Dec 02, 2010

in Relative Strength

Charles Schwab recently published some summary statistics on their accounts. They said that while 90% of accounts own individual stocks – just 15% of accounts hold ETFs. So while many people may have been using ETFs for many years now, using Schwab as a proxy, about 85% of people still need some introduction to ETFs.

There are 3 basics schools of thought on active management in general:

- Those that think it’s impossible

- Those that think it’s easy

- Those that think it’s a challenge -- but rewarding

For those that think passive management is the way to go, your job is still not over. You will still need to figure out an asset allocation. “Just buy index funds” actually doesn’t get you far --- there are over 1000 ETFs that follow various indexes and there is no single answer to what exactly constitutes a passive strategy. I can’t imagine there exists a professionally trained investment advisor who advises putting 100% of money into a S&P 500 index -- but I guess never say never. So absent that, there are still allocation decisions to be made about stocks vs bonds -- as well as the mix of international stocks and how much to include in alternatives like REITs & Precious Metals. These are all classic passive indexing discussion points.

For those that think like #2 above – that active management is easy, this crowd is likely just plain dangerous. They simply ‘don’t know what they don’t know.’

The third group acknowledges the challenge and comes at the issue with some humility. We sit firmly in the 3rd camp. It takes some analysis and testing and hard work to do well in investing. You don’t need to just come up with ideas – you need an investment PROCESS. That is, some type of structured approach.

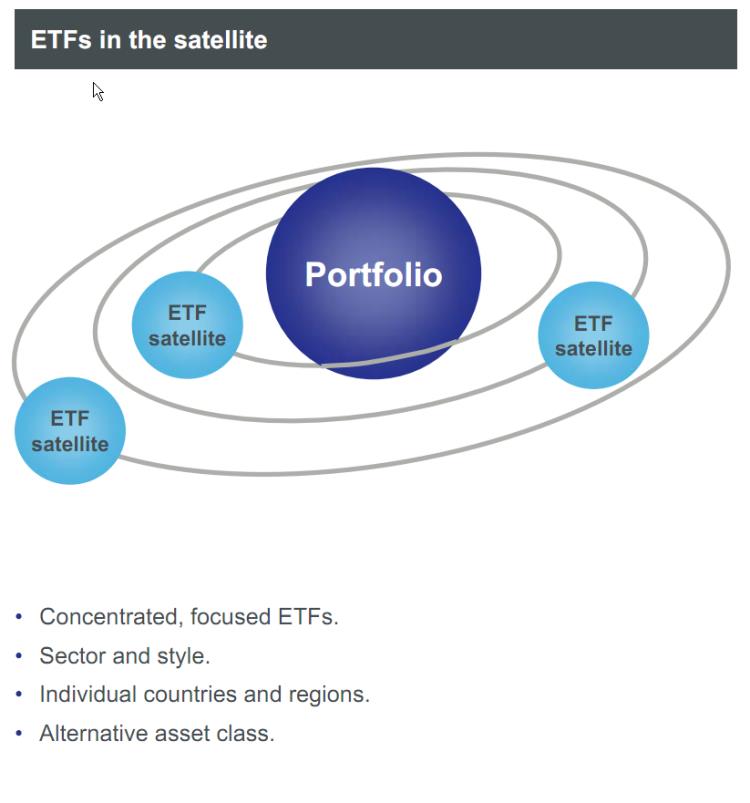

So let’s introduce the core-satellite approach. It’s excellent for its flexibility in balancing return & risk. Here is a visual that Blackrock has used for this:

Source: Blackrock

What makes this framework really powerful is that you can pursue more aggressive strategies --- but still rein in the overall risk of a portfolio. You can stay within your specific risk tolerance but still buy/overweight some attractive (but perhaps more-volatile) segments. Or perhaps you are an advisor and your clients have different risk appetites. You can use your same ideas across these different accounts but just change the allocations between the conservative core and the more aggressive satellite strategies to more precisely target the appropriate risk-budget.

A typical investor thought might be --- I like the idea of investing in Emerging Asia – but how do I do it? How do I think about the risk involved in the short-run if and when some problem emanates out of South Korea or India or China?

