Tracking Error

Feb 28, 2022

in Tracking Error

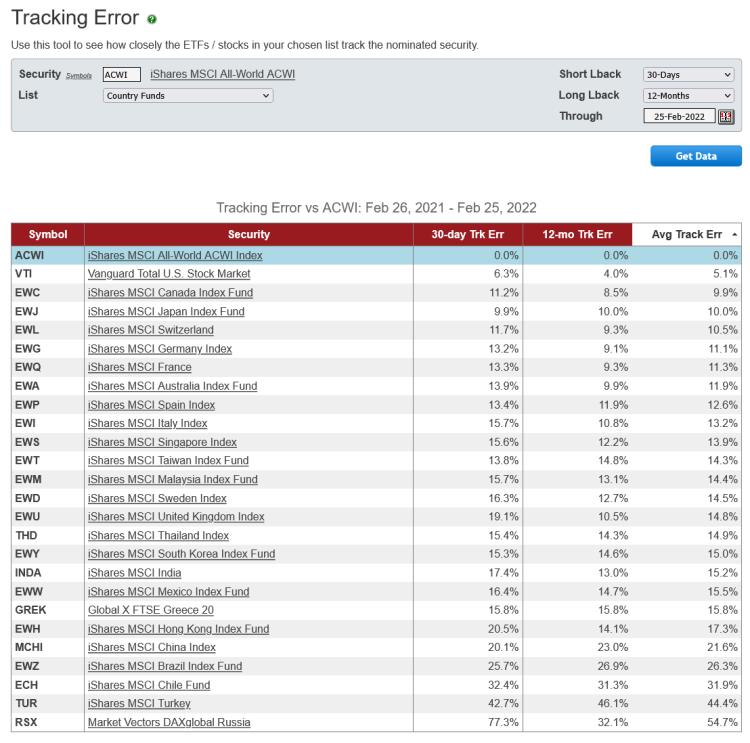

We have added a new tool that enables subscribers to see how closely the ETFs, stocks or mutual funds in their various lists track a given benchmark security.

Tracking error is the annualized standard deviation of the daily return difference between the security and the benchmark. i.e.

TE = StDev(daily total return - benchmark daily total return) x SQRT(252)

1% Tracking Error therefore means that, if returns are normally distributed, the security’s return will be within +/- 1% of the benchmark return 68% of the time and within +/- 2% of the benchmark 95% of the time.

Realized daily returns are obviously not perfectly normally distributed, so those probabilities are not to be taken literally, they are simply a rough guide. Nonetheless, tracking error provides an alternative perspective on risk from volatility and maximum drawdown.

A stock or ETF that has a persistently high tracking error will deviate substantially from the benchmark and is therefore unpredictable. This does not mean the security must automatically be excluded from the portfolio, but it would be prudent to set its position size accordingly.

Side note: The tracking error of a 2x leveraged ETF will be approximately the same as the volatility of its benchmark. i.e.

StDev (2x Daily Return - Daily Return) x SQRT(252) = StDev (Daily Return) x SQRT(252) = Volatility

SSO tracking error vs SPY ~= SPY volatility

QLD tracking error vs QQQ ~= QQQ volatility

etc.

click image to view full size version

Go to the Tracking Error tool

Follow ETFreplay on