Volatility Storms, Crises and ETF Correlation

May 16, 2010

in Correlation

First, a chart of GLD vs the FXE Euro Currency ETF is a simple yet powerful way to show the primary issue in the world right now:

This EC (Euro currency) crisis has brought on a volatility storm (sharply rising volatility / VIX). It is common to hear analysts and portfolio managers say; what does a Greek default have to do with my US domestic small cap stock?? Well, a lot actually if the Greek problems lead to a crisis – as a crisis will cause overall market volatility to rise.

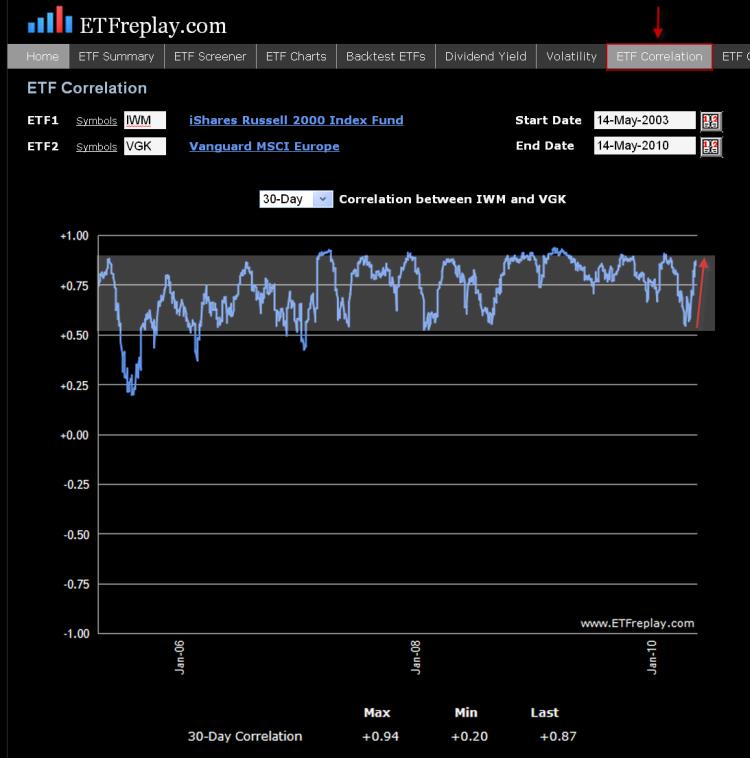

Correlations RISE in times of crisis. This is not just a random statement, it can be viewed mathematically using the Capital Asset Pricing Model (CAPM) framework.

In CAPM, the correlation between two assets can be expressed as a function of their Betas and the variance of the market. If we assume that both assets have a beta of 1.0 and identical residual risk, then it becomes mathematically true that correlations rise as variance rises. Thus, some type of crisis causes overall variance to rise (in this case it’s the escalating debt problems in Europe) and then this rising variance will cause correlations to rise.

Note the serious divergence of small cap US stocks and the MSCI ETF Europe (correlation at first drops on the lower chart) -- and then the subsequent increase in ETF correlation when VIX / volatility increased sharply.

For a more complete technical explanation of this topic see "Active Portfolio Management" (Grinold & Kahn, 2000). This book is extremely technical and really only for professional investors with mathematical orientation.

Follow ETFreplay on