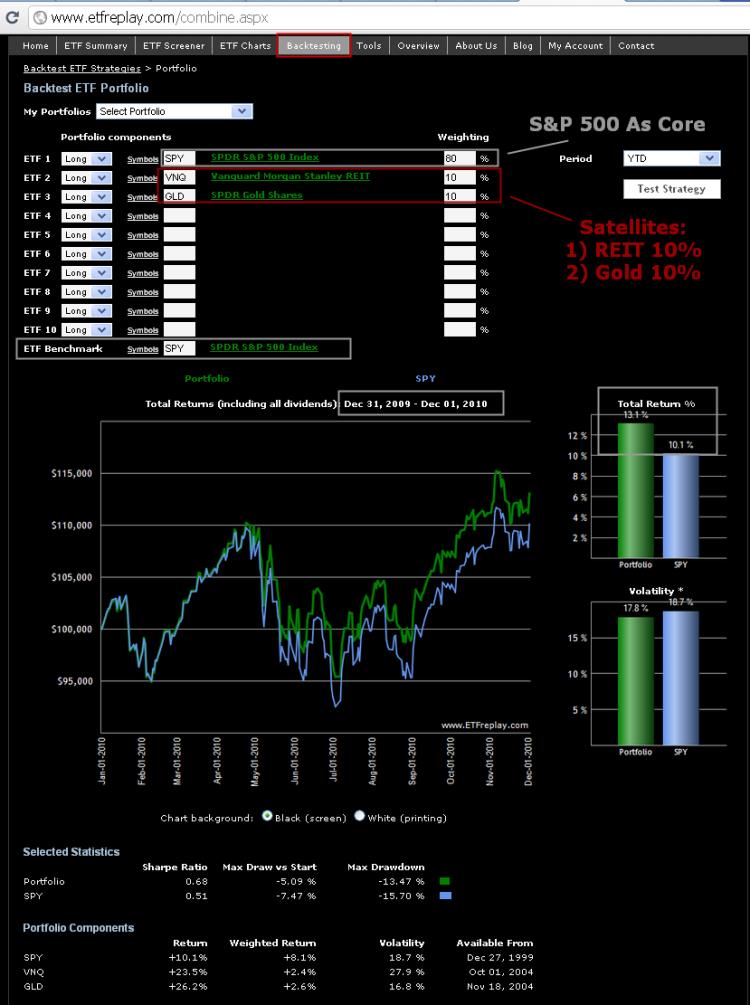

So for a very basic start, let’s mix the core idea of completely passive-indexing with just 1 or 2 actual ideas. In this example, rather than invest in just the benchmark S&P 500, we will invest 80% in the S&P 500 and 10% in each of two other market segments --- Real Estate Investment Trusts and Gold.

Below is a look from our free Backtest Portfolio app to observe how this portfolio looks Year-To-Date (total return):

Note the 3 percentage point pick-up in performance this year for some pretty simple ‘tilts’. Importantly, note also that there has been some diversification benefit (reduction in volatility). Other than returns being better, the core-satellite portfolio went down less over the summer. So it went down less and yet has added 3%. Your tilts added significant value here. Not bad for a start. But we can do better.

If you are a registered user on the site – whether you registered 8 months ago or yesterday – you may have noticed you had 1 starter portfolio we created called ‘Sample Portfolio.’ Rather than use REIT’s and GLD as our satellite strategies, what if we instead used this sample portfolio top relative strength pick as 20% of the portfolio. Here is that example using our new Advanced RS Application (for subscribers)

Notice that the result here is +14.8% return with even more diversification benefit (it went down even less during the summer correction). Remember, it is 80% S&P 500 in the first place so this is actually an excellent result. Standalone, this ‘sample portfolio’ that we created in the Spring time has had a banner year --- see for yourself within the portfolio backtest app.

As you will see when using the TAA application – and as we will discuss in upcoming blogs, you can change the percentage allocations from the core to the satellite and back to the core and see how it affects the overall results -- not just in returns but in ‘smoothing out the ride’ with lower volatility. This is the very essence of TAA.

All of this is just a start for those who are new to ETFs. We have many more options available in this core-satellite framework. A more conservative investor – perhaps older and less willing to take even average risk --- could start with a bond-only core portfolio and then add equities as satellite strategies. Or we could start with a more diversified core (say mixing REITS & Gold & Junk Bonds in the core) and then add country or sector funds in the satellite(s). These and other ideas will be future blog topics.

