Regime Change Backtest Example

Apr 24, 2019

in Regime Change

Regime Change is used in finance to describe when a condition changes. IF [condition1] is met, THEN invest in [X]... ELSE invest in [Y]. ETFs allow us to easily test conditions which are defined not by some calculation you've created to simulate an index, these are publicly traded securities with real money invested in them. There is no ambiguity as to the rules when you use real-world securities as is so often the case with non-financial regime tests.

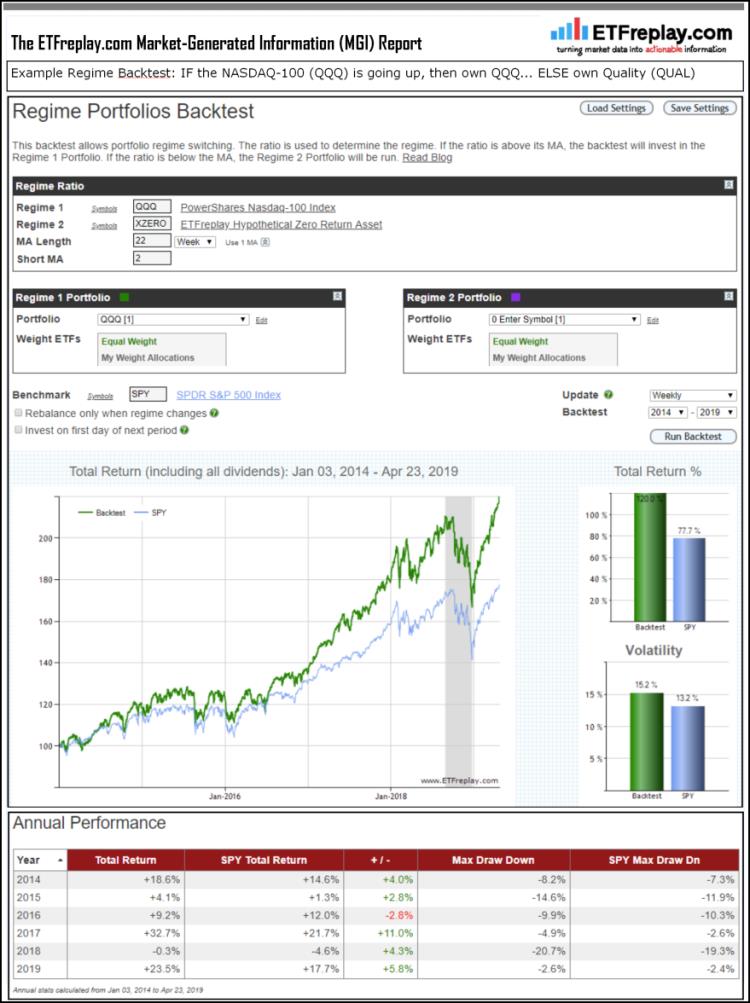

Here is a simple example to get the hang of it, is the NASDAQ-100 going up? If it is, buy it. If it isn't, invest in a different type of ETF. In this example, the different type of ETF is defined by the QUALITY FACTOR. Quality stocks are those with strong balance sheets, lower earnings variability & higher Return On Equity -- as ranked by indexing firm MSCI. QUAL actually owned real stocks on each day with real money, we aren't subjectively now determining what should be classified as quality and what shouldn't.

What does the performance report look like for this idea? See below for summary version of an ETFreplay.com backtest report (statistical analysis excluded in image below).

Then try other ideas. All of your ideas don't have to work for you to be very successful at this. Indeed, this strategy has underfperformed its benchmark 46% of the time in last 5 years (as measured by relative performance in each calendar month). Yet the outperformance over time has been good.

Follow ETFreplay on