Apr 25, 2024

in Relative Strength, RS Composite

The range of Relative Strength tools and backtests on ETFreplay come in two varieties: 3 Factor and Composite.

3 Factor Relative Strength

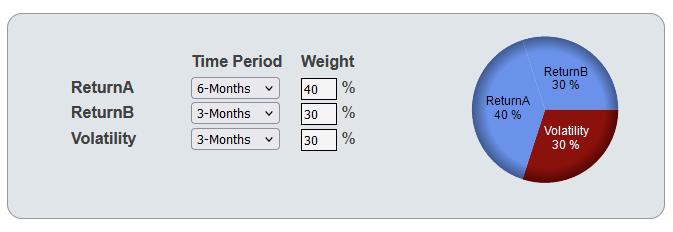

The Relative Strength (RS) model employed by the Screener, RS Reader and the majority of RS backtests is loosely based on the Sharpe Ratio, which measures return per unit of risk. However, while the Sharpe Ratio effectively equally weights the time period for return and volatility, the RS model takes the Sharpe Ratio concept and decomposes it into three separate factors:

- ReturnA - Higher timeframe total return

- ReturnB - Lower timeframe total return

- Volatility

Volatility is a measure of risk and is the annualized standard deviation of daily returns over the specified lookback period. Risk is uncertainty and the larger the range of possible outcomes, the higher the volatility will be and therefore the greater the risk. Consequently, unlike returns, it is ranked low to high. Therefore, the greater the weight assigned to volatility, the more volatile ETFs are penalized. 1

From these three factors, and the weights assigned to them, the overall rank is calculated. The precise process is fully explained in How The Screener Works.

Both the lookback periods and the weight of each factor can be changed. For example, to rank the ETFs by only 6-month total return, set Return A to '6-Months' and set its weight to 100% (and the weights of ReturnB and Volatility to zero).

As with most models, the shorter the lookback periods chosen, the more responsive to changes the RS model will be. However, this also means that it is more likely to be whipsawed by noise and will have a higher trade frequency. A balance must therefore be struck. If a model proves to be too busy with a particular list, then longer looback periods should be employed to get above the noise (or greater weight assigned to the higher timeframe).

i.e. A model using 6-month ReturnA and 3-month ReturnB will produce less trades than 3-Month and 20-day etc.

The performance of a model can be evaluated using one of the various Relative Strength backtests and the Parameter Performance Summary makes it possible to test numerous different parameter combinations in one go. 2

Relative Strength Composite

The RS Composite model is designed to protect against the possibility of parameter choice misfortune, which can arise when relying on a single lookback period for relative strength.

i.e. though a particular lookback may have historically outperformed other lookback lengths, there's always the possibility that it may underperform in the future.

The RS composite model reduces that risk by diversifying across a range of return lengths. It does this by stepping through the lookback periods, from a specified minimum to maximum, and invests in the top (strongest) x securities from each of those. 3

By using a range of RS lengths, the composite model entirely avoids the risk of being exclusively in, what could transpire to be, the worst performing model variant.

See:

Notes:

- As an extreme example: use the Screener and set the Volatility weight to 100% (ReturnA and ReturnB weights to zero) and the least volatile ETFs will appear at the top of the list.

- Reading the Parameter Performance Summary guidelines is highly recommended

- It is also possible to backtest Mean Reversion, by investing in the bottom (weakest) x securities.