Dec 02, 2010

in Drawdown, Volatility

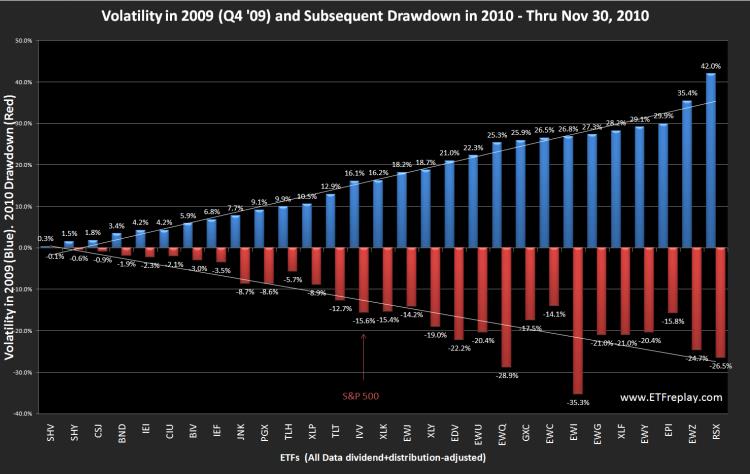

Volatility is a tough topic to get your hands around. But one key idea is to think in terms of drawdowns -- in general, the higher the volatility the higher the drawdown. What does this mean? It doesn't mean that volatility is just bad --- it means that with funds like the Russia Fund (RSX) or Brazil (EWZ) or Financial stocks (XLF), your TIMING is more important than with something like a consumer staples ETF (XLP) or an investment grade bond fund (CIU). Since we've posted this many times this year, it's time to take a look at some actual hard data through the first 11 months of 2010.

The chart below compares the known volatility exiting 2009 with the subsequent drawdown in 2010. We think this shows the basic idea pretty well. Its certainly not going to be exact --- but in general, it makes sense. So we can think about this from a higher level to help us. If our portfolio were 100% long Brazil (EWZ) all year, then the portfolio value would have moved down -24.7% off its high at one point. You didn't 'lose' -24.7% vs your starting cost --- but you did lose a big % off the high. A goal in portfolio management is to smooth out the ride a bit.

Note here that this is just one 11-month period of data. The concept is solid -- but the future will be different. The S&P 500 had a -15.6% drawdown during this particular period. Less volatile ETFs all had lower drawdowns. A few on this list that had significantly higher volatilities had lower drawdowns --- but not by much. This is for concept and its relative. If the S&P 500 has a larger drawdown next year, then expect these numbers to all be bigger when we do this again next year.

Nov 28, 2010

in Relative Strength

A typical buyside analyst looks at the world in terms of business fundamentals, earnings estimates, quality of management, competitive position, competitive advantage, return on invested capital, P/E multiples and so forth.

You will often hear analysts talk about P/E’s being low relative to growth rates or low vs 10-year bond yields or low vs a group of comparable companies or the overall market etc.

Is the price/earnings (P/E) multiple a good indicator for future performance? One interpretation of this fundamental valuation measure is rather than thinking in terms of the current valuation vs ‘fair value’ --- is simply to observe whether the valuation is expanding or contracting and decide if you believe this will continue.

If a P/E has just gone from 14x to 12x, its cheaper – but is that bullish? How do we know its not headed lower? We should probably test this and see if it works and then create some guidelines for portfolio strategy based on this. Wouldn’t that make sense rather than just blindly believing that a lower multiple is bullish?

Relative strength can actually be thought of as fundamental analysis if you wish to think about it like that. It would not be unusual for a fundamental analyst to say during a rally “the P/E multiple is still too low at 12x next years earnings” -- even though it’s up from a low of 9x and you bought the stock at 10x. But this is not any different than watching relative strength and buying at the same price and looking for further valuation expansion.

Good relative strength analysis captures when a market segment is experiencing valuation expansion. A low P/E is not actually bullish unless its low and then expands higher. This is the crucial aspect – not the absolute level of valuation.

Nov 24, 2010

In old-school financial theory, ‘the market’ was often assumed to be the S&P 500. Many people in the financial industry grew up on defining things (like Beta –> and therefore Alpha) relative to the S&P 500. This wasn’t the correct interpretation from Modern Portfolio Theory --- but as the 1990’s bull market raged, the question was not about U.S. equities vs bonds vs international investing or anything else --- it was more a discussion of simply ‘which US equities?’ – and the popularization of ‘style boxes’ that carved up the U.S. market according to size (small , mid or large cap) and style (value vs core vs growth).

In 1998, the S&P 500 rallied 25%+ while small cap U.S. stocks were essentially flat. The dispersions between picking segments of the U.S. were very important then. Much discussion was also whether you were overweight technology – or underweight sector XYZ – all along assuming that of course your universe was U.S. equities. The economy was robust and it was not unusual for companies to grow 5-10%+ every 90 days (sequential quarterly growth).

Those days of course are long gone. The companies growing 5-10%+ every 90 days now are more likely located in Brazil or India etc… Still, the dispersions between market segments can be very large. The conversation doesn’t end at --- overweight bonds --- but which bonds? Long-duration corporates or intermediate high-yield -- or preferred stocks for that matter? Overweight international stocks? Which international stocks – what regions, which countries?

One very interesting aspect of ETFs is that they allow allocations to be adjusted not just easily – but with such precision and at essentially no cost. Expense ratios are in the 0.40% zone and are already accounted for in market prices. With free trading now available --- it just gets better.

But ETF investing doesn’t have to end at allocation decisions. ETF rotation involves rotating beta exposures over time. Its not just about picking a low-cost allocation and sticking to it. Surely you have some view on some market segment in some region of the world?

