Category: Regime Change

May 07, 2019

in Regime Change

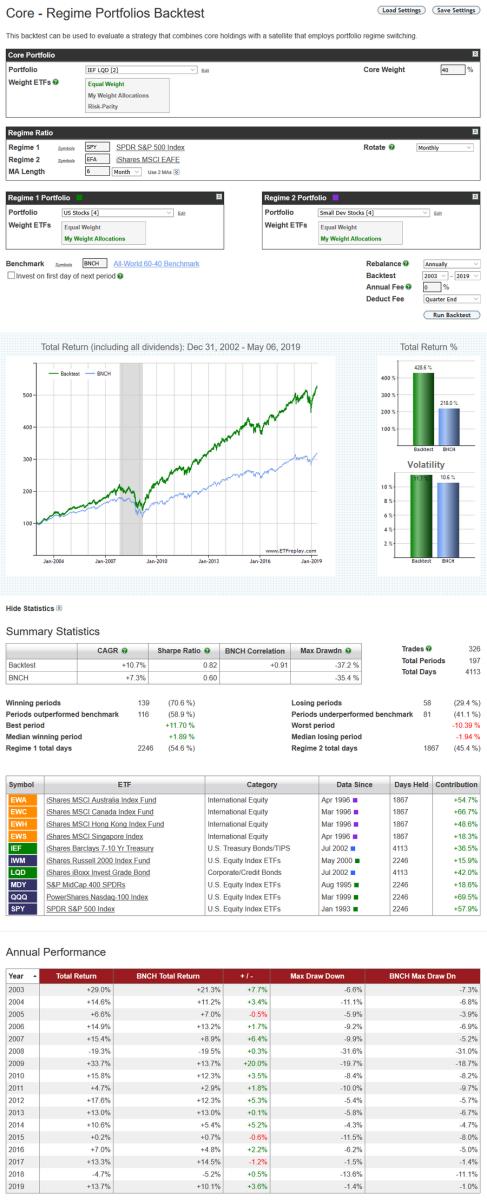

Back in 2010 we created our first multiple strategy module, the Advanced Relative Strength backtest, allowing subscribers to combine together different models into an overall portfolio. To illustrate the backtest, we produced a simple example that employed two sub-strategies; a basic US equity model (MDY, IWM, SPY and QQQ) and an international model using smaller developed country funds (EWA, EWC, EWH and EWS).

The example below uses the same ETFs as that original illustration, but this time, rather than running each model concurrently, we have employed the SPY / EFA ratio moving average as a regime switch to dynamically alternate between the two portfolios. When the SPY / EFA ratio is trending upwards (i.e. above its MA), the backtest invests in the US equity portfolio. When the opposite is true, it switches to the International stock portfolio. This regime approach is then mixed with a solid fixed income core portfolio (IEF and LQD) to form an annually rebalanced 60-40 strategy.

The Core-Regime Portfolios backtest is available to pro subscription members.

Apr 24, 2019

in Regime Change

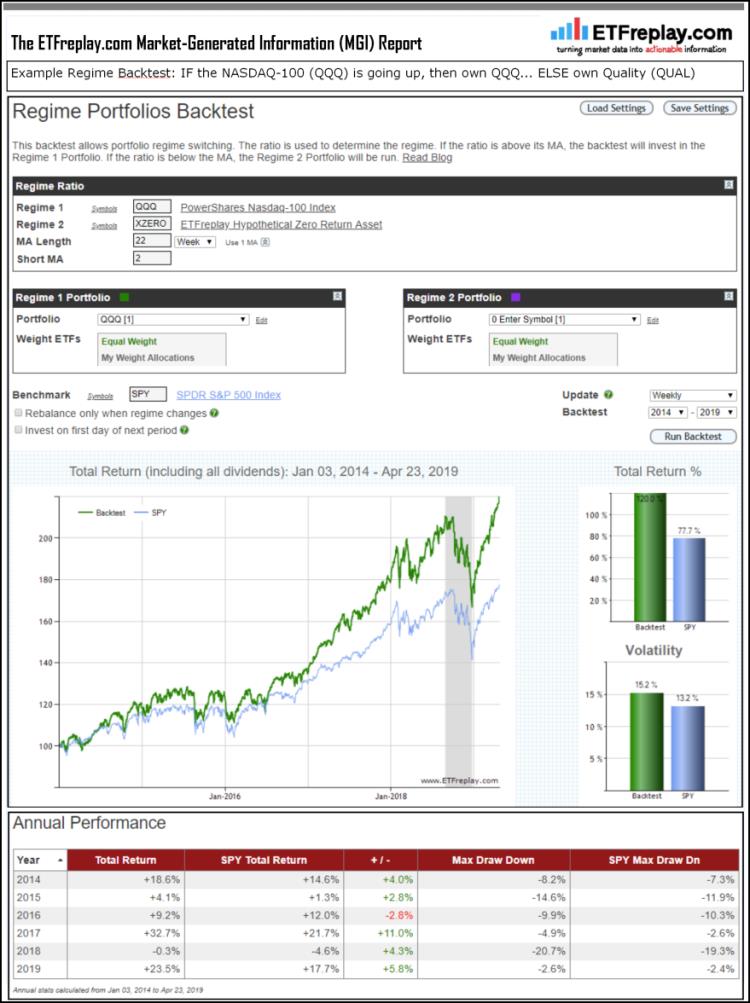

Regime Change is used in finance to describe when a condition changes. IF [condition1] is met, THEN invest in [X]... ELSE invest in [Y]. ETFs allow us to easily test conditions which are defined not by some calculation you've created to simulate an index, these are publicly traded securities with real money invested in them. There is no ambiguity as to the rules when you use real-world securities as is so often the case with non-financial regime tests.