Feb 16, 2024

in Backtest, Relative Strength, RS Composite

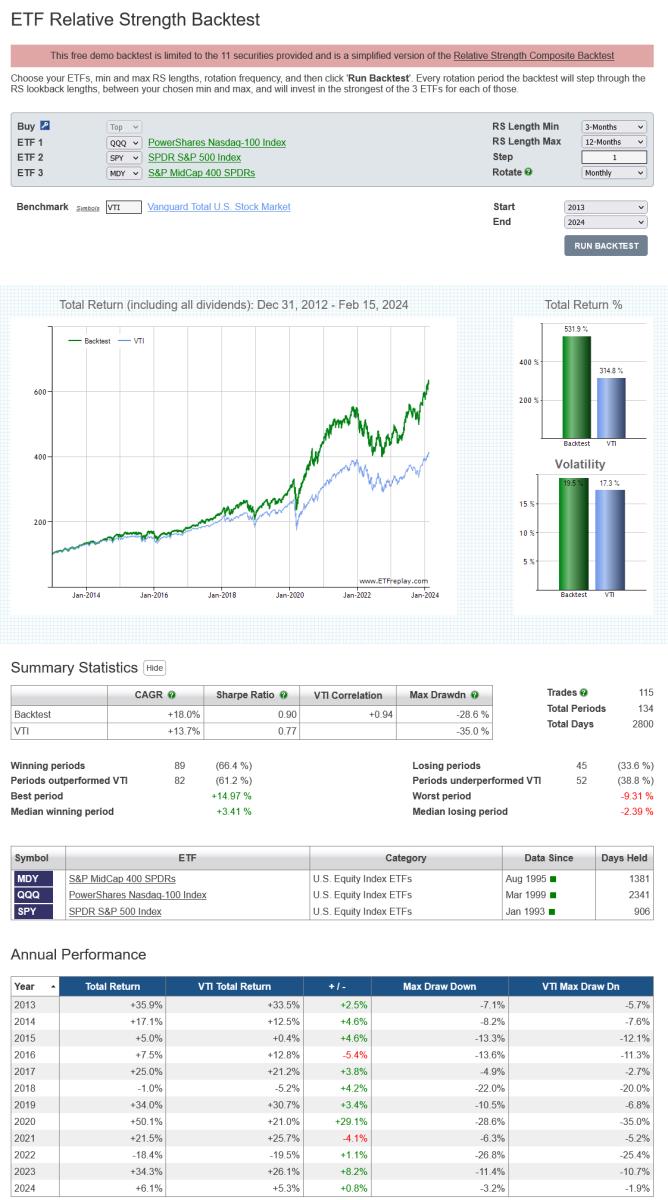

The ETF Relative Strength backtest, which is free to use, now offers the option to backtest either regular 3-Factor RS models or Relative Strength Composite models.

With Relative Strength Composite, rather than relying on a single lookback period for relative strength, you can diversify across a range of RS lengths and thereby protect against parameter choice misfortune.

i.e. though a particular lookback may have historically outperformed other lookback lengths, there's always the possibility that it may underperform in the future.

The RS composite model reduces that risk by stepping through the lookback periods, from your chosen minimum to maximum, and invests in the top (strongest) of the 3 securities from each of those.

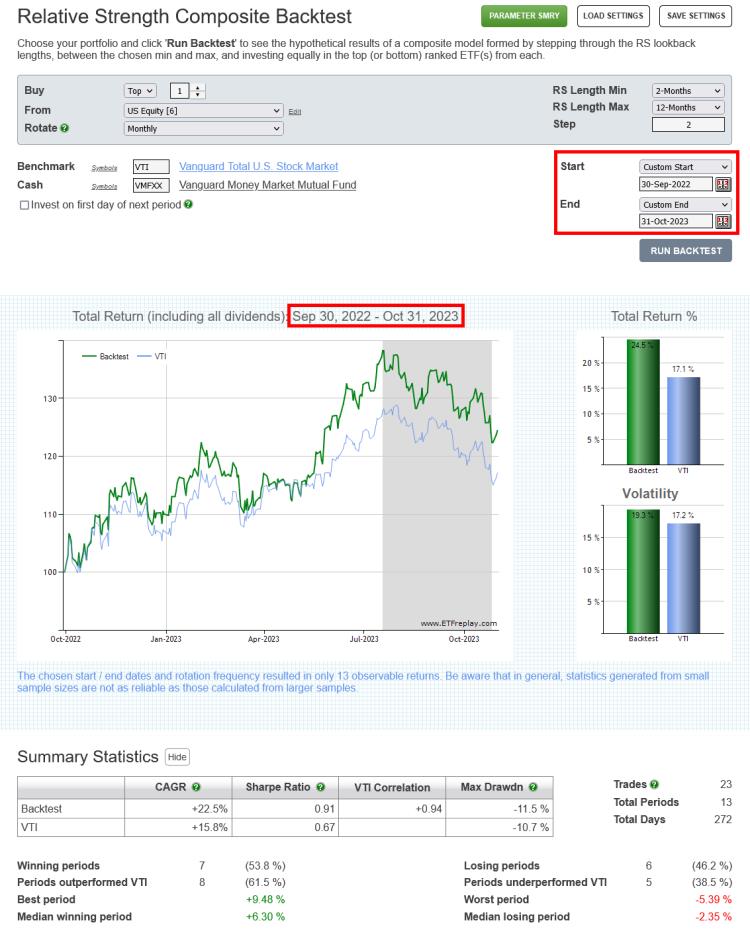

In the example below the minimum RS length is 3-months, the maximum is 12-months and the step value is 1. This means that, each month, the backtest will invest 10% in each of the:

