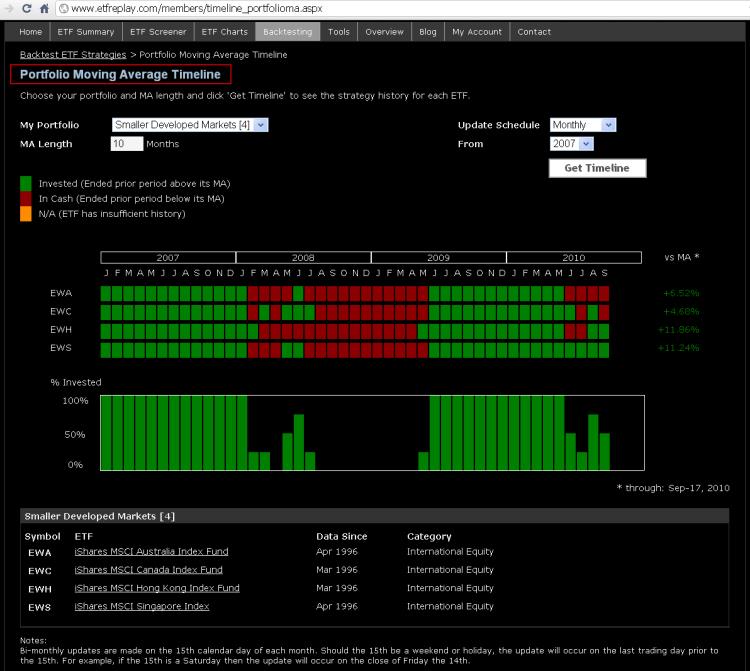

The example below uses 4 key smaller developed markets outside Europe & the U.S.

1. EWA iShares MSCI Australia Index

2. EWC iShares MSCI Canada Index

3. EWH iShares MSCI Hong Kong Index

4. EWS iShares MSCI Singapore Index

Follow ETFreplay on