Importantly, expressing this view can be done as a satellite rotation strategy against a core portfolio of conservative investments, or on its own. Its up to you and your risk tolerance and any other constraints you impose.

The point is that there is tremendous value to be added that has nothing to do with stock-picking. ETF's allow us to operate at a level that is above stock-picking – and picking market segments has and always will be more important than stock-picking.

Even with all the ‘insider networks’ of professional money managers --- hedge fund indexes have shown very mediocre net performance, with any benefits of outperforming funds accruing primarily to the hedge fund manager -- and not to the investor. Moreover, the data to fully risk-adjust these performances just isn’t available without a daily NAV – something hedge funds do not report.

So here we have transparent, ultra low expense ratio, free trading vehicles that operate at a level far more important than adding (or subtracting) 2.00% in stock-picking.

To quote a recent line I heard from a high-profile CEO: “Get on the bus.”

Nov 21, 2010

in Relative Strength, Screener

We have received this question a number of times in email and so we wanted to clarify something.

R.S.I. (known as the Relative Strength Index) and the way we at ETFreplay.com discuss ‘Relative Strength’ are not the same thing. We wanted to briefly explain this.

R.S.I. is a technical analysis tool that involves only a single security -- it measures the average amount of up closes vs the average down closes over a given period of time. The most important distinction here is that R.S.I. only looks at the closing values of one security. There is nothing in the calculation of R.S.I. that involves anything but the historical prices of this SINGLE security.

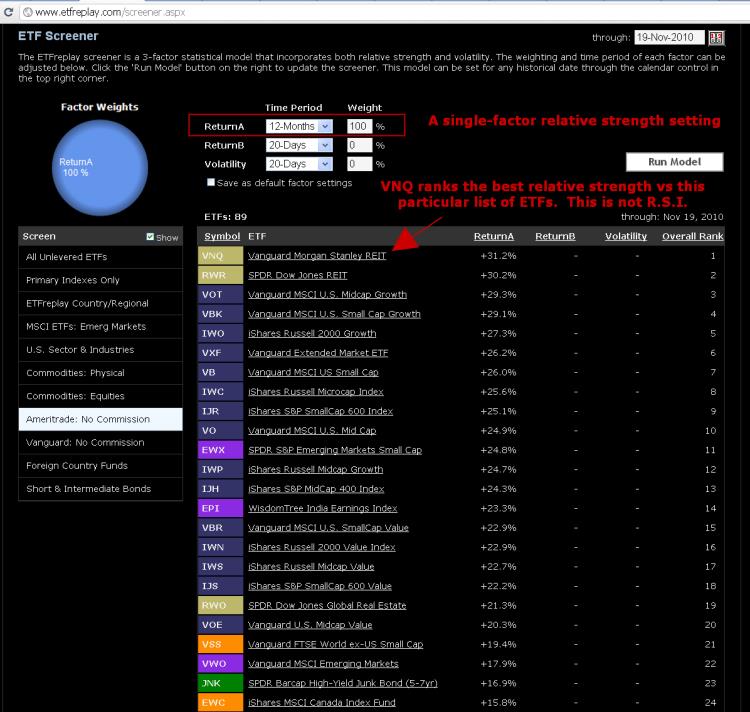

The way ETFreplay uses relative strength has nothing to do with R.S.I. We use relative strength as a way to determine which among multiple market segments is relatively strong.

Many of you are probably familiar with Investors Business Daily. The paper has for a long period of time used a ‘RS Rank’ --- this is more like what we use. Note that IBD certainly did not invent the concept of relative strength -- but they built a database of securities and then ranked everything relative to each other. Institutional-oriented software programs do the same thing. A RS Rank of 90 in IBDs method means that a stock has outperformed 90% of the other securities in their database over a given period of time. High-end institutional software does something similar – except they proceed more mathematically by instead expressing the strength of the security as the distance from the average of a group --- and this is usually stated in terms of the # of standard deviations away from the mean (think z-score).

This is all similar to what we have done – except we do it with ETFs and then allow you to backtest it yourself rather than just saying ‘you should buy relative strength because it works.’ We also allow the user to define relative strength themselves – using easy browser controls like drop-down menus and text boxes. So for example you could simulate IBD’s method by using 12-month performance and ranking ETFs in a given universe like this:

click image to view full size version

Then you could go the Portfolio Relative Strength backtest to see how 12-month relative strength has been holding up over the past 10+ years and see what kind of drawdowns its had.

This is all a research process – its just that we are performing research that comes in a very practical form. We aren’t researching stocks, we are researching strategies --- strategies based on baskets of stocks. Backtesting is not the only thing that matters --- but its pretty darn good information for you to factor into your decision-making process. Without some historical testing, you could easily go a lifetime of doing things that you thought worked – but actually don’t -- and never really did.

Go to the Screener

Not a subscriber? Subscribe