- Top ETF from QQQ, MDY and SPY ranked by 3-month total return

- Top ETF from QQQ, MDY and SPY ranked by 4-month total return

- …5-month total return

- …6-month total return

- …7-month total return

- …8-month total return

- …9-month total return

- …10-month total return

- …11-month total return

- Top ranked ETF from QQQ, MDY and SPY ranked by 12-month total return

click image to view full size version

If QQQ ranks top for all 10 of those specified RS lookback periods, then 100% will be invested in QQQ. If SPY ranks top for 11 and 12-month returns and QQQ for the others, then 80% will be invested in QQQ and 20% in SPY. etc etc.

The step value can be increased to determine whether it is possible to obtain sufficient diversification without needing to employ every RS length. For instance, raising the step value to 3 in the above example will mean the backtest ranks QQQ, MDY and SPY by 3, 6, 9 and 12-month returns each month and invests 25% in the top ranked security from each of those.

To backtest just 6 and 12-month RS lengths, set RS Length Min to 6-months, Max to 12-months and Step to 6. The backtest will then, each month, rank QQQ, MDY and SPY by 6 and 12-month returns and invests 50% in the top ranked security from each.

Go to the ETF Relative Strength backtest

Not a subscriber? Subscribe

Note:

- All returns on ETFreplay are Total Return, which accounts for price appreciation and the receipt and reinvestment of dividends (and any other distributions, such as capital gains distributions). See Total Return vs Price Return

-

Subscribers, when logged in, have the option to switch from backtesting relative strength to mean-reversion and are not restricted to the 11 symbols provided for ETF 1, 2 and 3. Annual subscribers (regular and pro) also obviously have access to the fully fledged portfolio RS Composite backtest.

Jan 01, 2024

in Total Return

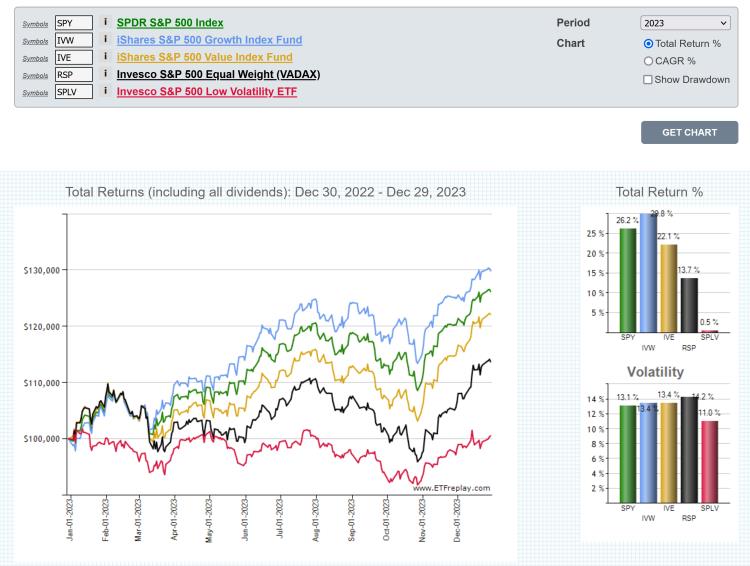

The chart below displays the 2023 Total Return for a few different types of S&P 500 ETF (growth, value, market-cap weight, equal weight and low volatility):