Here is a simple example to get the hang of it, is the NASDAQ-100 going up? If it is, buy it. If it isn't, invest in a different type of ETF. In this example, the different type of ETF is defined by the QUALITY FACTOR. Quality stocks are those with strong balance sheets, lower earnings variability & higher Return On Equity -- as ranked by indexing firm MSCI. QUAL actually owned real stocks on each day with real money, we aren't subjectively now determining what should be classified as quality and what shouldn't.

What does the performance report look like for this idea? See below for summary version of an ETFreplay.com backtest report (statistical analysis excluded in image below).

Then try other ideas. All of your ideas don't have to work for you to be very successful at this. Indeed, this strategy has underfperformed its benchmark 46% of the time in last 5 years (as measured by relative performance in each calendar month). Yet the outperformance over time has been good.

Jul 26, 2018

in Relative Strength, Regime Change, Video

A video with a demonstration of the new Core-Regime RS Backtest module. The public video below uses the following subscriber-only backtest ETFreplay Core - Regime Relative Strength Backtest

to expand video on screen, click the ' 4 expanding arrows' icon in the bottom right corner of the video screen

Mar 20, 2018

in Regime Change, Video

A video using the Regime Portfolios Backtest to check-in on using high-yield bonds as information into the state of the market.

to expand video on screen, click the '4 expanding arrows' icon in the bottom right corner of the video screen

Jan 18, 2018

in Regime Change

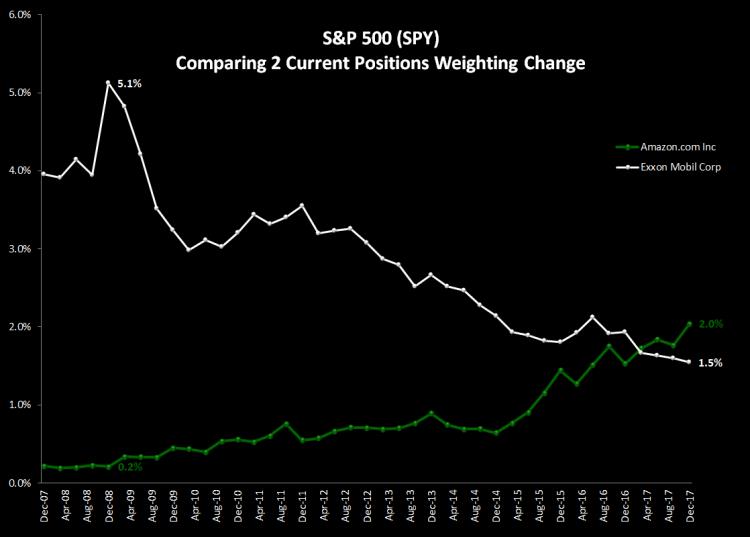

An index can change rather importantly over time. Some segments go through sustained secular performance and become increasingly important on a secular basis. This has happened with the internet relative to much older industries. Sometimes it can be a bubble but for every time someone calls something irrational, there are many cases where something secular is happening.

Below is a chart plotting how much more important Amazon.com is to the performance of the S&P 500 than it used to be. This has come at the expense of names like Exxon.

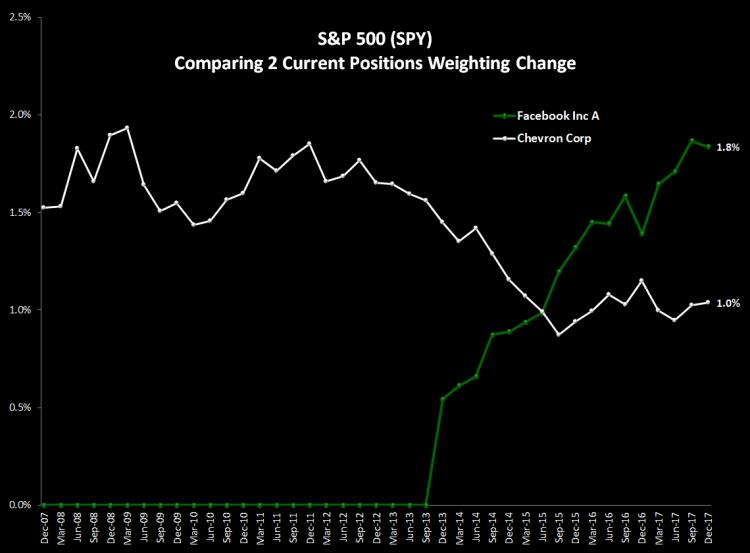

Another example is Facebook vs Chevron:

To look at a different part of the world, think about how important China Mobile used to be vs where it is now and how Alibaba Group was 0% and now its the 2nd largest holding in the S&P China Index.

Think about what this does to fundamental ratios like P/E's and dividend yields on the index aggregates. Exxon pays a large dividend -- AMZN and FB don't pay anything in dividends. Exxons P/E in 2007 was under 13x while the AMZN P/E has averaged well into the triple digits over the past 10 years.

This is loosely related to 'Regime Change' -- the fundamentals of backtesting are that you should think about RECENT DATA and weight it more heavily than old data. Same concept. What the P/E was 10 years ago isn't very important And what it was 30 years ago is less important than that. We do NOT mean to imply 'this time is different'. We are simply saying weight more recent times more highly than you do data from 100 years ago.

See also: Regime Change Backtesting