Using Market Generated Information For Market Structure: Financial Stock ETFs

Jan 23, 2017

in Ratio, Regime Change

Last month we did a blog post on using high-yield bonds as a key indicator. This month we continue with a focus of using financial stock ETFs as a second indicator.

Many people seem to want to try to simplify everything down to one variable -- often something like a P/E ratio or a moving average. We think investors should look at a range of important indicators and then take a weight-of-the-evidence approach. Indeed, we built ETFreplay.com so that you can easily run and update a list of strategies AND do this on a continuous basis and thereby stay in tune with the overall structure of the market.

There is no better information than that which the market itself generates. A good market participant will learn to read what the market structure is telling you by analyzing its intermarket relationsihps.

Financial companies have business models that make our economy go. From mortgages and credit cards for individuals to bank loans and payment services for corporations, financial companies are absolutely vital indicators on overall conditions and this is why these companies are regulated closely by government agencies.

It makes sense that when financial stocks are doing well, how bad can the market environment be?? Look back at past recessions and you will see very poor performance of financial stocks.

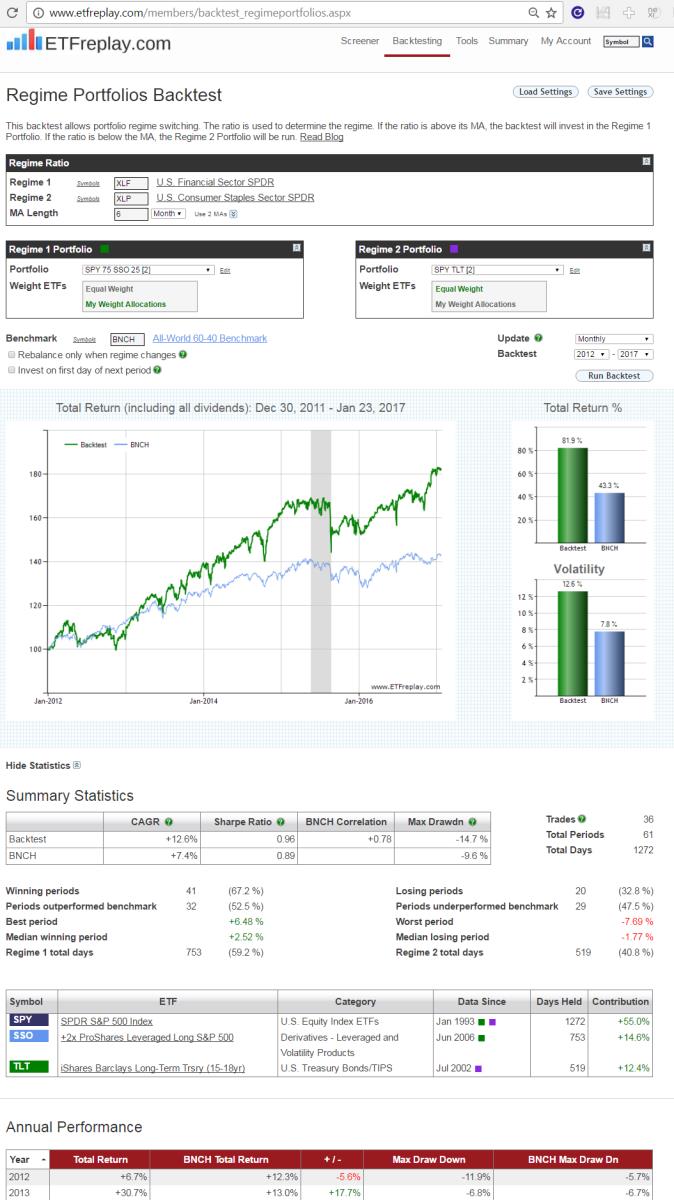

The backtest below is meant as an INDICATOR -- not a strategy to implement per se.

When financial stocks are beating a known risk-off stable segment like US Consumer Staples, we will bring our portfolio Beta up above 1.00 by adding a 25% position in SSO (the 2x S&P 500 ETF).

When financial stocks are underperforming, we will split our holdings into 50% SPY and 50% TLT. This is the 'risk-off' portfolio. (Note that in this example -- no matter which regime is in play, the portfolio will hold at LEAST 50% SPY -- think of that as the 'core' portfolio and the other 50% as the 'satellite').

Here are the results. Make sure to dive-in and immerse yourself in this topic. Alter the time periods incrementally. Alter the risk-on risk-off portfolios. Study sub-period backtests. What are the good aspects to this backtest? What are the possible limitations?

Follow ETFreplay on