click image to view full size version or go to the chart page

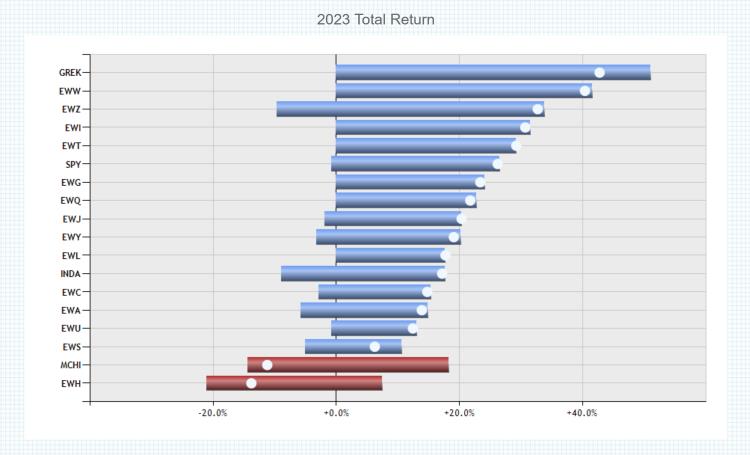

To put the performance of the market-cap-weight S&P 500 into global perspective, the below chart and table shows 2023 Total Return of SPY alongside a selection of developed international and emerging market country funds.

click image to view full size version

note:

Total Return accounts for price appreciation and the receipt and reinvestment of dividends (and any other distributions, such as capital gains distributions). See Total Return vs Price Return

Nov 07, 2023

in Backtest

Subscribers can now set specific start and end dates on all portfolio Relative Strength, Regime, Ratio MA, Moving Average and Channel backtests.

All the backtests still allow you to simply set the start and end year, if so desired. But, it is now also possible to choose a custom start and / or end date, as per the example below:

Note: if the specified start date is not a valid rotation day, the backtest will start on the chosen day and will invest in the picked securities as of the rotation date that immediately preceded the specified start date.

For example:

If a monthly rotating Portfolio Relative Strength backtest has a chosen start date is Jan 10, 2023, the backtest will begin on Jan 10, 2023 and will invest in the top x ranked ETF(s) through Dec 31, 2022.

If a quarterly rotating Portfolio Moving Average backtest has a chosen start date is Nov 29, 2019, the backtest will begin on Nov 29, 2019 and will invest in ther ETF(s) that were above their MA through Sep 30, 2019 (and will invest in cash for those that were below).

etc. etc.

Sep 08, 2023

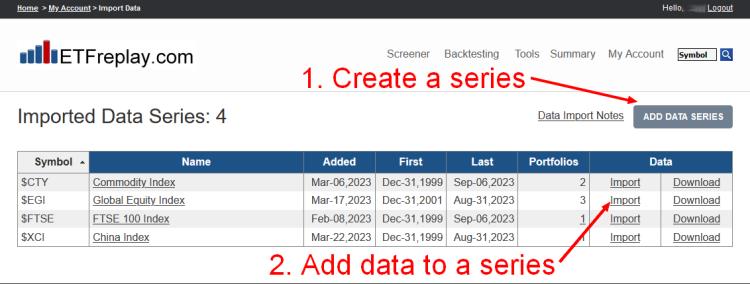

With a Pro Subscription it is now possible to import your own data series for use with any tool or backtest on the website.

To import your own data, click on the new Import Data link and then create a series by clicking on the 'Add Data Series' button. Enter a ticker symbol (a $ prefix is added automatically to any imported series) and give your data series a name.

To add data to a series, simply click 'Import' and choose the Excel file that contains your data.

Note that:

- The Excel document must be a .xlsx file and the sheet must be named Sheet1 (no space) and contain 2 columns; Date and Value.

- The data must be daily (U.S. trading dates only; non-valid dates will be ignored / omitted)

- The earliest allowable date is Dec-31, 1996

- The sheet should not contain any date gaps between the first date and the last date to be uploaded (other than market holidays and weekends)

- New data can be appended or backfilled, or existing data can be overwritten (see following note)

- Any existing data will be overwritten by newly uploaded data that has the same date

Up to 25 Imported Data series can be created and their symbols can be added to portfolios and therefore used with any backtest. Your Imported Data symbols are private; they can only be used by you. i.e. other subscribers cannot use them in charts or add them to a portfolio etc.

To edit or remove a series, click on its name in the Imported Data Series table.

Regular subscribers can upgrade to a Pro Subscription at My Account > Subscription Settings > Upgrade to Pro