Nov 05, 2020

in Sequential RS, Sectors

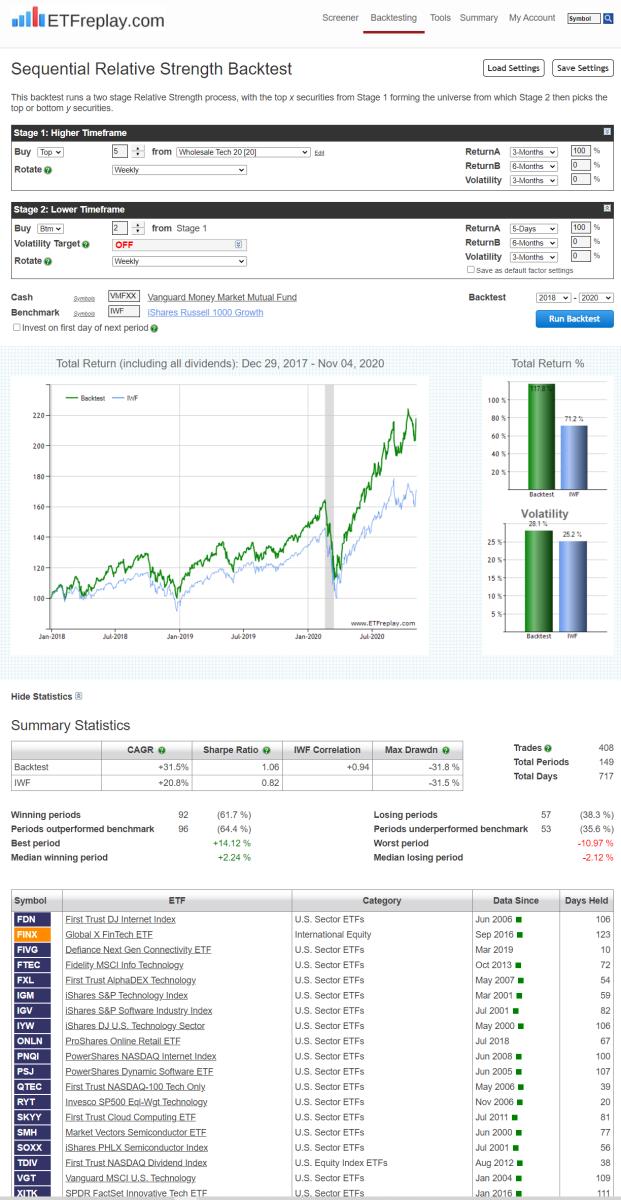

Sequential Relative Strength Is Powerful. Rather than always have the same list to go through, it automatically ranks a list and then only uses that sublist to choose from in a 2nd ranking... Keep in mind that over past few years you have still 'lost' money nearly 40% of the time -- so don't think that this is super easy to actually execute. It never seems like that... But keep working at finding good lists and making good entries and over time you will outperform and if you outperform an index that does well, you can do really well.

Jun 20, 2020

in Backtest, Video, Sequential RS

Note: during the launch of our new application called Sequential Relative Strength, we are allowing all accounts to create portfolios using individual stocks. This app module is able to expand on the core Portfolio Relative Strength and add a 2nd stage to help improve entry points.

The idea behind this module is to more easily combine intermediate-term relative strength with short-term mean reversion. Short term weakness within a strong long-term trend is normal. Try running your backtest with this mean-reversion added and then compare it to a model which does the opposite. Analyze the results. Think about the volatility of the resulting equity curve. Look at sub-periods. Are the results highly lumpy? Were the results achieved in earlier years but fade in recent years? These are some of the things ETFreplay was created to do -- not just look at the return of a strategy -- but to decompose it and analyze it to try to find something that is more robust. #STUDY

to expand video on screen, click the '4 expanding arrows' icon in the bottom right corner of the video screen. Use the settings icon to change to 1080 quality if it seems at all blurry