Low Drawdowns and High Returns. 2017 thus far has been investment nirvana

Sep 27, 2017

in Drawdown

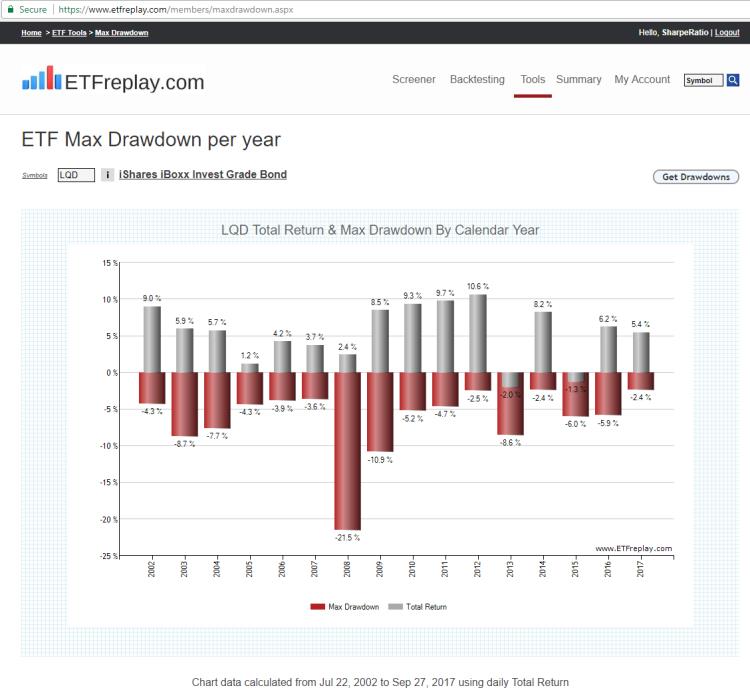

Over the past ~15 years, the bond market has generally had positive single-digit returns and also single-digit calendar year drawdowns. As the gentlemens asset class, bond ETFs generally don't have the anguish associated with the big drawdowns of many equity ETFs.

For a reference point, below is a snapshot of Calendar Year returns and drawdowns for LQD, an investment grade bond ETF:

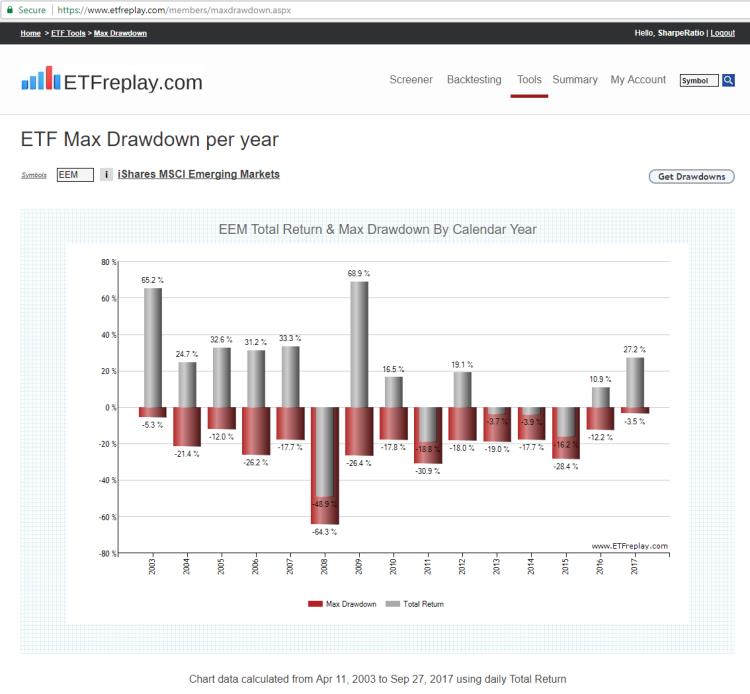

What is remarkable about this year is the combination of high returns with extremely low drawdown in some traditionally high-vol, high-drawdown segments - such as emerging markets. 2017's max drawdown for emerging markets has actually been less than most BOND market years.

+27% YTD total return near the end of the 3rd quarter of 2017 vs just -3.5% drawdown. Obviously, strong return and Low volatility leads to high rankings in our Relative Strength models. Uptrends can have some violent short-lived corrections but investors can manage such volatility by tilting their portfolios away from the weakest segments.

Link to the tool in this blog (subscribers): ETF Max Drawdown

Follow ETFreplay on